The cislunar econosphere (part 1)by Ken Murphy

|

| The first thing to understand is that we are not going to go straight to the Moon and then begin backfilling cislunar space with commercial activity. What’s going to happen is that activity is going to expand outward. |

As an advocate for free market cislunar and Lunar development, and President of The Moon Society, I am often asked “So what kind of business is there to do in space and on the Moon?” As if any one person would have all the answers, but research in the Lunar Library has shown that the question has certainly not gone unpondered. Too often, though, there is a fixation on one particular aspect, a particular product or service, which is thought to be the driver, the killer app that will unlock vast new wealth and make everything else happen by default. That, combined with the framework that NASA has provided for U.S. space activities over the decades, has unfortunately put blinders on what could be considered, and quite frankly has hampered our ability to move forward.

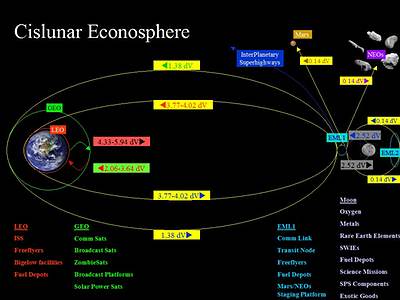

Embrace the chaos of free markets. The first thing to understand is that we are not going to go straight to the Moon and then begin backfilling cislunar space with commercial activity, although some folks advocate for such. What’s going to happen is that activity is going to expand outward, and once activity has reached the neighborhood of the Earth-Moon L-1 point, the Moon (and so much more) becomes a no-brainer. EML1 is the killer app of cislunar space, to the extent one might exist.

Earth to orbit

So how is this going to happen? Suborbital gets to market first. The obvious contenders are Virgin Galactic, Blue Origin (though does anyone really know what they’re doing?), and XCOR for crewed, and Masten Space Systems and Armadillo Aerospace for uncrewed flights, although it has been suggested that Armadillo’s products could support “spacediving” activities.. After the initial round of prepaid pioneers are flown off, look for microgravity science payloads to become an increasing segment of the straight up-and-down market, and look for suborbital to expand into the point-to-point market for persons and goods. (When it absolutely, definitely has to be there today.) Expect strong seed capital from NASA in the early stages of the microgravity science utilization, just as happened back in the 1990s with NASA’s Space Commercialization Centers, but really universities, foundations, and even companies should be stepping up with funding and payloads. And not just funding they’ve received from NASA, but with their own monies so that they really own the results.

We’re already seeing excitement in this area, as exemplified by the Next Generation Suborbital Researchers Conference at the end of February. Some payloads are even getting to orbit through the CubeSat program, and NanoRacks LLC is offering commercial access to ISS, even showing their upcoming launch manifest on their homepage. A lot of folks deride microgravity science as a pointless endeavor, pointing to the general lack of results that have ended up in the consumer sector. The issue, though, is not a lack of potential in the sector, but rather the constraints in which it has operated to date. Sounding rockets are limited in what they offer, and being automated one hopes the black box works the first time. The Shuttle was never able to provide a reliable and consistent, or even frequent, launch schedule, and the demand for space always overwhelmed the limited supply. Challenger was a serious blow to the kneecaps as well.

When the author inquired about paying for a Hitchhiker payload, the reply (in 2002) was that there were over 60 GASCans waiting to go, paying your own freight did not move the payload ahead in the queue before freeriders (and if NASA felt a subsequent payload was more scientifically meritorious it could be bumped ahead of paying customers), and not every Shuttle flew GASCans. Not a promising platform for building a vacuum sphere business (glass spheres ‘filled’ with the vacuum of space), and what other options were there? Astrotech [NASDAQ-CM: ASTC] subsidiary Astrogenetix has had better luck recently working on vaccines against some of the more virulent staph bugs based on results from flown hardware.

