The ups and downs of smallsat constellationsby Jeff Foust

|

| “The good news for us is that the launch landscape has drastically changed,” said Barna. “I have to turn down launches. I can be relatively choosy.” |

BlackSky, OneWeb, and UrtheCast join a number of other companies actively developing constellations of smallsats, weighing from a few hundred kilograms down to a few kilograms. Those satellites are intended for applications ranging from communications to imagery to GPS radio occultation, a technique to sample the atmosphere that can provide data for meteorology.

Early doubts that smallsats had limited uses have faded as spacecraft technology has advanced and some pioneering ventures, like Skybox Imaging and Planet Labs, have found technical and financial success. Smallsat constellations, though, have traditionally faced two major challenges beyond their satellites’ ability to carry out their missions: getting the satellites launched to begin their missions, and bringing them back down afterwards.

Solving the launch problem

For years, smallsat developers have complained about the lack of affordable launch opportunities. Dedicated smallsat launch vehicles were either expensive or flew rarely, or both. Secondary payloads, where smallsats hitched rides to orbit on larger launch vehicles, offered more affordable launch options, provided there was excess capacity available for them.

Today, though, the situation is different. Smallsat developers, including those planning large constellations, say there is no shortage of options, including not just an emerging fleet of dedicated smallsat launchers and growing secondary payload opportunities, but alternative concepts as well.

“The good news for us is that the launch landscape has drastically changed,” said Jenny Barna, launch manager for Spire, during a session of the Small Payload Rideshare Symposium earlier this month at the Applied Physics Laboratory of Johns Hopkins University in Laurel, Maryland.

Spire is developing a constellation of 3U CubeSats, with dimensions of approximately 10 by 10 by 30 centimeters, which will collect GPS radio occultation data and also track ships using a system called Automatic Identification System (AIS). The company plans to launch the first 20 of its satellites by the end of this year, with a full constellation of 125 satellites in place by the end of 2017.

Spire plans to fly those missions as secondary payloads on other launches, of which Barna said there are now plenty to choose from. “There are so many opportunities for us to ride as secondaries to orbits that we like as a CubeSat that I can’t answer the phone all the time,” she said. “I have to turn down launches. I can be relatively choosy.”

Planet Labs, which has already launched dozens of 3U CubeSats to collect medium-resolution imagery of the Earth, has also taken advantage of secondary payload missions, some of which became available on relatively short notice. “One of the beauties of the CubeSat standard is that there can be that last-minute switch,” said Mike Safyan, director of launch and regulatory affairs at Planet Labs. “From the launch vehicle’s perspective, it doesn’t matter what’s inside that [CubeSat] deployer, as long as it fits inside of the deployer and follows the rules.”

Planet Labs will likely make more use of such secondary payload opportunities in the future as it deploys its operational constellation of 150 satellites in 475-kilometer sun-synchronous orbits. Most of its satellites, though, have been technology demonstrations deployed from the ISS, making use of a CubeSat deployment system there operated by NanoRacks.

“The station is in what I like to call a ‘Goldilocks’ orbit, decided by committee: not too high, not too low,” said Rich Pournelle, senior vice president of business development for NanoRacks. “It’s not an orbit you would pick, but it exists, and you have a regular supply chain to it.”

| “We’re trying to push a new normal, in some sense, where we can foster missions that are dedicated to secondary payloads,” said Hofeller of SpaceX’s proposed “dedicated rideshare” launches. |

That regular supply chain, in the form of cargo spacecraft that carry CubeSats along with other station cargo to the ISS, has attracted considerable interest. At the time of his presentation earlier this month, Pournelle said NanoRacks had deployed 64 CubeSats from the station, with another 16 on the station awaiting deployment. An additional 99 CubeSats are on contract for future launches, as well as three larger smallsats that will be launched after the installation of a new satellite deployer, called Kaber, later this year.

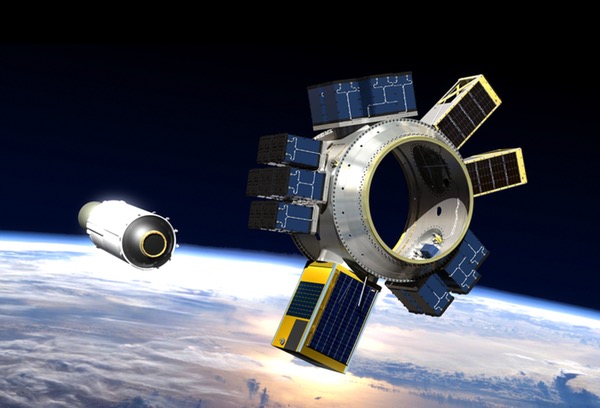

Some are taking the concepts of secondary payloads to extremes. Spaceflight Services is planning to deploy 89 satellites on the first mission of its SHERPA tug, flying as a secondary payload on a SpaceX Falcon 9 in the fourth quarter of this year. Philip Brzytwa, business development manager of Spaceflight Services, said at the meeting that three of the spacecraft will be larger smallsats, including one from DARPA weighing 160 kilograms.

“We want this to be a standard, once-a-year to sun-sync mission,” he said. “There is demand for this.” Ultimately, he said the company would fly multiple SHERPAs on one mission, with propulsion, and do “more exotic missions.”

SpaceX itself is considering offering more opportunities for secondary payloads. “We’re trying to push a new normal, in some sense, where we can foster missions that are dedicated to secondary payloads,” said SpaceX’s Jonathan Hofeller. He said the company was planning its first “dedicated rideshare” mission, carrying exclusively satellites that would normally fly as secondary payloads, in 2017, increasing that to two or three a year by 2019.

