How low can launch costs go?by Sam Dinkin

|

| As long as demand for people (or satellites) to go to orbit exceeds supply by a wide margin if the market price was near cost, the ticket price will reflect the demand curve rather than the supply curve. |

This calculation is rough because they are comparing the energy cost of a one-way trip and the retail cost of a round trip. They also called out their omission of a factor for having to carry oxidizer and having to meet other challenges of space travel.

Another touch point for future cost is Elon Musk tweeting something to the effect of the cost of cargo to low Earth orbit will be less than ten percent of Falcon 9 cost:

Feb 10, 2019 Rahma: “will [cargo in Starship on Super Heavy] be cheaper than F9 for kg to LEO for instance?”

Feb 10, 2019 Elon Musk: “At least 10X cheaper”

Here is my rough calculation for what that translates to in terms of the price of a round trip ticket to orbit. Falcon 9 delivers up to 22,800 kilograms to LEO for a launch price rack rate of $62 million. That leads to a cost of $2,719 per kilogram. To estimate how many people a passenger version of Starship can take to LEO, we can look at the A380 passenger plane vs. a hypothetical A380-800F freighter. As originally planned, the freighter had a capacity of 150 tonnes of cargo. The original three-class passenger configuration of the A380 carried 555 passengers. That works out to a passenger being a 270-kilogram weight equivalent in seats, consumables, crew, luggage, the passenger’s own weight, and so on.

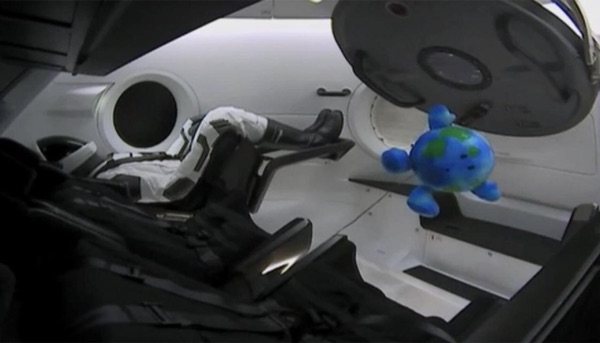

Using that very rough equivalence, the Starship cost of $271.90 per kilogram would work out to a cost of approximately $73,490 per passenger round trip, if they can sell nearly every seat on every launch. That is not too far off the Greason-Bennett mature-market guess of $42,720. My calculation omits at least as many factors as their calculation. By contrast, carrying NASA astronauts via commercial crew is resulting in an estimated $44.4 million revenue per F9/Dragon seat which, even if it is only three astronauts, is estimated to be priced at more than twice the cost of the Falcon 9 list price. For Super Heavy and Starship, at one tenth the estimated SpaceX’s winning bid price per seat for a contract with NASA, that would still be $4.44 million per seat.

The cost level is not the revenue level

| Given the messianic nature of the exodus aspirations of Musk, would-be Mars settlers can reasonably hope that the SpaceX price for that market will be close to marginal cost. |

As long as demand for people (or satellites) to go to orbit exceeds supply by a wide margin if the market price was near cost, the ticket price will reflect the demand curve rather than the supply curve. List prices for space travel will remain in tens of millions for a while, and the millions even with multiple launch companies with low-cost launch systems. Bigelow announced a round-trip package deal, including lodging, to the ISS for one to two months for $52 million per seat using Falcon 9.

If the cost is less than $100,000 per seat and the revenue is $4–40 million or more per seat, then getting to a mature market is a matter of two factors. The first is vastly expanding supply via execution of ambitious new plans for low-cost reusable launch systems from SpaceX, Blue Origin, and others. The second is price competition. Without competition, we can expect the lower cost to result in market bifurcation between low-price-elasticity customers, like NASA and DoD, and high-price-elasticity customers. We saw an early glimpse of what that looks like with SpaceX launching 60 satellites for its Starlink constellation in May. External customers can only guess at SpaceX internal launch price, but it is probably lower than $62 million per launch, given that launch at that price is profitable without reusing the first stage. Given the messianic nature of the exodus aspirations of Musk, would-be Mars settlers can reasonably hope that the SpaceX price for that market will be close to marginal cost.

Yield management

I will not wait for a fare sale at $42,720. A price of $74,490 would be fine for me for the trip even if it costs $3,000 a night for lodging for a 25-night stay. (I just hope that is not $3,000 per sunset during each 92-minute orbit.) Hopefully, a steep drop in costs will lead to something closer to a 24 percent market nominal growth rate for launch until space launch goes from a single-digit billion market to a multi-trillion solar-system market like the global market for airlines. The 24 percent number is the nominal growth rate of Amazon’s share price. We can hope launch industry growth is better than the underwhelming prediction of the space economy growing from $350 billion today to $1 trillion some time in the 2040s. The nominal growth of US GDP has had a geometric mean of 4 percent for the past 20 years. The space economy getting to $1 trillion in 2045 would only be a 3.6 percent geometric mean growth rate.

Note: we are temporarily moderating all comments subcommitted to deal with a surge in spam.