Another entrepreneurial idea the author had back in the day was to go around and quietly buy up the various flown boxes. These would be refurbished and then leased to scientists who wanted to do research without having to engineer their own. The presumption was the fact that these were flown instruments, previously cleared for flight on the Shuttle, and this would help facilitate the processing for any subsequent flight, as NASA was already familiar with the instrument. Well, we all know what happens when you presume. The ultimate priority, though, is to get scientists to orbital lab benches.

| Space development is going to start out with lots of small companies exploiting particular niches. |

First, we need to get the crew to orbit problem solved. We’ve got good rockets, and we’re working on the crew vehicles. An optimistic timeline is within three years, but the equation involves a large NASA variable that could easily push that out to five or six or even more years. Until private industry gets to the point where it is going to space in spite of NASA, not because of it, the timeframe will tend to push outwards. The basic solution to accelerate private sector development is to enable more direct investment by individual, but not necessarily qualified, investors, so that more investment capital can be directed into the industry. There is legislation in the works to better enable equity investment, for example through crowd-sourcing, enabled by our much more capable computing abilities (itself enabled by Apollo).

It does rather seem a shame to have to ask the government for permission to invest in a collective manner in a company and industry in which I believe and actually know something about (notice how few of the companies named have stock tickers noted). I shouldn’t have to jump through a million hoops to invest in companies I see addressing particular needs for which I envision markets. Some examples of such companies include Orbital Outfitters, which develops spacesuits; Altius Space Machines, whose “Sticky Boom” technology for non-consensual docking maneuvers could also have applications for debris salvage operations; and Celestis, which takes cremains to orbit and has a 30-year legacy.

Space development is going to start out with lots of small companies exploiting particular niches. Other examples of niche exploitation include Wyle Labs, which focuses on human performance services for commercial human spaceflight customers, and NASTAR, which describes itself as “the premier air and space training, research, and education facility in the world”. Ball Aerospace [NYSE: BLL] serves a variety of niches, such as remote sensing, astronomy, optics, laser communications, data exploitation, low-observable antennas and precision cameras. Draper Labs has a specialty in advanced guidance, navigation, and control systems; high-performance space science instruments; and reliable and high-performance processing systems. Honeybee Robotics focuses on developing technology and products for next-generation advanced robotic and spacecraft systems that must operate in increasingly dynamic, unstructured and often hostile environments. Stone Aerospace’s Shackleton Energy Company envisions robotic access of the Lunar poles in the not too distant future. Paragon SDC identifies itself as “the premier provider of environmental controls for extreme and hazardous environments”, and has partnered with Google Lunar XPrize competitor Odyssey Moon to grow a plant on the Moon. Analytical Graphics provides software for orbital analysis. MacDonald, Dettwiler and Associates provides robotic arm services for on-orbit facilities. Harris Corp. designs specialized antennas. Andrews Space offers a range of technical competencies from space system design and rapid prototyping to business analysis. There are many niches to be exploited in the still fledgling commercial space industry.

We must not shy away from fear of failure. While Beal Aerospace may have gone out of business, it did allow SpaceX to pick up nice engine test facilities outside of Waco, Texas. People will get bamboozled and they will lose money, but it happens in every industry in every country on the planet. It’s bad that it happens, as it represents malinvestment, but we can’t seem to make it go away.

Getting crewed vehicles online is critical to any further development. If it can’t be done, what follows is meaningless. Current optimistic projections run somewhere in the 2015 timeframe for test flights; maybe a bit before, maybe a bit later. Expect at least one critical flaw or disaster that will lead to new protocols of some sort or another. The best things that NASA can do in this regard is purchase rides for their astronauts, just as they do from Roscosmos, and promulgate universal, international interfaces (in metric) like docking ports and communications standards, as well as work with industry to ensure the highest quality space product in the market.

Current efforts in the US to provide crewed vehicle to orbit capability include Blue Origin’s vehicle efforts, Boeing’s [NYSE:BA] CST-100 capsule, Sierra Nevada Corporation’s Dream Chaser lifting body, and SpaceX’s Dragon capsule. Development of all four have been supported by NASA’s Commercial Crew Program through funded Space Act Agreements. SpaceX’s Dragon started development through NASA’s Commercial Orbital Transportation Services (COTS) program, alongside Orbital Sciences Corporation’s [NYSE: ORB] Cygnus vehicle. In addition, NASA has its own Orion Multi-Purpose Crew Vehicle (MPCV) capsule program.

