Getting there is still the hardest partby Jeff Foust

|

| “We think 2015 is going to be a little bit of a tough year” for smallsat launches, said Buchen. |

For years, companies have promised to help solve the problem of space access for smallsats. One track has been to make those secondary payload opportunities more frequent and easier to manage, for both the smallsat developer and the launch provider. Another track has been to develop a new generation of small launch vehicles designed specifically for small satellites that promise more frequent access to the orbits desired by those spacecraft. Both approaches have made progress, but the smallsat launch problem is still far from resolved.

Spaceflight Industries’ SHERPA will carry 87 smallsats on a Falcon 9 launch next year. (credit: Spaceflight Industries) |

Secondary opportunities and challenges

Most CubeSats and other smallsats are still launched as secondary payloads, taking advantage of excess capacity on larger launches. While such secondary payload opportunities have been around for many years, what’s changed recently is the ability to launch CubeSats from the ISS: the satellites are brought to the station on cargo missions and later deployed from a special dispenser. The relative ease in which satellites can be transported to the station and the frequent launch opportunities afforded by the steady stream of cargo missions made that option particularly attractive, at least for missions that didn’t mind the relatively short lifetime being launched form the station’s orbit afforded.

But the ISS option, used by a number of CubeSat developers, has had its problems as well. Last fall, the dispenser malfunctioned, halting deployments until astronauts fixed the dispenser early this year. A bigger problem, though, has been that steady stream of cargo missions to the ISS has slowed to a trickle. The Antares launch failure last October and the Falcon 9 launch failure in June have grounded both the Cygnus and Dragon spacecraft, the primary vehicles for transporting satellites to the station.

With both vehicles grounded until at least late this year—the next Cygnus flight, on an Atlas V, is scheduled for December, while the next Dragon flight hasn’t been scheduled but isn’t expected before November—access to the station has almost dried up. A Japanese HTV cargo spacecraft, which berthed with the station last week, did carry a number of CubeSats, but the HTV flies only about once a year, versus several flights per year of the Cygnus and Dragon combined.

The company hardest hit by this lack of ISS access for CubeSat launches is Planet Labs, the San Francisco-based company planning a constellation of such spacecraft to provide daily imaging of the Earth. Last year’s Cygnus failure took with it 26 of the company’s satellites, while eight more were lost on the June Dragon failure. While the company has publicly shrugged off the losses of the satellites (and launched 14 more on this month’s HTV mission), they’ve privately noted that those failures, and the resulting interruption in access to the station, have slowed their “agile aerospace” approach of rapidly developing and testing, then improving, their satellite designs.

The cargo mission failures have had a broader effect on smallsat launch access as well. In 2014, a report by Atlanta-based SpaceWorks Engineering forecasted that 140–143 “nano/microsatellites,” defined in the report as those weighing between 1 and 50 kilograms, would launch in 2014. In fact, 158 such satellites launched last year, an increase of 72 percent over 2013.

That same report forecasted more than 200 such satellites would launch in 2015, but the company acknowledges actual launches will fall far short of that. “We think 2015 is going to be a little bit of a tough year,” said Elizabeth Buchen, director of SpaceWorks’ engineering economics group, in an August 12 presentation at the Conference on Small Satellites at Utah State University in Logan.

At the time of her talk, fewer than 50 nano/microsatellites had launched so far in 2015. That total has increased to more than 60 with the HTV launch, but she said it was unlikely that the total would reach even last year’s mark, let alone their earlier forecast for 2015. “We’re probably not going to hit the number of satellites we got last year,” she said.

The biggest reason for that shortfall, she said, was the stand-down of the Cygnus and Dragon vehicles, which accounted for a significant fraction of the CubeSat-class spacecraft launched in recent years. The loss of Antares is particularly critical, she said, since those launches have accounted for about one third of the nano/microsatellites launched since the beginning of 2013.

ISS cargo missions are not the only way to launch smallsats, but they are some of the most popular ones. Buchen noted that only about 15 percent of launches in recent years have carried secondary payloads of some kind.

| Multimanifesting dozens of smallsats is “harder than herding cats,” said Lim. |

One long-standing challenge of launching smallsats as secondary payloads is the effort needed to integrate those satellites, working with both the launch services provider and the primary payload. Those challenges multiply as the number of smallsats on a single launch grows.

“There are unique challenges that occur once you reach a certain threshold number of spacecraft,” said Daniel Lim of TriSept Corp. in an August 10 presentation at the conference. He estimated that threshold to be between two and three dozen smallsats. “It’s harder than herding cats.”

TriSept is one of several companies that serve as “brokers” for smallsat launches: they act as intermediaries between smallsat developers and launch providers, aggregating smallsats for launch. For smallsat developers, such brokers can help them identify launch opportunities and handle the integration work; for launch providers, they can treat a collection of dozens of smallsats as a single secondary payload, easing their workload and making them more willing to fly secondaries.

Lim noted smallsats are often developed on much shorter timelines than larger primary payloads. “This causes some disconnect. It causes some potential for smallsat providers or rideshares to come in and perturbate or disrupt the main mission integration flow,” he said. “If you talk to any primary spacecraft provider, or you talk to any launch vehicle provider, that is a big no-no.”

Brokers, he said, can help avoid any disruptions by being that interface between the launch provider and multiple smallsat developers. TriSept handed the integration of 31 smallsats from 20 operators that launched on a Minotaur in November 2013, which at the time was the largest number of smallsats launched at once.

Others are looking to launch even more smallsats as secondaries. Spaceflight Industries’ SHERPA payload adapter will host 87 smallsats on a Falcon 9 launch from Vandenberg Air Force Base in California now expected for the first quarter of 2016.

