Blockchains and the emerging space economyby Vidvuds Beldavs

|

| Central to the economy is money and rules for transacting business, as well as institutions that facilitate business activity. To build a self-sustaining space economy, these questions are no less important than building reliable spacecraft to get us to our destinations. |

A general definition of an economy is “an area of the production, distribution, or trade, and consumption of goods and services by different agents in a given geographical location.”1 A space economy refers to an economy beyond the Earth, based on the use of space resources. Communications satellites in geosynchronous orbit, or Earth resource scanning satellites in low Earth orbit, are parts of the terrestrial economy and result in services delivered to people on the surface of our planet. Mining water ice on the Moon to produce fuel or water for life support in space would be economic activity in the space economy. When performance of such activities in space can demonstrate the possibility of sustainable, positive cash flows in the aggregate, then the space economy can be termed to be self-sustaining. At that point, goals such as colonizing Mars or developing space settlements in off-planet habitats, such as proposed by Gerard K. O’Neill,2 can become possible.

Building blocks of a space economy

Generally, the idea of colonizing Mars or industrially developing the Moon brings to mind rockets and related technologies to get equipment and people to a destination, or infrastructure such as communications hubs, fuel depots, and so forth. However, these are technologies used in some economic activities but are not the economy itself. Central to the economy is money and rules for transacting business, as well as institutions that facilitate business activity, such as banks. To build a self-sustaining space economy, these questions are no less important than building reliable spacecraft to get us to our destinations.

The dollar, euro, renminbi, and other terrestrial currencies have limitations that argue for the creation of space money for a space economy. Money is a store of value defined within the rules of commerce governing transactions between buyers and sellers. Space markets may involve human as well as robotic actors in transactions. Existing forms of money are based on transactions between humans who are subjects of sovereign nation states. As a result, terrestrial money has national and geopolitical overtones that make it less suitable for use in space than a currency specifically designed for a space economy involving interests from around the globe and beyond, both human and robotic.

Hernando de Soto is a development economist who identified clear property rights and a formal, efficient to use property registry as the primary distinction between countries that are developed and well off and those that remain poor.3 The implication for space development is that substantial development cannot take place until there is a property or a land-use register recognized by all participants in the space economy. Clearly, the property register will need to be compliant with the Outer Space Treaty that excludes conventional real property, whose ownership rights are granted by a sovereign state, to comply with Article II : “Outer space, including the moon and other celestial bodies, is not subject to national appropriation by claim of sovereignty, by means of use or occupation, or by any other means.”4

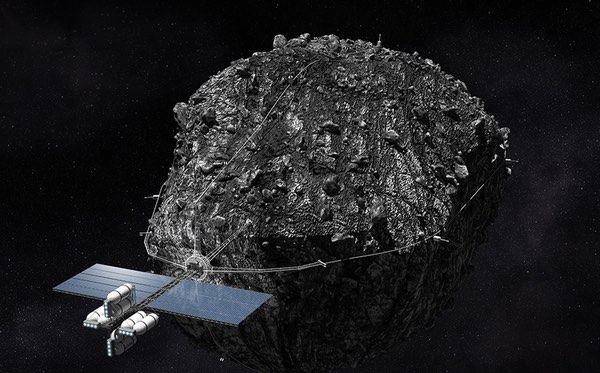

Industrial processes on the Moon and on asteroids, as well as in facilities in space, will be primarily robotic. Materials will be mined and processed into products by robotic systems and conveyed to other robotic systems. While some of these products will be directly used by humans, most use will be by robots involved in other production steps or be stored by robotic systems or conveyed to other locations by robotic systems. In effect, the space economy will be an instance of the Internet of Things (IoT).5 The first operating facility on the Moon is likely to be a robotic village with the robotic systems communicating with each other and with humans offsite through the Internet.

The common element among space money, a space property registry, and the IoT for robotic systems in space is the use of blockchain technology.

Blockchain

Blockchains are distributed transaction ledgers first introduced with the Bitcoin cryptocurrency in 2008.6 Blockchains have been referred to as the greatest innovation since the Internet with the potential to transform financial systems, government functions, and the IoT.7 Google, Microsoft, IBM, and other major IT firms, as well as central banks and large commercial banks, have large-scale activities underway to research and to develop capabilities to use blockchains.8

| Blockchain technology can enable another building block of the space economy, which is a Space Bank. |

Blockchains are being implemented as the technology underlying property registers.9 Blockchains are also fundamental to the operation of IoT.10 IoT subfunctions would include the communications relays and protocols governing the IoT implementation, be it a robotic village on the lunar surface, a multi-client space station, interplanetary spaceship, Earth-Moon transporter, and other systems.

