Kneeling before a sovereignby Dwayne A. Day

|

| Because they included a Kevlar-like material similar to that used in bulletproof vests, Bigelow’s spacecraft were in fact bulletproof. The company’s business plan, however, was not. |

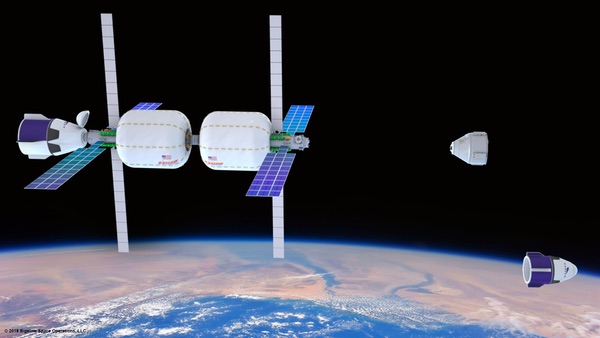

Bigelow debuted on the space stage in 2000, gaining access to a unique bit of NASA technology: an inflatable habitation spacecraft called Transhab that NASA had been working on in-house for several years. The concept of inflatable space stations dates to the early years of human spaceflight, when several companies, including tire maker Goodyear, explored the idea of a soft-skinned vehicle that would be inflated and become semi-rigid in the vacuum of space. NASA never adopted the technology in the Apollo and shuttle eras, but the agency began development of it in the 1990s. For reasons that were never quite clear, but were due at least partly to the immaturity of the technology, the agency canceled the project and used more conventional structures for the International Space Station. That’s when Bigelow stepped in and. through an agreement with the space agency, acquired the technology for further development. Early on, Bigelow said that he preferred the term “expandable” rather than inflatable, because the latter implied that the vehicle was like a balloon and therefore fragile. Because they included a Kevlar-like material similar to that used in bulletproof vests, Bigelow’s spacecraft were in fact bulletproof. The company’s business plan, however, was not.

In the 2000s, Bigelow expected that they would sell opportunities to fly in their inflatable habitats to foreign governments that would fly their own astronauts and conduct their own experiments and could conceivably put their own flag on the outside of the spacecraft. It was never clear what the final arrangements would be for such flights, but the potential customers would have to be countries with a lot of money, and a desire for greater visibility on the world stage, most likely including several Persian Gulf clients that in the 2000s were in the early stages of major economic, education, and technological development projects.

In his recent interview, Robert Bigelow stated that the 2008 economic crisis wiped out that potential market. Bigelow claimed that the company signed memoranda of understanding and letters of intent with eight unnamed countries interested in using its space stations. But, according to an article in SpaceNews, the customers, Bigelow said, “went from fantasizing about ambitious space programs for human beings in LEO to worrying about whether or not they’re going to default tomorrow on their national debt.”s He did not address the fact that the only human spacecraft then capable of reaching one of his orbital habitats was the Russian Soyuz. According to Bigelow, today his company is facing new competitors, including the International Space Station, and China. Once China has a space station operating in the 2020s, they could invite other countries to send astronauts for visits, thus undercutting any potential market for Bigelow.

It is not exactly clear what Bigelow’s early agreements covered. They probably involved more than merely flying experiments in space and probably also included flying citizens of those countries who would be primary sponsors of singular missions. But when Robert Bigelow refers to the ISS and China as his competitors today, he is apparently referring to something less than a foreign government mounting a complete space mission and more like the kind of arrangement that NASA used to have when it flew foreign nationals on space shuttle missions.

| There is an inherent problem with the “sovereign market,” which is that governments are generally uninterested in paying large amounts of money simply to fly their citizens as passengers on somebody else’s spacecraft. |

Bigelow was not the only company interested in sovereign customers. In December 2012, space startup Golden Spike announced plans to develop a commercial human lunar landing capability. (Golden Spike’s plans were discussed extensively in The Space Review. See: here, here, and here.) Like Bigelow, Golden Spike wanted to find foreign governments that would pay to fly passengers on their spacecraft—offering the opportunity to, say, land the first Saudi Arabians on the Moon. Several countries were rumored to be in “discussions” with Golden Spike at the time, but none ever became customers, and the company went dormant.

The illusive sovereign

There is an inherent problem with the “sovereign market,” which is that governments are generally uninterested in paying large amounts of money simply to fly their citizens as passengers on somebody else’s spacecraft. Although a country can make one of their own astronauts into a national hero, usually if a government decides that it wants a space program, their goal is more than to simply fly in space, but also to develop the country’s own domestic industry and education capabilities. Unless a company can offer to train that country’s engineers and allow that country’s industry to build significant portions of the spacecraft domestically, it is not going to want to pay the money. It was never clear that Bigelow could have offered any of those inducements, nor could Golden Spike.

