For smallsats, launch options big and smallby Jeff Foust

|

| “We decided we wanted a bigger payload capability,” Charania said of LauncherOne’s use of a 747. “We believed the market was robust enough for us to have a dedicated aircraft to service this market.” |

And this year, like in the previous three decades, one key topic of discussion was how to launch smallsats. With the growth of satellite constellations that, combined, will require thousands of satellites in the next decade, developers of small launch vehicles see a rich market that they believe could support multiple vehicles. They will have to compete, though, with larger launch vehicles offering new solutions for satellites willing to hitch a ride.

Banging down doors for rockets

At a side meeting held August 8, just before the main conference started, a standing-room-only audience filled a lecture hall to hear about the latest in small launch vehicles. They heard from several companies who made the case that they would soon be flying a new generation of low-cost small launchers designed to serve the growing demand for smallsats.

Rocket Lab, a company headquartered in the US but with most of its operations in New Zealand, is working on its Electron small launcher, capable of placing 150 kilograms into a sun-synchronous orbit. Earlier this year, the company said its first flight, from a launch site on New Zealand’s North Island, was planned for mid-year. That schedule has slipped a bit.

“We’re getting close to launch in the next few months,” said Rocket Lab’s Brad Schneider, not elaborating on the cause of any delays. The initial Electron launches will be test flights, with commercial missions starting next year. “We’ll start directly into commercial launches the latter part of the first quarter of ’17. That’s what we’re shooting for.”

If it sticks to that schedule, it will be followed later next year by Virgin Galactic’s LauncherOne. That vehicle, first announced in 2012, originally was to launch from the same carrier aircraft, WhiteKnightTwo, as the company’s SpaceShipTwo suborbital vehicle. Late last year, though, the company announced it was purchasing a Boeing 747—previously owned, by coincidence, by Virgin Atlantic—to serve as the new LauncherOne aircraft.

The purchase of the 747, the company’s A.C. Charania said in a conference presentation, is two-fold. “We decided we wanted a bigger payload capability,” he said. “We believed the market was robust enough for us to have a dedicated aircraft to service this market.”

The 747 will increase LauncherOne’s payload capacity to 300 kilograms for sun-synchronous orbits. Launches will begin in the second half of next year, he said, initially flying out of the Mojave Air and Space Port, which supports sun-synchronous and other high-inclination orbits. The company is also looking for sites to fly out of for launches to lower inclinations; Charania didn’t mention any, but his slides showed both KSC and Virginia’s Wallops Flight Facility as two potential options.

Firefly Space Systems is working on its Alpha vehicle, with an initial payload capacity of 200 kilograms to a sun-synchronous orbit. “Firefly Alpha is our approach to get to space as quickly as possible,” said company CFO Michael Blum. “This is not the highest performance vehicle that you could come up with, but it is the one that you can develop the quickest and the cheapest.”

That payload capacity can be increased over time to serve the “full sub-one-metric-ton payload category,” he said. For example, he said adding a turbopump to the vehicle, which in its initial design is pressure-fed, could double its capacity. It’s looking to start flying the Alpha in 2018, with its manifest of flights that year sold out and most of 2019 also sold out, he said.

A newer entrant in the small launch sector is Vector Space Systems. It is developing the Vector One rocket based in part on a nanosatellite launch vehicle concept Garvey Spacecraft Corporation, formally acquired by Vector last month, had been working on for several years. As the name suggests, it is focused on the smaller end of the market, with a payload capacity of about 50 kilograms.

Vector Space expects to start launches in 2018, but unlike Firefly has no plans to develop larger vehicles. “Rather than making money by learning how to make it bigger, like everybody else seems to do, we’re truly going to stick with one size and we’re going to figure out how to launch more of them,” said CEO Jim Cantrell.

| “People are literally banging our door down trying to get rockets because they’re just not enough capacity out there,” said Vector’s Cantrell. |

That’s a lot of companies planning a lot of launches—Firefly alone envisions doing 50 launches a year by the early 2020s—but they’re just the tip of the iceberg. Dozens of other vehicles are in various stages of development. During the hour-long side meeting, some of those other developers chimed in from the audience, like former astronaut Sid Gutierrez, who believes his company, Rocket Crafters, has the solution to low-cost small launch with 3D-printed hybrid rocket motors.

Is there really enough demand, though, for even the four companies—Firefly, Rocket Lab, Vector, and Virgin—on stage at the side meeting, let along the many more in the audience and elsewhere? “We see a big demand from a domestic US standpoint as well as internationally,” said Rocket Lab’s Schneider. “I think we could sustain a nice business model.”

“Our market research assumes none of the constellations ever become operational,” said Firefly’s Blum, who believes there’s a “good mix” of both commercial and government customers overall. “We see that demand continues to outstrip the market certainly into the next decade.”

“People are literally banging our door down trying to get rockets because they’re just not enough capacity out there,” said Vector’s Cantrell. He acknowledged, though, that if and when multiple small launch vehicles enter service at the flight rates they envision, “there’s a potential there will be a lack of demand” to support all the companies.

