The challenges of commercializing research in low Earth orbitby Jeff Foust

|

| “We expect that the majority of the demand will be private-sector driven,” Scimemi said. “The majority of the NASA focus will be on beyond low Earth orbit.” |

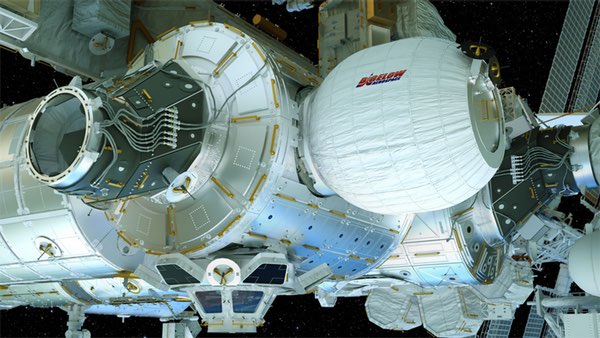

“A free flyer is absolutely a goal of Bigelow Aerospace, and the BEAM, which will be the first time that an astronaut steps inside an expandable habitat, is a very important milestone moving forward towards that vision,” said Mike Gold, director of DC operations and business growth, during a panel session March 30 at the National Academies that was part of a day-long examination of the commercial prospects for activities in low Earth orbit.

What emerged from that discussion is that the technical infrastructure needed for performing research in LEO, particularly by people, is finally coming together. Orbital ATK and SpaceX have vehicles to transport cargo to and from the ISS that can also be used commercially, while Sierra Nevada Corporation is developing its own cargo vehicle that will be ready in a few years. Boeing and SpaceX, meanwhile, are making progress on commercial crew vehicles that are scheduled to make test flights next year. And Bigelow has its B330 modules that the company says will be ready once commercial crew systems enter service.

What was less clear from that discussion, though, was the demand for those systems: who will want a commercial space station, particularly when the commercial viability of LEO research remains uncertain?

NASA argues that it is trying to stimulate that demand now on the ISS, with the goal of having sufficient demand to support commercial suppliers by the time the station is retired in the 2020s. “Private industry is the driver for the development and the sustainment of the supply,” said Sam Scimemi, ISS director at NASA Headquarters, describing the agency’s vision for commercialization in LEO.

The demand for those commercial facilities, Scimemi said, could include NASA, but only as one customer of many at most. “We expect that the majority of the demand will be private-sector driven,” he said. “The majority of the NASA focus will be on beyond low Earth orbit.”

That demand, though, is slow to develop, at least without the significant incentives provided by NASA and the Center for the Advancement of Science in Space (CASIS), the non-profit organization that oversees research on the half of the US part of the station designated a national lab by Congress. “The national lab, CASIS, is critical to the development of that demand,” Scimemi said.

CASIS, though, has been criticized for its slow start and a lack of clear results to date. Scimemi defended the organization at the National Academies event. “CASIS is making great strides in advancement on board the ISS to utilize their assets that are available to them through the national lab,” he said. “They have come up to speed with a vengeance.”

CASIS officials at the meeting played up their progress, showing slides with logos of a number of Fortune 500 companies that want to take advantage of what the organization calls the “ultimate innovation platform.” Winning over companies, though, has been a challenge.

“In every case, we walk into those companies and they say, ‘Oh, it’s interesting, the International Space Station, but you’re not relevant to us,’” said Cynthia Bouthot, director of commercial innovation and sponsored programs at CASIS. “They don’t, on its face, understand why they would think of diverting any of their research or technology development to station.”

| “What can we not do without that we have to get from space?” asked Culbertson. “We don’t have that yet.” |

Even those companies who signed up to fly experiments on the station admit that, in many cases, they’re still figuring out what LEO research is good for. “It wasn’t that we were drawn in in a standard way,” said Ken Savin of Eli Lilly, which is working with CASIS to fly several experiments on the ISS, including some that will launch on the Dragon this week. “It was more that we were given this opportunity, and we found the things that fit.”

