Déjà vu or sea change? Comparing two generations of large satellite constellation proposalsby Stephen J. Garber and James A. Vedda

|

| To discern whether history is repeating itself or just “rhyming,” it should be useful to examine the details of those enthusiastic endeavors of the 1990s and compare and contrast them with the similar-sounding business plans of today. |

The typical proposed satellite constellation of the 1990s involved “bent-pipe” architecture, meaning a combination of technologies in space and on the ground. This setup sends a signal from a satellite phone handset to a space-based repeater, then down to a ground station connected to existing terrestrial phone infrastructure. This approach allowed global telephony but had some significant limitations. Sat phone users often needed to go outdoors to get a line-of-sight signal to a satellite overhead. In addition, using existing ground infrastructure and satellites was cumbersome and didn’t provide a direct, speedy connection for users.

Iridium, however, took a different approach: its designers aimed to bypass the need for all this ground-based infrastructure by switching signals in space. This would save considerable expense since cell towers are actually expensive and difficult to build. One author writes that it cost approximately one trillion dollars to build the five million cell towers that exist today globally and that these towers need maintenance and upgrades over time.[3]

If the proposed large satellite networks of the early 1990s were a product of “irrational exuberance,” as then-Federal Reserve Chair Alan Greenspan famously remarked in 1996 in a larger context, then they were clearly subject to bursting of the dot.com bubble in the late 1990s and the turn of the millennium. Many economists and other observers would note that money for investment capital for all sorts of technology projects flowed too freely initially and thus these projects inevitably faced a “market correction.” Simply put, “much of the growth and eventual downturn in the satellite industry’s fortunes during this period mirrored the economic boom of the 1990s, culminating in the dot-com crash of 2000–2001.”[4]

Another limiting factor specific to the space sector was launch costs for spacecraft. Before the “new space” era of companies such as SpaceX and Blue Origin, there were few launch vehicles in the United States inventory and not many more worldwide. The cubesat concept was not developed until 1999, let alone ridesharing or piggybacking for secondary payloads. Despite the decades-long call for a reduction in the per-pound price to orbit, launch costs remained high in the 1990s. As one writer points out, the financial failures of this first group of satellite constellations after a large increase in commercial launches earlier in the 1990s led to excess capacity, a negative cycle.[5]

But why did almost all of these proposed constellations fail within a few years? Surely several factors were at play. Bent-pipe architecture was complex and unwieldy while space-based technology was perhaps overly ambitious. Launch costs were high and miniaturization hadn’t fully taken hold yet. Terrestrial cell phone deployment and market acceptance occurred much more rapidly than expected, providing more affordable service that satisfied—using smaller handsets—the needs of the overwhelming majority of customers. The market segment with a critical need for satellite-based telephony proved to be smaller than expected. In short, these systems were ahead of their time and lacked a sufficiently strong market demand.

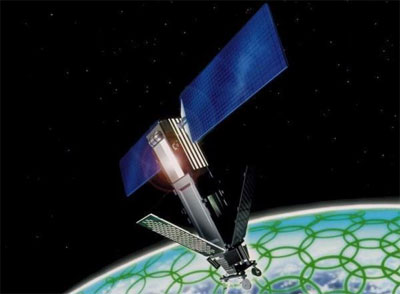

The original Iridium filed for Chapter 11 bankruptcy protection in 1999, but the new Iridium is doing well and recently completed its next-generation satellite constellation. (credit: Iridium) |

What’s different about the current situation?

One significant difference now is the demonstrated demand for satellite broadband coverage rather than telephony. Currently over half the world’s population uses the Internet. Outside the space community, a Morgan Stanley analyst predicted that the space economy will triple its current level to over $1 trillion by 2040, with broadband Internet access representing a remarkable 50 percent of that growth.[6]

| In short, these early systems were ahead of their time and lacked a sufficiently strong market demand. |