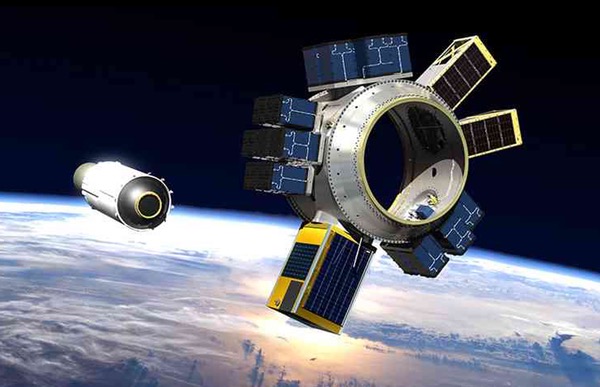

Spaceflight’s SHERPA will carry 87 smallsats on a Falcon 9 launch currently scheduled for late October. (credit: Spaceflight) |

“The market was just not there”

And the competition for small launch vehicles doesn’t come from just among themselves. Today, most smallsats are still launched as secondary payloads, either taking advantage of excess payload space on various launches or flying as cargo to the International Space Station to be later deployed from there. Those options are not going away in the near future.

In fact, in some cases those alternatives are being augmented. Later this year Spaceflight, the Seattle company that brokers secondary payload accommodations on various vehicles, is launching its SHERPA payload adapter on a Falcon 9. SHERPA is carrying 87 satellites, ranging from a 150-kilogram microsatellite down to a 2U CubeSat.

SHERPA will itself be a secondary payload, flying on a Falcon 9 carrying the Formosat-5 satellite for Taiwan. That launch, from Vandenberg Air Force Base in California, is currently scheduled for late October, Spaceflight president and CEO Jason Andrews said in a presentation about the mission at the conference.

Spaceflight is looking to move beyond just secondary payloads. Last September, the company announced it was purchasing an entire Falcon 9 launch from SpaceX, a so-called “dedicated rideshare” mission planned to launch in the second half of 2017 from Vandenberg. That mission will carry more than 20 small satellites, including the lunar lander for SpaceIL, a Google Lunar X PRIZE team.

| “I think I’m okay at selling stuff, and I had a hard time selling Falcon 1. The market was just not there,” Shotwell said. |

In an interview later in the conference, Andrews said he did not see the new generation of small launch vehicles as competitors to his business model, particularly given the demand for launches to sun-synchronous orbit. “For popular destinations, like SSO, these bigger rideshare missions are probably going to be more affordable for a lot of customers,” he said. “That said, these small dedicated rockets are enabling for going to unique places, and they absolutely service a niche.”

SpaceX, the company working with Spaceflight on both SHERPA and its dedicated mission, seems to agree. A decade ago, when the conference was about the third the size it is today, SpaceX was seen as the savior of the smallsat field with its Falcon 1 small launch vehicle. In its initial iteration, the Falcon 1 promised to carry payloads of about 500 kilograms into low Earth orbit for $6 million, a capability and price comparable with some of the new small launch vehicle entrants.

The Falcon 1, though, last flew in 2009. SpaceX, after talking about bringing back an enhanced version of the Falcon 1—greater payload performance but also a higher price—for a few years, has declared the Falcon 1 dead, never to return as the company focuses on the Falcon 9, Falcon Heavy, and whatever vehicles might exist in the future.

The problem, SpaceX president Gwynne Shotwell said in a keynote address at the conference, was a lack of demand. “We certainly couldn’t get it to earn its place on the factory floor. Falcon 9 and Dragon were much better products for us to pursue,” she said. “I think I’m okay at selling stuff, and I had a hard time selling Falcon 1. The market was just not there.”

SpaceX is instead embracing rideshare opportunities, working through “aggregators” like Spaceflight. Shotwell noted SpaceX had a new agreement with Spaceflight for four more dedicated rideshare missions over the next four to five years. “That will hopefully provide access—regular, count-on access—to space to sun-synchronous orbit and maybe other LEO destinations, but GTO as well,” she said.

She added SpaceX was also willing to fly smallsats as secondary payloads on its Falcon Heavy rocket. “There should be a lot of extra capacity on this rocket,” she said. “Hopefully we will fly a lot of ESPA or ESPA-like rings underneath the primary payload to provide regular access for you all to fly.” (ESPA, or EELV Secondary Payload Adapter, is one common interface for secondary payloads.)

| “I believe the parameters in the industry have changed dramatically,” Shotwell said. “There’s a lot of folks out there that are competing for that, so I imagine that they know something.” |

SpaceX is not the only one looking at dedicated rideshares and other approaches to using larger rocket for smaller satellites. In a presentation at a CubeSat workshop before the main conference, Fabio Caramelli of the European Space Agency said ESA was exploring ways to use its Vega small launch vehicle—whose current payload capacity of 1,500 kilograms to a polar orbit is significantly larger than many others under development—to provide a “bus service to space” for smallsats.

That service, called the Small Spacecraft Mission Service, would fly once a year and carry 15 or more satellites at a time. “The objective is to develop a tailored mission service operational capability for the Vega system to guarantee access to space at an affordable price,” he said. “It sounds simple, but it’s not.”

But even Shotwell said she believed that there was a market for small launch vehicles that didn’t exist several years ago. “I’m hoping the case has changed enough. Certainly the numbers, both the investment numbers as well as the number of launches, has changed dramatically,” she said. “That’s what Falcon 1 did not have at the time.”

“I believe the parameters in the industry have changed dramatically,” she continued. “There’s a lot of folks out there that are competing for that, so I imagine that they know something.” We will, over the next few years, find out just how much those small launch vehicle companies really know.