Blockchain technology can enable another building block of the space economy, which is a Space Bank (a First Bank of the Moon, perhaps?) The function of the Space Bank can include a clearing process between activities transacted in Space Money (SM) and activities transacted in dollars, euros, pounds, renminbi, and other currencies on Earth. The Space Bank could include lending and other traditional functions of banks. Lending could be done in SM, conventional terrestrial currencies, or other cryptocurrencies.

A special variant of the Space Bank could be the Space Investment Bank. The Space Investment Bank could accept investment in terrestrial currency to invest in operations transacted in SM involving space resources identified in the Space Property Register and operations by a range of robotic devices.

Space Money

Money has evolved over millennia initially as tokens representing physical things, like the number of sheep, to later gold or another valuable commodities. The US dollar, euro, and other major currencies are fiat currencies whose value is based on the strength of the economy, the consistent payment of obligations of the government, and other considerations. Over time, money evolved to fulfill the following functions: a medium of exchange; a unit of account; a store of value; and, sometimes, a standard of deferred payment.

After the development of the Internet, electronic money emerged that could be used to transact business on the Internet. PayPal is an example of a centralized electronic money system where transactions are based on the value of fiat currencies, principally the US dollar or the euro. In 2009, Bitcoin emerged as a decentralized, peer-to-peer electronic money system that used a decentralized ledger called a blockchain to store transaction history and the value of the currency. Bitcoin and successor currencies such as Etherium11 are not based on or backed by either a fiat currency like the dollar or a valuable commodity like gold. The value emerges through a consensus process. A significant advantage to decentralized ledger systems is that no central control is required. Parts of the network could go down and the “Internet of Value”12 would continue to fulfill its functions.

SM is proposed as a blockchain-based cryptocurrency intended to serve as a medium of exchange involving space economic activities, including robotic and human activities, purchase and sale of space resources or products produced from space resources, or of transportation and other services provided in space particularly where no terrestrial-based activities are involved. SM benefits from being neutral regarding specific terrestrial currencies. The nationality of the buyer and the seller does not matter. It also does not matter whether the buyer or seller is a person or a robotic system autonomously fulfilling services to customers.

An example could be a power-beaming satellite in lunar orbit that sells power to a robotic rover on the surface, charging the rover for the specified number of kilowatt hours. The rover pays for the electrical power received, with both operating as parts of an IoT system. Humans would not necessarily be in the accounting loop. Value accumulated by the power-beaming satellite, however, could be used to fund its maintenance and potential replacement. Any surplus savings could be directed to investment accounts for business expansion, technology upgrades, or further development. If this sounds like science fiction, keep in mind that the EU is considering imposing taxes on robotic labor.13

| The blockchain of the land use entry would contain the full transaction history of the site. As a blockchain it would be unhackable and establish clear title to the land use rights. |

An advantage of SM is that it would be independent of terrestrial currencies and, since there would be no initial space markets, the unit of value would need to be set by the designers. Terrestrial currencies have been pegged to gold and other precious metals. Or, they could follow examples such as Hong Kong, which pegs its currency to the US dollar through a currency board14 that gives the Hong Kong dollar comparable stability to the US dollar. SM would benefit by being neutral regarding terrestrial affiliation, so it can be pegged to the IMF Standard Drawing Right (SDR), which is a weighted basket of major currencies.15 Latvia is a small country that pegged its currency, the lat, to the SDR from 1994 to 2004 when Latvia joined the EU, after which it pegged its currency to the euro. Latvia joined the Eurozone in January 2014, when it switched to the euro. The SDR can be considered the most stable financial unit in the world insofar as activity weighted economic activity in all major currencies is reflected in its value.

Land use claims and the space property registry

A precondition for a space property registry is the capacity to precisely locate the property. To do this, precise and up-to-date geodetic maps of the Moon or other celestial bodies chosen for exploitation will be required. This technical requirement needs to be addressed from the viewpoint of a property registry that requires very precise boundaries be demarcated for use claims. A GPS-type system may be sufficient at the stage where there is a mining or utilization rights claim. However, when mining operations are being developed, then precise maps and physical boundary markers may be required depending on the regulations covering claims to land use rights and land use rights confirmed by a governing authority. Top-level Issues relating to the establishment of claims to land use rights include specification of the rights sought: surface rights, subsurface rights, rights to space above the site, set asides for transportation and other services, and so forth. The boundary markers could be smart devices with the capacity to respond to inquiries and to record information. Claims would require substantiation that could include physical samples taken from a defined number of points within the claimed site, possibly drilled to a defined depth, as well as permanent physical markers endowed with memory capacity identifying the location and boundary points of the site.