Another major difference today is the additional motivations, beyond financial gain, of “new space” actors to get into the LEO satellite communications market. In general, the 1990s space entrepreneurs saw themselves as satellite operators who believed their ventures would be profitable. In contrast, many of today’s entrepreneurs consider themselves service providers who employ satellites as tools. OneWeb’s Greg Wyler “is principally motivated by altruism and a heartfelt desire to deliver Internet to the unwashed masses,” SpaceX’s Elon Musk “has stated quite bluntly that his effort is driven by a desire to generate cash to fund Mars colonization,” and Richard Branson may be motivated “by the opportunity to use their [Virgin Galactic] launch platform.”[7]

The investment climate also has changed significantly since the mid-1990s and even in the past five or six years. One recent study by the firm Space Angels calculates that venture capitalists have invested $18 billion in space from 2009 to 2018, with approximately $3 billion in the last year alone (more than the aggregate from 1983 to 2009.) Space Angels also tallied more than 500 venture capital firms investing in space since 2009, and over 100 in 2018. Another venture capital firm focused on space, Seraphim Capital, reported that investment in satellite constellations and airborne platforms jumped over 25 percent in the last year.[8]

Another recent study by Bryce Space and Technology calculated $3.23 billion in private space investment last year, with 62 percent coming from venture capital (a jump of 22 percent over the previous year.) One of the authors, Carissa Christensen, notes that this venture capital component is significant because “these investors are convinced by the business cases of these startups despite the limited number of companies in the sector that have provided a return to their investors.” Christensen also notes that current investors are more understanding and tolerant of risk than investors in companies such as Globalstar and Iridium were back in the 1990s and hence investors today “won’t panic when startups inevitably fail.”[9]

One reason for increased private investment is the obviously related launch vehicle market, and specifically its progress toward the holy grail of reusability. In particular, SpaceX has begun to take significant strides toward reusing its Falcon 9 Block 5 boosters, and Blue Origin is also actively pursuing this goal. Nevertheless, some analysts are “still skeptical booster reuse makes business sense” because of the traditional “utter inelasticity of the launch market” (despite changing prices, demand remained steady). Space Angels notes that the launch and satellite subsectors continue to garner the lion’s share of private investment in the space sector, with more than $1 billion each. Mark Boggett from Seraphim Capital contends that despite SpaceX’s progress, “there still is a bottleneck around launch” for the megaconstellations, in part because a “huge amount of capacity [is] coming to the market” simultaneously.[10]

The military is also playing a significantly different role with potential large LEO satellite constellations than in the 1990s. In contrast, now the Air Force is amenable to jumping on the bandwagon later if commercial sector LEO broadband succeeds. This technology could be “spun on” for military communications purposes rather than pushing for dedicated large military satellite systems. One top general has stated that “military users of satellite communications want to be able to ‘roam’ seamlessly among different service providers or constellations.”[11]

Thus, the military is content to let the private sector take more of the lead and absorb more of the costs of investment and operation. The Air Force would like to be an early adopter, but only one of many customers for commercial LEO broadband services. As one DoD official noted, “We think we’ll be an important customer but to think we’re going to dominate this industry and develop our own capability is ridiculous.”[12]

The Air Force’s Strategic Development Planning and Experimentation Office’s Global Lightning program is looking into the possibility of using off-the-shelf commercial satellite services for its communications needs. This office provided $2.5 million to SpaceX for an initial study.[13]

| With the advent of increasingly capable small satellites in the last twenty years, it is now much more feasible to loft many lighter, cheaper satellites into orbit. |

The Defense Advanced Research Projects Agency (DARPA) also has been sponsoring Project Blackjack, an effort to demonstrate the viability of mating relatively inexpensive military payloads with commercial spacecraft buses. After awarding three preliminary design review contracts to commercial firms, DARPA’s goal is a proof-of-concept constellation of approximately 20 satellites. Blackjack could be a big opportunity for commercial firms to work in the military sector. It also could be an opportunity for the military to provide a relatively small seed investment to let the commercial sector develop some technologies that the military could then use. The next phase of Blackjack aims to demonstrate the capability for satellites to communicate with each other to analyze data autonomously, without direction from the ground. While it’s certainly possible that Blackjack may succeed, two somewhat similar DARPA smallsat efforts were cancelled in 2013 and 2015.[14]

Defense Undersecretary for Research and Engineering and former NASA Administrator Mike Griffin is eager to benefit from the private sector’s investment in megaconstellations and believes DoD could set up its own similar system. Specifically, he would like DoD to develop a large constellation of LEO satellites for communications and new sensors that would be more resilient than large satellites in higher orbits.[15]

With the advent of increasingly capable small satellites in the last twenty years, it is now much more feasible to loft many lighter, cheaper satellites into orbit. In the last six years, more than 1,300 smallsats have been launched, and almost 100 commercial companies are launching smallsats into LEO.[16] A virtuous cycle has ensued with more smallsats leading to more innovative, less costly ways to get a payload to orbit, such as ridesharing and piggybacking.