Others are chasing long-held visions of using space not just for research but also for manufacturing. “I always had visions of doing manufacturing in space, “ said Paul Reichert of Merck, who has done protein crystal growth experiments on both the ISS and earlier shuttle missions. “Before you can do that, you need to show a unique benefit. I don’t have that data yet.”

Brian Hess of LaunchPad Medical, by comparison, was a newcomer to space. His company, developing a synthetic bone adhesive called Tetranite, won a competition run by CASIS and MassChallenge, a Boston-based startup accelerator, to test his product on the station to see if it could treat osteoporosis. “It’s sort of a shining moment in our company’s early history, because we saw this as a phenomenal opportunity,” he said, since it offered a way to test his material in a way not feasible on Earth.

What’s missing, many argue, is a long-desired “killer app” for commercial LEO research, something so compelling that it will open the floodgates and generate enough demand to sustain perhaps multiple commercial facilities in orbit.

“What can we not do without that we have to get from space?” asked Frank Culbertson, president of Orbital ATK’s space systems division, about that search for a killer app for LEO research. “We don’t have that yet.”

“If something is developed on a commercial basis, or the government cooperates and it’s commercialized, and it’s a product that can only be developed or manufactured or produced in space,” he continued, “then business will take off.”

Some think that a lack of awareness about the benefits of microgravity in particular has hindered the search for a killer app. “The awareness is extremely low still out there,” said Ioana Cozmuta, microgravity lead at the Space Portal, a commercialization office at NASA’s Ames Research Center.

She said she tried to address that by holding workshops about the benefits of microgravity research in workshops in the Silicon Valley area outside of the traditional space industry events, trying to reach potential new users. “The gamechanger is commercial space, and this burst of capabilities” for a wide range of microgravity research, including both suborbital and orbital, she said. “The price per pound is going in the right direction.”

She continued that, when she now approaches businesses about microgravity research, she asks them a simple question: how does gravity affect your bottom line? “Businesses care about their bottom line,” she said. “They want to know if there is a gravitational impact on their bottom line.”

| “Businesses care about their bottom line,” Cozmuta said. “They want to know if there is a gravitational impact on their bottom line.” |

While those outreach efforts continue, the clock is ticking for the ISS itself. All the major partners, with the exception of the European Space Agency, have formally agreed to extend the station’s operations to 2024; ESA is expected to make a formal decision at a ministerial meeting late this year. NASA has previously indicated that, from an engineering standpoint, the station can run to 2028.

At the same time, NASA wants to use the ISS as more than just a commercial research lab. The agency has a long list of exploration research it wants to conduct on the station to prepare for later human missions to cislunar space and, eventually, to Mars. Most of that research is currently slated to be done by 2024, at which point NASA’s rationale for continuing station operations will wane.

Some have suggested that NASA should reprioritize its allocation of research space on the station to favor that exploration research over access to the national lab to ensure it’s done by 2024, if not sooner. At a meeting last week at NASA Headquarters, the NASA Advisory Council approved a recommendation to NASA that it examine that balance of research to see if time allocated to the national lab would be used more effectively for exploration research. (While the 50-50 split between NASA and the national lab was established in legislation, that law gives NASA flexibility to make changes.)

That recommendation was driven by a concern that the ISS might end before NASA completes the research needed to take the next step in its Mars exploration plans. “The Council therefore feels that it would be beneficial for the Agency to better understand the effect that the resources being devoted to the ISS national laboratory might have on the important research needed to reduce technology and human health risk for the Journey to Mars,” a final draft of the recommendation, approved by the council April 1, stated.

The challenge, then, is to find viable commercial research and development activities in low Earth orbit—which could eventually become production and manufacturing activities—before the ISS reaches the end of its life, and to leverage the commercial transportation capabilities that either exist now or in the next few years.

If that happens, whether it’s the long-sought killer app or something less dramatic, the technical infrastructure to support that work outside the ISS won’t be an obstacle. “If we do find the killer applications, or even applications that can at least be profitable, we are looking at not just modules on the ISS, not just one private-sector free flyer, but multiple stations,” said Bigelow Aerospace’s Gold.