Offering good insight into what kinds of things private industry launch to orbit might enable are the Concept Exploration & Refinement (CE&R) studies that NASA conducted back in 2004 after the Vision for Space Exploration was released. These tapped into work done by NASA’s Decadal Planning Team around the turn of the millennium, which continues in the form of the Future In-Space Operations (FISO) Working Group.

Low Earth orbit (LEO)

Once in orbit, there are more possibilities enabled. While we’re limited at the moment to the ISS up in a 51.6° inclination orbit, there are other inclinations that may be of interest. Once Bigelow Aerospace is able to provide usable space on orbit with their BA330s, and transportation can be adequately provided (one of the reasons that crew vehicles should be compatible with Falcon, Delta, and Atlas rockets), there are a number of uses that can be imagined. It’s not clear whether Bigelow is going to adopt the current ISPR standards for equipment (which would re-open the black box leasing idea from earlier), or perhaps implement a new standard that would tie users to the BA330s.

| There’s no shame in being the steward of a space hotel, even if it may be rather unpleasant at times. |

Where would these inclinations be? Where are the launch sites? Equatorial would be one, easily accessible from Kourou, but the scenery from orbit is pretty boring overall. Kennedy’s inclination is an obvious choice for NASA activities. An inclination of about 40° overflies most US launch sites, from Spaceport America to MARS. And it’s entirely possible that more facilities will be added in the ISS inclination. Whatever facilities are put on orbit, they will likely be in the inclinations most readily accessible from terrestrial launch sites.

What to do? What not to do? My favorite option is microgravity sciences. “Space Industrialization Opportunities” by Jernigan and Pentecost is a great academic introduction to the topic. A more contemporary introduction is “A World Without Gravity” from ESA. Ceramic metals. Glass metals. Foamed metals. Bizarre alloys impossible in the gravity well. Optics. There is so much research to be done, much of it with real market potential. The faster that suborbital flights can provide capability to microgravity researchers, the better it can serve as a springboard to when we do get facilities in orbit. Once on orbit, things like free-flyer platforms should be considered to co-orbit with the facilities. The research to be done there will lay the groundwork for later production processes undertaken farther out in cislunar space. NASA is supporting these researchers, but more support must come from academia and industry.

Being much traveled, I understand the joy of visiting new places in person and exploring my world corporeally. It’s all about the senses, and having flown a Zero-G flight (back in 2004; even got a “barf quote” in the local paper), I am sensitive to the impact of the different gravity environments and their effects on the senses. I highly recommend it, especially Lunar gravity. It’s an absolute joy. Once facilities are on orbit, they will become a destination for travelers seeking new experiences, new vistas, and new destinations, plus their tickets help pay the rent. This is a proven fact by the number of non-governmental-employees who have already visited the ISS, and even Mir before that, through the work of companies like Space Adventures. Even the Shuttle had members of Congress as fellow travelers, and private citizens working for companies.

While some will purchase their ticket to orbit, others will have to work their way up there. There’s no shame in being the steward of a space hotel, even if it may be rather unpleasant at times. Don’t forget the movie industry, which may decide it wants to incorporate more microgravity effects in its storytelling. There will also be those who want to conduct their research away from prying eyes and corporate and governmental malefactors. Speaking of governments, if an open crew transport market becomes available, as well as usable space on orbit, expect a number of governments to consider pursuing their own national agendas from an orbital platform as a means of showing off to their neighbors their technological prowess. It may also arise that satellites and probes end up being launched to the vicinity of orbital facilities for a post-launch checkout before being sent on their way. In this way, many expensive failures can be avoided. What if, for example, Phobos-Grunt had been launched to the vicinity of an orbital facility, and for a few million dollars could have had an engineering team pay it a visit to figure out what’s going on?

