Chicken or the egg: space launch and state spaceportsby Roger Handberg

|

| One needs to be aware of the possible potholes in the road to orbit and financial success. |

These numbers illustrate the almost gold rush fever that has hit the space commerce field: the expectations are that great economic opportunities exist and communities and states need to seize the moment. The difficulty as the earlier article here points out is that the opportunity for actual space-related industry might prove more limited that many imagine. This reflects the reality that identifying a viable space partner, especially a launch one, is much more problematic than expected. Oklahoma discovered this earlier when its spaceport, developed for a specific company, never got off the ground (see “Little spaceport on the prairie”, The Space Review, June 7, 2004).

The present boom mentality reflects the opening of the space industry to purely commercial operators in a manner not seen until recently. Launch providers, or rather want-to-be launch providers, proclaim their presence with press releases, simulated launch scenarios (replacing earlier PowerPoint-driven presentations), and rosy predictions of future economic gains. All of this may happen, but one needs to be aware of the possible potholes in the road to orbit and financial success.

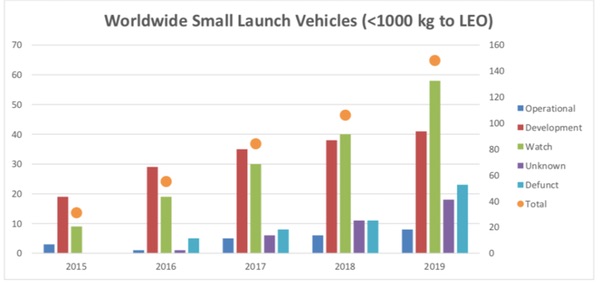

Much of the hype is driven by SpaceX and its impact on the perception that going to space is now easy. Its success in returning boosters back to Earth for reuse appears to break the conundrum of high launch costs since reusable launch vehicles are a critical part of the dream of reaching space cheaply and, almost by definition, frequently. This vision is further driven by the explosion in small launch options under development, operational, and aspirational. One estimate based on the paper by Carlos G. Niederstrasser, “A 2019 View of the Impending Small Launch Vehicle Boom,” is that there are at least 148 small launch options being proposed, developed, or flown. These are being developed because the large satellite market is served by entrenched operators operated by the Europeans, Russians, Chinese, and Americans, with the Japanese and Indian space programs bidding to expand the commercial market. As the number of large satellites being sent to orbit declines, that market appears to be stagnating, raising interests in the small launch market.

|

For state spaceport enthusiasts, building a launch facilty increasingly appears to be a safe bet given the evidence in the table below, also drawn from Niederstrasser. The US appears the leader in the number of small launch systems under development. If even half are successful, that would dramatically expand the potential pool of launch locations possibly needed to meet launch demand.

Country of Origin of Launch Vehicle Developers

| Country | Count |

|---|---|

| USA | 20 |

| China | 6 |

| Spain | 3 |

| United Kingdom | 3 |

| Argentina | 1 |

| Australia | 1 |

| Australia/Singapore | 1 |

| Brazil | 1 |

| Europe | 1 |

| India | 1 |

| UK/Ukraine | 1 |

| USA/New Zealand | 1 |

All of this is premised on the explosion in satellite launches that is occurring. Giant constellations of primarily communications satellites are to being launched or proposed by a wide range of corporations including Amazon, Telesat, OneWeb, SES, and SpaceX, with others emerging almost monthly. The size of these constellations is estimated prior to actual operations to range a couple of hundred to thousands, possibly up to 40,000 by SpaceX. OneWeb and SpaceX have already launched test satellites to orbit. SpaceX has been the most aggressive in sending multiple launches of Starlink to orbit and projecting initial global operations by 2021. The constellations will consist of smallsats (under 500 kilograms), which in principle can be launched on most small rockets. This combination of an explosive growth in satellite numbers and the need to launch and replenish the constellations fuels the enthusiasm for adding new spaceports. Replenishment especially appears a possible niche market for small launch providers, as it allows for tailored cheaper launch profiles.

| State spaceports are going to continue to find the competitive market difficult, basically because there are too few launch options to go around. |

A problem arises that the established launch companies are already working to reduce the possibility of small launchers becoming major players. Both Arianespace and SpaceX have announced separate plans to schedule launches of multiple payloads on a somewhat fixed schedule. Small launch vehicles can only thrive if the larger launchers are effectively excluded from competing for replenishment and even original launch of satellites.

This is the second time large satellite constellations have appeared as possible sources of business for launch companies. The first, in the early 1990s, saw the proposed appearance of large comsat flotillas as a potential source of business for smaller launch companies. For technical and financial reasons, that never occurred, in part because large launch providers responded by carrying multiple payloads to orbit. This had two effects. One was that multiple satellites flew on fewer launches by heavier boosters rather than one by one to orbit on smaller launchers. Also, replacements and some initial comsat launches flew as secondary payloads to a primary larger communications satellite. The intent and effect was to destroy whatever market the small launch companies thought was out there.

Both SpaceX and Arianespace are dusting off the old playbooks but in a new way. SpaceX has proposed that it will fly payloads to orbit on a fixed schedule through a “dedicated rideshare” program, thus removing the largest issue for the secondary payload. Normally, that payload would have to wait until the primary was ready for launch. Thus, technical difficulties with the primary meant all other payloads waited because the primary was paying the bulk of the flight bill and in fact could fly alone. Arianespace’s option is more limited but an effort to accommodate smallsats. If these options become viable and continue, they would significantly impact the future success of small launch companies and, by extension, their demand for launch ports.

The point is that successful state spaceports are going to continue to find the competitive market difficult, basically because there are too few launch options to go around. SpaceX has for the first time been able to create a partially reusable launch vehicle that appears more efficient than the Space Shuttle in terms of processing for re-flight, but it is not totally reusable yet. Nor is the booster’s return to the launch site operations totally without risk. Based on location, many of prospective state spaceports will still confront the problem that, to be operational, they need to have a completely reusable launch vehicle operating there. Further, increasing the risk for state spaceports, SpaceX is building a private spaceport in South Texas that could impact Space Florida and its Cape Canaveral operations.

In the late 1990s, there was a temporary boom in state spaceports with NASA’s X-33 prototype program (considered a shuttle replacement), but that program was cancelled in 2001. What attracted states at that time was the expectation that the X-33 would fly as the VentureStar in a completely reusable mode, meaning the entire vehicle went to orbit and returned. Subsequently, SpaceShipOne was also premised on that reusable aspect but it does not reach Earth orbit. But even there, the state spaceport, Spaceport America, https://www.spaceportamerica.com/ at the heart of that operation, remains vulnerable to market considerations as Virgin Galactic also develops spaceport arrangements in other countries for conducting operations. These alternative locations are based on closeness to potential customers able to pay a quarter of a million dollars for a several-minute zero gravity experience.

The future of commercial space grows in ways that are unexpected, but the reality remains that reaching Earth orbit is difficult and remains so. State spaceports are subject to changes in technology and economics, both of which they do not control. Both Florida and California have, at different times, struggled with changes in the space launch industry. Florida’s Space Coast is the most obvious survivor of the shifts in NASA programs—the end of Apollo followed by the shuttle’s retirement—and the rise of the commercial sector. Newer spaceports are better conceptualized as economic development agents rather than space players until they are able to attract either a commercial space player of note or a number of smaller ones that create the synergism that fuels economic growth.

Note: we are temporarily moderating all comments submitted to deal with a surge in spam.