An obvious analogy to this situation is military and civilian aircraft procurement. It is quite common for foreign governments to agree to buy military fighter jets or even commercial airliners only if substantial components are built in their countries. Many modern aircraft development projects are based upon this work-share assumption. The F-35 fighter, for instance, has subcomponents built in multiple countries, and the initial negotiations over who built what were often contentious. Every F-35 partner wanted to work on the most cutting-edge systems for the plane, such as its avionics, and many were disappointed, complaining that they were given responsibility for minor structural parts like the arrester hook. Foreign governments will often only agree to purchase legacy military aircraft if the manufacturer agrees to produce significant parts within the customer’s borders. Boeing deliberately set out with its 787 commercial airliner production to line up partners all over the world, thereby establishing what they hoped would be a customer base among many nationally-owned airlines.

| Spaceflight has long been a status symbol—as long as you do it yourself. There is limited symbolism to purchasing the equipment or the service from somebody else and putting your flag on it. |

Space companies also face a great deal of scrutiny over the issue of International Traffic in Arms Regulations, or ITAR, which can treat even totally innocuous space-related items as if they are weapons. Bigelow experienced this in 2006 when they needed to take to Russia a stand to keep their test satellite off the floor. The stand, which Robert Bigelow described as “indistinguishable from a common coffee table,” was part of a satellite assembly and therefore needed to be guarded at all times by two security officers. The takeaway lesson is that an American company will find it difficult to involve a foreign government in the design and development of a spacecraft.

Another issue is that a human spacecraft is a relatively sophisticated vehicle, and there will not be many subsystems that can be delegated to other countries even if ITAR did not get in the way. Add to that the problem of symbolism. If Bigelow had flown one of their inflatable habitat modules, none of the launches would have been from the client state’s territory. A sovereign customer that might accept not gaining contracts or educational training benefits from such a spaceflight will realize that national symbolism will be diminished if all of the launches and all of the hardware manufacturing happen outside of their country. Spaceflight has long been a status symbol—as long as you do it yourself. There is limited symbolism to purchasing the equipment or the service from somebody else and putting your flag on it.

Even if the 2008 economic collapse had not occurred, Bigelow would have still found it difficult to capture clients. It is not surprising that ultimately the company ended up serving as a contractor to NASA, successfully flying its BEAM technology demonstrator as part of the International Space Station. Many other companies started out with ambitions of serving entirely new markets only to end up in much more traditional roles as government contractors; it may not be glamorous, but it is better than bankruptcy.

Beware of promises of market demand

The failure of the emergence of the sovereign market is just one example in a long history of space markets that various entrepreneurs predicted would blossom that ultimately withered. Back in 2011, Henry Hertzfeld, who is now the director of The George Washington University’s Space Policy Institute, gave a talk about the history of efforts at space commercialization. Hertzfeld warned “beware of promises of market demand” and noted that ever since the beginning of spaceflight there had been predictions that new markets would emerge to produce various products and commercial services. He provided a list of many of them:

- 1960s and 1970s

- Factories in space—drugs, gallium-arsenide crystals, materials

- 1980s

- Space Power Satellites

- Direct TV (10-year delay)

- 1990s

- LEO Telecommunications

- Remote sensing

- 2000s

- Space Tourism (suborbital)

- Colonization of the Moon; mining of Moon’s resources

- 2010s

- Fuel Depots

- Demand from foreign governments

In some cases, terrestrial alternatives, like cellphone technology and fiber optic cables, undercut the space-based market. As Hertzfeld pointed out in a recent email, in cases like telecom and direct TV, markets eventually did develop, but well beyond a profitable business plan horizon envisioned when they were promised or proposed. In other cases, like suborbital space tourism, the technology proved harder to perfect than the entrepreneurs expected. And in many cases, the expectations were never very realistic to begin with.

If we had some cheese we could have ham and cheese, if we also had some ham…

The above list is not exhaustive. Gallium-arsenide crystals and pharmaceuticals were still being touted as potential markets in the 1990s, and there are still die-hard believers in space-based solar power who probably have not bothered to install commercially available solar panels on their rooftops yet. You could also add a few more to the current decade such as asteroid mining, widespread commercial remote sensing, and space-based Internet. The latter two are still in their nascent stage and have not collapsed (yet?), although there was much greater enthusiasm about commercial remote sensing’s growth possibilities only a few years ago than there is today.

| The much-touted possibility of “public private partnerships” as a way to fill in the gap between government ambitions and private interests often depends upon a promised, but presently nonexistent, market. |

Often, prediction of a new market is just one conditional part of an equation with at least one other condition. For instance, space-based manufacturing could be possible if we had low-cost launch. Back in 2009, hundreds of scientists at the American Geophysical Union annual convention attended a special workshop on what commercial reusable spacecraft could offer them. They were told about the possibilities of low-gravity and upper atmosphere research that would be enabled by these new vehicles. But if they had started building experiments back then, the equipment would still be gathering dust today, because the commercial reusable suborbital launch capability does not exist even after nearly fifteen years of promises.

Similarly, the much-touted possibility of “public private partnerships” as a way to fill in the gap between government ambitions and private interests often depends upon a promised, but presently nonexistent, market. “Public private partnership” is often invoked to imply that the government can get what it wants by partnering with a commercial entity that wants the same thing and is willing to invest private capital. But as John Donahue of Harvard University noted in a 2017 workshop on the future of civil space, the term “has gone from obscurity to meaninglessness without passing through a period of coherence.” It’s like saying “abracadabra” and expecting that a problem—the government’s lack of money, or a company’s need for capital—will be solved in a flash of light and a puff of smoke. Often the invocation of a public private partnership solution is based upon the belief that a new market will emerge that a commercial entity wants to tap, rather than being based upon a demonstrated existing market. As the long history of non-emergent space markets demonstrates, there are reasons to worry that a new market will not emerge, and thus the partnership will fail, often before it can even begin. If this happens, the government’s options are to guarantee the debt of a private partner, or to go it alone.

Bigelow and Golden Spike provide examples of how companies can bet on a market that fails to materialize. Golden Spike was not able to recover from that. For Bigelow, a company that has been working on this for almost two decades, the last chapter has not been written, but this story may be coming to a close.