There is no international agreement in recognizing land use rights on the Moon or other celestial body. There are also no procedures to make claims to such rights, or certifying such rights when the land is utilized for purposes permitted by an internationally-recognized governing authority. Also, the very idea of selling land use rights in a market for space resources cannot even be entertained until these fundamentals are addressed. However, the existence of a system to manage a land use registry could emerge as a factor driving negotiation of agreements regarding land use rights. For example, research organizations involved in lunar exploration could register all uses of lunar land that take place, be they purely scientific or instead pilot mining or materials processing operations permitted under existing space treaties. The companies, research organizations, and space agencies involved in lunar activities could develop rules for registering the different types of land use that will get underway. No doubt cases will arise where one organization does initial development of a site and, for any number of reasons, may not continue, but other organizations may be willing to pay for the right to operate at that location.

The blockchain of the land use entry would contain the full transaction history of the site. As a blockchain it would be unhackable and establish clear title to the land use rights. In time, companies could start to use the land use rights register and agree to self-governance measures, engage in mining, and even sell land use rights leading to the creation of markets for lunar property. Formal agreement among states could follow under such a scenario. Historical precedent for this exists in the California gold rush, where government formalized the claims that had been established earlier informally.16

There is no international agreement regarding a governing authority of the Moon. Thus far the Outer Space Treaty provides little that is substantive regarding how such an authority would be created, what authority it would have, or how its operations would be funded. The Moon Treaty that was approved by the UN General Assembly in December 1979 provides general guidelines for an international regime to govern lunar development in Article 11, section 7:

7. The main purposes of the international regime to be established shall include:

(a) The orderly and safe development of the natural resources of the moon;

(b) The rational management of those resources;

(c) The expansion of opportunities in the use of those resources;

(d) An equitable sharing by all States Parties in the benefits derived from those resources, whereby the interests and needs of the developing countries, as well as the efforts of those countries which have contributed either directly or indirectly to the exploration of the moon, shall be given special consideration.

The Moon Treaty, however, has only been ratified by 16 nations,17 none of whom are major spacefaring powers, and is widely viewed as inactive. However, given that such agreements are reached regarding assignment of land use rights, then all transactions involving a given defined territory on the Moon can be captured via the blockchain for that parcel. This includes original survey data; any improvements to the property, such as structures; initial land use claims; any further sale of the property; any liens or debts against the property; and so forth.

Space markets

A variety of space markets will emerge for energy, space resources, shipping and warehousing, passenger transport, and others. The creation of structures such as the Lunar Marketplace and Swap Shop (LMASS),18 proposed at the 2016 International Astronautical Congress by George Nield, head of the FAA Office of Commercial Space Transportation, is a welcome start:

“Think of it as a corkboard,” Nield said. The potential traders could include businesses that are working on ways to move cargo from low Earth orbit to lunar orbit, or on moon landers, or on habitats, or surface transportation, or communication services, or other technologies that will eventually be needed for lunar operations.

If the LMASS is designed early on to utilize blockchain technology, as the number of users increases SM could be introduced for transactions involving space activities and space resources. This could make LMASS and possible successors a universal portal accessible to any entity that can operate with SM regardless of the currency of their location.

Space resources

Water as a space resource

An early candidate for a marketable space resource is lunar water. Water exists in the form of ice in deep craters at the lunar poles. Estimated quantities are huge and could potentially provide fuel, water for life support, and water for radiation shielding for human missions heading to Mars and beyond. Lunar and asteroid water can be considered as an economic resource because, in the long term, recovery of water from the Moon is potentially far less costly than launching comparable volumes of water from the Earth.

| The existence of the space financial infrastructure will attract investors with no present ties to the space industry. |

Given a commercial venture on the Moon selling water to customers, such as space hotels, deep space missions, or to processing facilities in cislunar space, the transactions will involve a medium of exchange. While US-based firms are presently the leaders in commercial space development, it is highly unlikely that the US will emerge as the only or even the dominant presence in the space economy in the long term. The existence of a financial infrastructure including SM, Space Land Use Rights Register, Space Bank, and Space Investment Bank, would encourage investment in commercial lunar and cislunar ventures from multiple terrestrial economies, particularly as a standardized valuation of space resources is developed. We already have the example of Luxembourg, a very small country with modest spacefaring capabilities. The existence of the space financial infrastructure will attract investors with no present ties to the space industry.