One analyst cautions, however, that initially the smallsat industry thought it didn’t need government help, but in the last few years, this industry has become hungry for federal contracts to make up for lower than expected commercial demand. One smallsat study revealed that there aren’t as many business customers as hoped for but if broadband megaconstellations come online, this could change.[17]

In addition, Machine to Machine (M2M) communication for the burgeoning Internet of Things (IoT) field is a notable, relatively new market. In 2015, an industry analyst noted there were hundreds of millions of terrestrial telematics units and the number of devices connected to the Internet has surely skyrocketed since then. Such satellite-based M2M could be useful for “end-to-end” tracking of shipping containers around the world.[18] The analyst commented that the “M2M market is so immense that collectively [Iridium and Orbcomm] don’t have enough capacity to serve it.” However, by fall 2018, the same analyst only saw demand for two to three constellations for specific markets such as M2M and broadband overall.[19]

Before an initial demonstration satellite even has been launched, Eutelsat has purchased additional small satellites for its planned IoT network. A Eutelsat official notes, however, that such a network will be narrowband, as opposed to the broadband needed for consumers.[20]

M2M communication may still be further in the future than some analysts think. Of the more than 20 planned constellations, the majority are for broadband communication, with only a few dedicated to narrowband for M2M.[21]

Another development is the increasing discussion regarding satellite latency, the time it takes a data packet to travel from one point to another. Tiny fractions of a second can be significant in areas such as electronic stock trading and gaming. Transmission delays for LEO satellites can be about 50 milliseconds, while those for satellites in geosynchronous orbit (GEO) can be five times as long. But because LEO satellites are closer to the Earth’s surface, they have smaller coverage “footprints” and thus a greater number of satellites is required in a constellation to provide seamless global coverage.[22]

Nevertheless, there is a range of opinions regarding the importance of latency. Greg Wyler, the head of OneWeb, believes that this is indeed very important, contending that “terrestrial systems can, of course, offer low latency, but can be difficult to install… recalling his experience prior to O3b [another company he formerly led, referring to the ‘other three billion’ people on Earth who lack good communications at all] trying to install fiber in Africa.” On the other hand, Intelsat’s former CEO, David McGlade, is less enthused about the value of low latency: “Does it matter that much for voice? Not very much anymore. Gaming? That’s nice to have. 5G? Maybe.” It is worth noting that with more dynamic web sites and better processing power, more users are interested in lower latency. Last but not least, the ground-based competition—fiber cables—can be a huge infrastructure investment, and the length of the signal path can be longer than optimal because it is not likely to be a straight line.[23]

LEO satellites also provide robustness in several related ways. They’re closer to Earth than, for example, GPS satellites in medium Earth orbit, so there is less path loss and their stronger signals are more resistant to jamming. Additionally, greater numbers of satellites in LEO provide redundancy in case of anomalies affecting one or a few satellites.[24]

| As with the original Iridium, the real challenge is not launching the satellites, but rather getting customers to pay for the service. In other words, “OneWeb’s current risks are seen as primarily financial, not technical.” |

There also is time pressure on the commercial firms building the large LEO constellations, as the Federal Communications Commission (FCC) and the International Telecommunication Union (ITU) have imposed some deadlines. Specifically, the FCC requires that a domestic applicant for use of spectrum deploy at least 50 percent of its proposed satellites within six years after license approval and complete its constellation within nine years, or else forfeit their use of that portion of the spectrum. The ITU requires satellite operators to take possession of a given spectrum slot within seven years and keep it there for at least three months before submitting “bring into use” paperwork. The idea behind these deadlines is to prevent large companies from unduly reserving placeholder slots ahead of time. Debate is expected at the quadrennial World Radiocommunication Conference in Egypt in October 2019 over whether these milestone deadlines should be adjusted.[25] The ITU’s seven-year deadline has existed since the 1990s, when it was intended for GEO satellites.