So there are many possibilities awaiting us just in LEO. Having an open market means that no one can predict what will happen and what whacky ideas will turn out to be cornucopias of wealth. Looking out past LEO, there are a number of possibilities, with GEO being the obvious choice. But GEO is expensive in terms of fuel, even if we are smart enough to put gas stations in the local neighborhood in LEO. For many, including engineers who have taken Economics for Engineers 101, this quickly leads logic to heavy-lift launch vehicles as the solution for providing adequate volumes of propellant. A subtler read of the situation suggests that you can’t lead the market to where it’s going, and what is needed now is more frequent use of existing, mass-produced launch vehicles to help drive economies of scale into a virtuous cycle of growth. Having facilities on orbit will be beneficial in that regard, but cannot provide the sole solution. Over the near term, it makes sense to deliver propellant to orbit in more frequent but smaller amounts, as that helps to make the cost of rockets cheaper for everyone. It will get to the point where “heavy” lift (let’s say over 100 metric tons at a time for the sake of argument) will make sense because of the volume of traffic that is going to orbit, but that time is not now. The Russians already figured this one out years ago.

| So there are many possibilities awaiting us just in LEO. Having an open market means that no one can predict what will happen and what whacky ideas will turn out to be cornucopias of wealth. |

Additionally, by the time there is enough volume going to orbit to consider heavy lift that will also be the time where reusable launch vehicles (RLVs) become a compelling solution. Materials research on orbit is likely to have helped advance that field in some regard (such as, perhaps, lightweight foamed metal cores for aerospike engines). It will be a decision point, and the likelier path is RLV transport, as the economics will make as much if not more sense than HLV. Having RLV transport will also much more greatly enable further growth in LEO, and further support efforts to go trans-LEO. This could happen as early as 2020, but more likely 2030 or beyond.

A more strategic consideration is towards things like space as an export market. In principle, a product shipped from a US launch site to, for example, an Isle of Man flagged facility like those proposed by Excalibur Almaz, would be an export. Would it be possible to get EXIM Bank financing? Coupled with Zero-G Zero-Tax type initiatives that helped get Internet-based commerce kickstarted, these could significantly facilitate interest in and growth of cislunar commerce. Whatever solutions arise, it won’t be an easy process, as noted by Near Earth LLC in a presentation at the NewSpace 2011 conference last July.

Geosynchronous/Geostationary Orbit (GEO)

GEO is sometimes referred to as the Clarke Orbit, after Sir Arthur C. Clarke, who noted its utility by applying some simple mathematics. While Sir Clarke envisioned large stations crewed by workers busily replacing blown vacuum tubes, what we’ve ended up with is a hodgepodge of telecommunications and broadcast satellites of increasing size and sophistication. The use of GEO is tightly controlled by the International Telecommunication Union, but over time a large number of inoperative objects have accumulated. These do not go stumbling about like their name, “zombiesats”, might imply. Rather, through a peculiarity of gravity (the gravitational lumpiness of Earth) and orbital energies, and centrifugal force, the objects tend to cluster in areas where there is a bit less gravitational pull from Earth, the two most obvious being the gouge dug out by India as it sped north into the Himalayas, and an area in the Pacific off the coast of the Americas. The latter, about 105° W, is an area of particular crowding and concern.

There have been ongoing efforts to address the problem robotically, such as EPFL’s proposed CleanSpaceOne, MDA’s [TSX: MDA] Space Infrastructure Servicing vehicle, and SkyCorp’s satellite life extension spacecraft. Still, companies may prefer some on-site supervision when revenue-generating satellites are at risk.

Broadcasters are pushing for larger satellites and more power, so that your direct-to-home television signals won’t fade out in a heavy rainstorm. Other interests are looking into solar power satellites, which would find an ideal home in GEO, which would allow a fixed broadcast point and constant source for the beamed energy. Most of our energy supply is second- or third-hand solar power, so why not go directly to the source?

So the basic agenda for GEO is:

- Garbage cleanup

- Bigger broadcast and telecom platforms

- Space-based solar power satellites