Value of space resources

The estimated value of a space resource could provide a basis for investment decisions much as the estimated value of a terrestrial resource, such as the presence of oil in Gulf of Mexico, serves as justification for the investment of billions of dollars to engineer enormous platforms for exploratory wells and eventual drilling.

| The existence of the space financial infrastructure will attract investors with no present ties to the space industry. |

In a self-sustaining space economy, the value of space resources is likely to be based significantly on the basis of the utilization of the identified resource for economic activities in space rather than to meet economic needs on Earth. Examples include water, carbon dioxide from the Martian atmosphere, and the use of lunar basalts, including basalt fibers and 3D-printed structural elements, for other spacecraft components. Initially, the value of these materials would be determined in part by the cost savings of avoiding launch from Earth. At present, one kilogram of water in low Earth orbit has a value roughly equal to the cost of launching it to LEO that presently exceeds $5,000 per kilogram.

Longer-term material resources will be identified with an economic value that significantly exceeds the cost of launch from Earth. Examples include asteroids that may be composed of concentrations of palladium group metals or, conceivably, the thorium anomaly on the Moon or the proverbial solid diamond asteroid that could have significant terrestrial value. Another case would be presented by the use of lunar regolith to construct solar cells to beam power to the terrestrial surface such as proposed by Peter Schubert19 or by Shimizu Corporation.20

Given that multiple states are involved in space development, the choice of a common currency would accelerate commercial development. Space resources could then be valued according to a common methodology and transactions could be made in common space currency rather than in national currencies. Given a common space currency and valuation methods, then regions of the Moon could be identified as claimed with mining rights for a specific commercial venture for a defined period of time and conditions agreed to by the parties active in lunar development. Given that a methodology is developed to value space resources and the legal framework exists to recognize a claim, then space resources, whether located on a specific asteroid or a region of the Moon, could become the basis for financing the development much as the future potential of a terrestrial resource is used as a basis for financing development of the resource itself. A rough idea how this might work was previously published here (see “The asteroid mining bank”, The Space Review, January 28, 2013).

Establishing a claim to lunar resources

The development of technologies to mine the asteroids, process the mined materials, and to produce products in space is proceeding rapidly. There is parallel development underway in space policy and in space law. US domestic law recognizes that commercial ventures that mine resources in space will have ownership rights over the materials that have been mined and can sell or process such materials.21 Luxembourg has taken this further,22 and we can expect other EU member states to follow. The Moon Treaty (Article 6 Section 2) states:

…States Parties shall have the right to collect on and remove from the moon samples of its mineral and other substances. Such samples shall remain at the disposal of those States Parties which caused them to be collected and may be used by them for scientific purposes. States Parties shall have regard to the desirability of making a portion of such samples available to other interested States Parties and the international scientific community for scientific investigation. States Parties may in the course of scientific investigations also use mineral and other substances of the moon in quantities appropriate for the support of their missions.

Whether or not the Moon Treaty becomes accepted international law, and regardless whether an international regime has been negotiated in compliance with this Treaty, the Treaty permits use of lunar resources for scientific investigation and nations may use “mineral and other substances of the Moon in support of their missions.” Given that all activities in space beyond GEO will continue to be exploration and scientific until a self-sustaining space economy has emerged with markets for space resources, for now there essentially are no restrictions on the mining of lunar resources.

Blockchain and the Internet of Things: foundations of the space economy

A “robotic village” was proposed in the late 1990s by Professor Bernard Foing as an initial operating facility on the Moon.23 If this village is an application of IoT and the blockchain, then all activities between the actors in the village can be tracked. How much energy does a rover consume? How much data does the rover transmit? How much does it receive and from whom? Each transaction can be costed and the owner of the rover, or the rover itself if it is an autonomous robotic device, can pay for the energy or the communications services.

| A self-sustaining space economy can only emerge after the building blocks are in place. What is exciting is that the building blocks are relatively cheap and that the act of creating them advances the emergence of the self-sustaining space economy. |

Given that ultra-precise geodetic maps of the Moon, or an asteroid or other body, are prepared that enable space resources at a location to be assayed, the values stored, and mining, use, or presence rights assigned, then those rights would confer value to the holder of the rights. This value could be the basis for issuing credit to the owner of the use rights to develop the resource.

Space resources that have not been assayed and have not been valued in terms of SM would have no value in the space economy, just as petroleum resources have no value until rights to their use have been established and their value has been assayed, at which point they are either actively being worked or considered proven reserves. If the rights to a particular resource are or can be contested by multiple users, that resource also has no value. Rights to use a particular resource must be exclusive to a particular user for a specified time to have value.

What blockchain enables are systems to manage the functioning of the IoT, comprised of the robotic systems operating in a given location on the Moon, cislunar space, Mars, asteroid or wherever, while also managing communications with owners and users, and also managing the economics of use. What this also enables is the creation of a system to finance space development based on space resources controlled by states or space business owners.