OneWeb launched the first six satellites of its 648-satellite constellation on February 27, 2019. Many challenges remain to meet the goal of completing deployment by 2022 and pave the way for possible expansion to 900 satellites. In 2015, the company targeted a cost of $500,000 per satellite with a total cost of building, launching, and operating the constellation at $3.5 billion. By fall 2018, however, projected costs had doubled to approximately $1 million per satellite. While OneWeb has notably raised $2 billion in capital, going from concept to full implementation will likely be challenging and one industry study estimates that the company “will need about $5 billion to get its full network up and running, and it’ll take about a decade before its backers start to see a return on investment.” A OneWeb board member was more optimistic, predicting profitability in 2022. To get there, OneWeb also plans to raise more funding, whether through its existing investors or an initial public stock offering. The company is “targeting several markets for connectivity, including inflight Wi-Fi, maritime and government users, but also has a mission to bring Internet access to every school in the world.” As a reader commented, however, as with the original Iridium, the real challenge is not launching the satellites, but rather getting customers to pay for the service. In other words, “OneWeb’s current risks are seen as primarily financial, not technical.”[26]

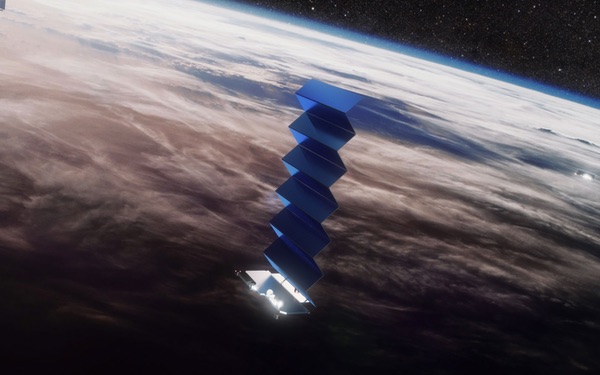

OneWeb plans a “mega-constellation” of at least 648 satellites. (credit: OneWeb) |

How is the current situation similar to that in the mid-1990s?

As in the mid-1990s, telephony and Internet coverage for mobile users remains lacking in large swaths of the US. Gwynne Shotwell, the SpaceX president, notes that she had trouble getting broadband access in rural Texas and thus argues that there is a need for it beyond large urban population centers.[27]

Even for those proposed constellations that are being designed to be largely space-based, the requisite ground infrastructure is a potential hurdle. One team of analysts calculated that SpaceX will need 123 ground stations and OneWeb will need 71, although this latter number could perhaps be halved with other potential efficiencies.[28]

Amazon’s head-turning announcement in April 2019 that it was planning a constellation of more than 3,000 satellites raises potential issues regarding the required supporting ground infrastructure, which Amazon had previously addressed by partnering with Lockheed Martin in 2018 to begin a joint venture known as AWS Ground Station. Amazon’s proposed new constellation, dubbed Kuiper Systems, features three layers of satellites below 700 kilometers altitude, which is lower than virtually all other previously and currently proposed constellations, necessitating more satellites (with smaller footprints.) The lower altitudes will allow the satellites to deorbit on their own soon after end of life, but this architecture may also affect ground station requirements.[29]

Conclusions

Until very recently, OneWeb was seen as the leader among potential megaconstellations, among more than 20 companies with plans, although Amazon’s proposed constellation of more than 3,000 satellites may jump ahead. Nevertheless, “some of these plans may not be more than wishful thinking” as funding is the key issue and these investments are still considered risky. On the other hand, some analysts confidently make predictions such as “Commercial space Internet provided by hundreds or thousands of satellites in low Earth orbit will become a reality in the next few years.”[30]

| Most large “new space” companies are privately held so it’s difficult to determine whether they are financially profitable. This speaks to the old joke about how to make a small fortune in space: start with a large fortune. |

As one investment analyst noted about the commercial space sector, some “investors are willing to overlook history if they believe they can make money.”[31] That said, will the current situation result in an outcome similar to the 1990s experience? There are many factors that have evolved since that time, making it reasonable to predict that things will play out differently.