The challenge of flying operational missions as secondary payloads has been finding the right launch that will put the spacecraft into the desired orbit. That can be hard enough for a single mission, but far harder if you’re trying to use secondary payloads to launch an entire constellation.

However, an “ad hoc” constellation of satellites cobbled together with secondary payloads can be nearly as effective as a carefully crafted constellation launched on dedicated missions, according to one analysis presented at the workshop. Joseph Gangestad of the Aerospace Corporation found that, using a metric called 95th percentile revisit time—the time between satellite passes over a given area for 95 percent of the globe—rideshare-launched constellations perform nearly as well as dedicated ones.

“Dedicated orbits aren’t always necessary for your mission,” he concluded. “A lot of your coverage metrics can be achieved with the rideshare opportunities that are already there. This is something you can do today.”

Illustration of Spaceflight Service’s SHERPA bus, able to carry dozens of CubeSats and other smallsats as secondary payloads. (credit: Spaceflight Industries Inc.) |

Avoiding the stigma of “debris sats”

As the launch opportunities grow, so do the number of smallsats, especially CubeSats, launched. A study earlier this year by SpaceWorks Engineering found that 158 nanosatellites and microsatellites, weighing 50 kilograms or less, launched in 2014, a 72-percent increase over 2013. The company projects that growth to continue in the years to come.

That growth, though, comes with the perception that CubeSats are becoming an increasing menace to operations in low Earth orbit. “There are those in the industry who derisively refer to CubeSats as ‘debris sats,’” said Ted Muelhaupt of the Aerospace Corporation during a session of the symposium devoted to orbital debris issues. “There’s some justification for that.”

CubeSats in their atomic form—10 centimeters on a side—are near the lower limit of what can easily be tracked by the US Air Force’s Joint Space Operations Center (JSpOC). Even larger CubeSats still pose difficulties in obtaining precise positions, resulting in greater uncertainties.

“Because of tracking uncertainties, cubesats have about as big an uncertainty volume as a normal satellite, so you have to avoid them just as much,” said Brian Hansen, who leads Aerospace’s Debris Analysis Response Team.

| “There are those in the industry who derisively refer to CubeSats as ‘debris sats,’” said Muelhaupt. “There’s some justification for that.” |

At the symposium, Aerospace officials discussed a simulation comparing the collision risks to a hypothetical satellite constellation posed by a single spacecraft with a cross-sectional area of 1 square meter with 100 CubeSat-sized spacecraft, each with a cross-sectional area of 0.01 square meters. All other things being equal the two scenarios should pose the same collision risk, since the combined area of the CubeSats is the same as the one larger spacecraft.

In fact, the simulation found that the collision risk posed by the CubeSats was 30 times greater than for the single satellite, because of the much greater uncertainties in the positions of the CubeSats. “The proliferation of cubesats can pose a significant collision and conjunction risk,” said Aerospace’s Andrew Abraham, who developed the simulation.

Compounding the problem is the lack of maneuverability of CubeSats. While companies are working on CubeSat propulsion systems, ranging from cold gas thrusters to electric propulsion, as well as deployable systems to increase drag and lower orbits, most CubeSats today have to rely on the gradual forces of atmospheric drag to reenter at the end of their missions, a process that can take from weeks to decades, depending on their initial orbits.

Companies planning smallsat constellations say they will adhere to existing guidelines that call for satellites in low Earth orbit to deorbit within 25 years of their end of life. That typically means placing them in orbits low enough to decay naturally.

“About 350 to 600 kilometers is the range we think is the responsible place to be putting our satellites,” Planet Labs’ Safyan said. That’s not a problem for the bulk of their current satellites, deployed from the ISS at an altitude that typically allows them to reenter in several months.

Spire is also keeping that 25-year guideline in mind as it selects launches for its constellation. Barna said they company was not too particular about the orbital altitude for its satellites, but did have an upper limit. “650 kilometers is where things start to get a little bit hairy with that,” she said.

Others at the meeting noted that the problem with smallsats and orbital debris wasn’t just their orbital lifetime. Lauri Newman, robotic conjunction assessment manager at NASA’s Goddard Space Flight Center, said there is another problem when a group of such spacecraft is deployed simultaneously, either from the ISS or as secondary payloads on a launch.

“The space station, for instance, will release a lot of CubeSats at the same time,” she said. “These CubeSats will come off in this cloud, and the JSpOC is trying to track them and add them to their catalog of objects, so that other satellites can avoid them.”

| “The proliferation of cubesats can pose a significant collision and conjunction risk,” said Aerospace’s Abraham. |

The problem with this “cloud” of satellites, she said, is that it can take up to a week for JSpOC to figure out which satellite is which and add them to their catalog. “Other spacecraft can’t take action against them because their position isn’t known,” she said. “There’s this time lag after launch of a CubeSat, or deployment of a CubeSat, when other objects can’t be protected.”

She suggested those deploying smallsats do analyses of where their spacecraft will be going in the days after deployment to proactively look for any close calls. Currently, she said, the only analysis required is to look for any possible reconnection between the satellite and its deployer.

Those in the CubeSat launch business say they’re willing to make it easier to track satellites as they’re deployed. Spaceflight’s Brzytwa said deploying all 89 satellites on their upcoming SHERPA mission at once “would be a fast track to make enemies in the industry.” He said the deployment of the carefully sequenced, with gaps between deployments ranging from several seconds to several minutes. “It’s in our best interest to make sure we’re identifying everyone as fast as possible.”

Smallsat constellations still face a number of obstacles, ranging from lining up financing to develop their systems to obtaining customer to close their business cases, as well as the execution risk any company faces trying to turn a business plan into a viable business. But challenges smallsats faced in the past getting them into space may be less of an issue in the future—provided they can also demonstrate they can get rid of them at the ends of their lives as well.