Starting up

A self-sustaining space economy can only emerge after the building blocks are in place. What is exciting is that the building blocks are relatively cheap and that the act of creating them advances the emergence of the self-sustaining space economy. Below are some starting steps:

- Establish the blockchain technology underlying Space Money, the Space Land-Use Rights Registry, and the Internet of Things for space operations as open source standard software. This could be contributed by a major software provider.

- Develop standards for recording any use of territory on the Moon by members of the International Lunar Exploration Working Group (ILEWG)24 in a lunar blockchain-enabled land use rights registry for the Moon.

- Initiate use of Space Money to cover any transactions among parties active on the Moon or between parties on the Moon and parties in cislunar space.

Recommendations

Develop a blockchain-based financial infrastructure for the emerging space economy to serve needs of lunar exploration and initial development through 2030 while laying foundations for post-2030 development. The initial cost would be modest.

Create working groups within the ISECG to further the development of rules governing key space economy functions:

- Space money and related governance and funds clearing mechanisms with terrestrial money including a space bank

- Lunar land-use registry

- Valuation of space resources

- Space investment bank based on space resources with contributions from public and private investment funds

The International Lunar Decade25 is proposed as a framework for international collaboration to establish shared infrastructure in cislunar space and on the Moon, to develop key enabling technologies, and to establish the legal foundations for the emerging space economy.

Use the UNISPACE 5026 global conference planned for 2018 to reach agreement on a strategy for the creation of the space economy. Think of it as the equivalent of the Paris Climate Conference for space development.

Endnotes

- https://en.wikipedia.org/wiki/Economy

- O’Neill Gerard K. 1976. The High Frontier, William Morrow and Company, Inc., New York,

- de Soto, Hernando, 2000. The mystery of capital: why capitalism triumphs in the West and fails everywhere else, Basic Books

- http://www.unoosa.org/pdf/publications/STSPACE11E.pdf

- http://readwrite.com/2016/03/29/iot-blockchain-unlocking-value-pm4/, also http://blockchained.blogspot.com/2015/03/internet-of-things-on-blockchain-network.html

- https://techcrunch.com/2014/10/25/bitcoin-2-0-sidechains-and-zerocash-and-ethereum-oh-my/?ncid=rss

- http://www.information-age.com/how-blockchain-will-defend-internet-things-123461443/

- https://mises.org/blog/why-governments-want-central-bank-issued-digital-currency; http://www.theeventchronicle.com/finanace/central-bank-digital-currencies-revolution-banking/#

- https://extranewsfeed.com/the-blockchain-is-perfect-for-government-services-heres-a-blueprint-628d4c73edb7#.d6du04lb0

- http://blockchained.blogspot.com/2015/03/internet-of-things-on-blockchain-network.html and https://www.digitaldoughnut.com/articles/2016/april/blockchain-is-the-most-disruptive-invention-since

- https://github.com/ethereum/wiki/wiki/White-Paper

- http://fintechnews.ch/blockchain_bitcoin/blockchain-internet-value/6215/

- http://www.reuters.com/article/us-europe-robotics-lawmaking-idUSKCN0Z72AY

- https://en.wikipedia.org/wiki/Currency_board

- http://www.imf.org/external/np/exr/facts/sdr.htm/ The value of the SDR is currently based on a basket of four major currencies: the US dollar, euro, the Japanese yen, and pound sterling. The basket was expanded to include the Chinese renminbi (RMB) as the fifth currency, effective October 1, 2016.

- https://en.wikipedia.org/wiki/Land_claim and http://www.law.cornell.edu/uscode/text/43/1744

- https://en.wikipedia.org/wiki/Moon_Treaty

- http://www.geekwire.com/2016/market-moon-village-faa/

- https://ildwg.files.wordpress.com/2015/03/energy-resources-beyond-earth-ssp-from-isru-schubert.pdf

- http://sservi.nasa.gov/articles/the-luna-ring-concept/

- http://www.spacepolicyonline.com/news/president-signs-fy2016-ndaa-commercial-space-bills-into-law

- http://www.spaceresources.public.lu/en/index.html

- http://www3.nd.edu/~cneal/CRN_Papers/Ehrenfreund12_ASR_GlobalExpProg.pdf. This 2012 source identifies startup of the Global Robotic Village, its role and activities in the exploration of the Moon.

- http://sci.esa.int/ilewg/

- https://ildwg.wordpress.com/

- http://www.unoosa.org/oosa/en/ourwork/unispaceplus50/index.html