Instead of an overreliance on telephony services, today’s predicted commercial LEO constellations are focused more on providing broadband in an economy that is much more thoroughly based on the Internet than it was during the dot.com boom. In addition, there is significantly more private sector investment capital available and likely better understanding of the financial risks. Smallsats have genuinely taken off in popularity in the last 20 years. The military is also more interested in building upon the private sector’s work to establish its own network of LEO satellites for communications and sensors.

There are also a number of other factors to watch closely. If companies such as SpaceX are able to master launch vehicle reusability, that would likely be a “game-changer” in terms of reducing access-to-orbit costs. If these new constellations are overly dependent on extensive terrestrial systems, such bent-pipe architectures will continue to be costly.

In terms of finances, it’s worth noting that Jeff Bezos has been funding Blue Origin to the tune of about $1 billion annually by selling Amazon stock.[32] Most large “new space” companies are privately held so it’s difficult to determine whether they are financially profitable. This speaks to the old joke about how to make a small fortune in space: start with a large fortune.

Patience is needed because like other technological sectors, space technology takes years to mature. Mark Boggett notes that his venture capital firm likes to invest in satellite constellation projects at the beginning of their five-year timeline because these firms need time to recoup the invested funds before becoming profitable. As he puts it, these constellations “are not in business to put satellites in space” but rather to use satellites as a tool to sell data analytics.[33] This is a point worth emphasizing because space traditionally has been a means to a larger end such as international prestige or national security, while economic profit has been secondary—until recently.

Endnotes

- Patrick J.G. Stiennon, “Disruptive Technology in Space Transportation,” The Space Review, October 22, 2018, and Vivek Suresh Prasad, “SmallSat Launch Market to Soar Past $62 Billion by 2030,” Via Satellite, July 2018.

- John Bloom, Eccentric Orbits: The Iridium Story (New York City: Grove Atlantic, 2016), pp. 453-454.

- Bloom, p. 453, and more generally, Bloom and Martin Collins, A Telephone for the World: Iridium, Motorola, and the Making of a Global Age. (Baltimore: Johns Hopkins University Press, 2018), passim.

- See https://www.federalreserve.gov/boarddocs/speeches/1996/19961205.htm and Cindy Boeke, “Via Satellite at 30: The 1990s and Early 2000s,” Via Satellite, November 28, 2016.

- Jeff Foust, “The Launch Industry Depression: When Will It End?” The Space Review, March 17, 2003.

- Lisa Schlein, “ITU: More Than Half World’s Population Using Internet,” December 9, 2018; Chad Anderson and Jessica Holland, “Satellite Broadband Set to Boom,” February 1, 2019; and “Space: Investing in the Final Frontier,” Morgan Stanley, November 7, 2018.

- Warren Ferster, “Chris Quilty Handicaps the Silicon Valley-Fueled Space Race,” SpaceNews, February 26, 2015.

- Caleb Henry, “Space Startup Investments Continued to Rise in 2018,” SpaceNews, February 4, 2019, and Space Investment Quarterly, Q4 2018. Regarding the latter point, Seraphim aggregated satellite constellations and airborne platforms in its analysis and also included a December 2018 announcement of a planned investment that Space Angels did not include.

- Jeff Foust, “Space Investment Hits Record High in 2018,” SpaceNews, April 10, 2019 and Bryce Space and Technology. “Start-Up Space: Update on Investment in Commercial Space Ventures,” 2019. The quotes are from the SpaceNews article.

- Space Investment Quarterly, Q4 2018; Jeff Foust, “How the Space Industry Learned to Stop Worrying and Love the Bubble,” SpaceNews, February 25, 2019, p. 17; Amy Thompson, “This Year SpaceX Made Us All Believe in Reusable Rockets,” Wired, December 30, 2018; George Sowers, “Commercializing Space: Before a Commercial LEO Market Can Flourish, the ISS Must Be Retired,” SpaceNews commentary, February 25, 2019, p. 25; Space Investment Quarterly, Q4 2018; and Debra Werner, “Heavens Above.” SpaceNews, February 25, 2019.