All of the payload integration, company president and CEO Jason Andrews said in an August 10 conference presentation, will be done at Spaceflight’s facilities in the Seattle area before shipping SHERPA to Vandenberg. To the rocket, SHERPA will be seen as a single payload that will be deployed from its upper stage before releasing its dozens of smallsats.

The deployment of those 87 satellites will have to be carefully choreographed and monitored, in part to avoid any collisions among the satellites and to aid in tracking of those spacecraft by the Air Force’s Joint Space Operations Center, or JSpOC. “Obviously, when you’re deploying 87 satellites, it looks like a cloud. It gets the JSpOC really excited,” Andrews said. “We’re there to provide the information so we can tell who was deployed when and in what orientation. All that’s worked out ahead of time.”

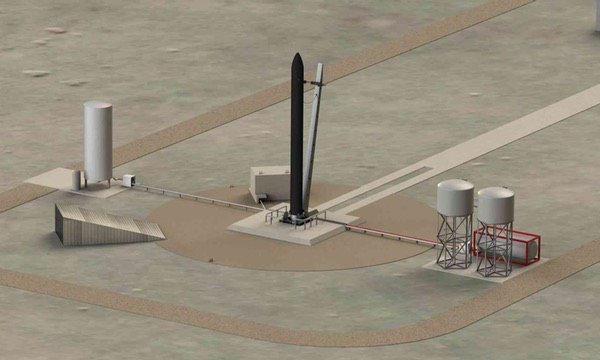

Rocket Lab Ltd. plans to launch its first Electron small launch vehicle from a site in New Zealand as soon as late this year. (credit: Rocket Lab Ltd.) |

Seeking the smallsat Holy Grail

Although smallsat developers have tried to make the most of secondary launch opportunities, including from the ISS, many still desire the control, in terms of orbits and schedule, provided by dedicated launches. “The Holy Grail of small satellites has always been dedicated launch,” said Carlos Niederstrasser of Orbital ATK in a August 10 conference presentation.

And there are a growing number of launch vehicles under development to serve smallsats. “Earlier this year, it appeared there was a new launch vehicle popping up in the news on almost a weekly basis,” he said.

| “The Holy Grail of small satellites has always been dedicated launch,” said Niederstrasser. |

Niederstrasser and colleague Warren Frick surveyed the industry and found 22 small launch vehicles—defined as having a payload capacity to low Earth orbit of no more than 1,000 kilograms—in various stages of development. (They found eight more after completing their study.) Those vehicles range from vehicles in service today, like Orbital’s own Minotaur and Pegasus, to concepts under active development to those that may not have have evolved much beyond PowerPoint charts.

One of those in the middle category—under active development—is the Electron by Rocket Lab, a company headquartered in the US but with most of its engineering staff in New Zealand. Electron is designed to carry 150 kilograms to low Earth orbit for less than $5 million a launch. Earlier this year, the company selected its first launch site, on a spit of land on the east coast of New Zealand’s South Island, with plans for a first launch near the end of this year.

The company is taking its own approach to brokering CubeSat launches, with an ecommerce theme. Earlier this month the company started selling slots for single-unit and three-unit (1U and 3U) CubeSats on its launches through its website. A 1U CubeSat can launch for $70,000 to $80,000, depending on the mission; a 3U goes for $200,000 to $250,000. Launches are available from the third quarter of 2016 into 2019.

But as Rocket Labs seeks to aggregate CubeSats for its small launcher, NASA is looking to provide something closer to dedicated CubeSat launches. In June, the agency released a request for proposal for its “Venture Class” launch services program, which covers the launch of 60 kilograms of CubeSats on either one or two launches. Proposals were due to the agency in July.

Garrett Skrobot, mission manager for NASA’s Educational Launch of Nanosatellites program, said at a NASA town hall meeting held during the smallsat conference August 10 that he expects the agency to make an award by the end of the fiscal year. “We have proposals in house that we’re reviewing right now,” he said. “Hopefully we’ll make selections by the end of September.”

But the large number of vehicles under development, or at least proposed for development, has raised questions about their viability. Many previous efforts to develop dedicated small launchers have fallen short for a variety of reasons, from a lack of funding to support development to limited demand for dedicated launches at the prices offered, especially if less expensive secondary opportunities are available.

“There’s not a lot of venture capital going into launch,” said SpaceWorks’ Buchen, who advocated for more investment in smallsat launch in her talk. “There’s a ton going into the satellite industry, but not as much into the launch side.”

Niederstrasser and Frick, in their presentation, said they made no attempt to judge the viability or credibility of the various smallsat launch vehicles they reviewed. “Some of them are clearly more credible than others,” he said, but declined to evaluate the vehicles included in their analysis.

| NASA plans to make a selection for “Venture Class” smallsat launch services by the end of September, said Skrobot. |

But he hinted at an issue those dedicated launchers face: pricing. About half of the vehicles with price information available were offering launches at about $40,000–50,000 per kilogram, while the rest were at about $20,000 per kilogram. “None of these costs come close to mirroring the cost of, say, a rideshare on a Falcon 9 or a rideshare on an Antares or a rideshare on an Atlas,” he said. “A dedicated mission definitely comes with a very steep cost penalty.”

Frick, after speeding through basic information about more than 20 rockets in a fifteen-minute presentation, held up a $100 bill. “In five years, I’ll be here. Anybody who wants to guess who has launched and which companies are still around” would get that money if they’re correct, he offered. For smallsat and small launch vehicle developers, the stakes are much higher.