- Air Force Space Command leader Gen. Jay Raymond quoted in Erwin, “Space Force Proposal Shifts Satellite Communications Procurement to Air Force Secretary,” SpaceNews, February 25, 2019.

- Sandra Erwin, “Air Force Laying Groundwork for Future Military Use of Commercial Megaconstellations,” SpaceNews, February 28, 2019.

- Erwin, “Air Force Laying Groundwork.”

- Erwin, “DARPA Assembling Team of Blackjack Players;” Sandra Erwin, “DARPA to Begin New Effort to Build Military Constellations in Low Earth Orbit,” SpaceNews, May 31, 2019; and Henry, “Telesat Wins Study Contract for DARPA’s Experimental Constellation,” SpaceNews, November 29, 2018.

- Sandra Erwin, “Space Development Agency a Huge Win for Griffin in his War Against the Status Quo,” SpaceNews, April 8, 2019, pp. 14-15.

- Florence Tan, Deputy Chief Technologist, NASA Science Mission Directorate, “Explore Science” presentation at the AAS Goddard Memorial Symposium, March 12, 2019, p. 12, citing Bryce Space and Technology SmallSat 2019 Report, and Henry, “Space Startup Investments Continued to Rise in 2018.”

- Erwin, “Government Inertia a Problem for Small Satellite Industry.”

- Ferster, “Chris Quilty Handicaps.”

- Ferster, “Chris Quilty Handicaps” and Debra Werner, “Analysts See Demand for Two or Three Megaconstellations.”

- Henry, “Eutelsat Planning Small LEO Internet of Things Constellation.”

- See, for example, Grant R. Cates, Daniel X. Houston, Douglas G. Conley, and Karen L. Jones, “Launch Uncertainty: Implications for Large Constellations,” The Aerospace Corporation, Center for Space Policy & Strategy, November 26, 2018.

- Nathan Chandler, “How Satellite Phones Work,” undated.

- Foust, “The Return of Satellite Constellations.”

- Tyler G.R. Reid, Andrew Neish, Todd F. Walter, and Per K. Enge, “Leveraging Commercial Broadband LEO Constellations for Navigation,” undated, pp. 1 and 13.

- Caleb Henry, “ITU Wants Megaconstellations to Meet tougher Launch Milestones,” SpaceNews, May 9, 2019.

- Caleb Henry, “Six Down, 642 To Go: How OneWeb Plans to Make Sure its First Satellites aren’t its Last,” SpaceNews, March 11, 2019, pp. 12–16; Caleb Henry and Brian Berger, “Amid Concerns, OneWeb Gets Vague about Constellation’s Cost.” SpaceNews, September 12, 2018; Jackie Wattles, “OneWeb Launches First Batch of Internet Satellites.” CNN Business, February 28, 2019; and Caleb Henry, “OneWeb’s First Six Satellites in Orbit Following Soyuz Launch,” SpaceNews, February 27, 2019.

- Foust, “The Return of Satellite Constellations.”

- Inigo del Portillo, Bruce G. Cameron, and Edward F. Crawley, “A Technical Comparison of Three Low Earth Orbit Satellite Constellation Systems to Provide Global Broadband,” IAC-18-B2.1.7, International Astronautical Congress paper, October 1, 2018.

- Caleb Henry, “Amazon Planning 3,236-Satellite Constellation for Internet Connectivity,” SpaceNews, April 4, 2019, and Henry, “Eutelsat Planning Small LEO Internet of Things Constellation.”

- Baard Kringen, “Broadband for All: OneWeb and European Industry in the Lead,” May 16, 2018, and Erwin, “Air Force Laying Groundwork.”

- Ferster, “Chris Quilty Handicaps.”

- Henry, “Amazon Planning 3,236-Satellite Constellation.”

- Werner, “Heavens Above,” p. 18.

Note: we are temporarily moderating all comments subcommitted to deal with a surge in spam.