Alternative financing for lunar mining explorationby Blake Ahadi

|

| For the lunar mining industry, the need for long-term, patient, and affordable capital renders traditional investment options obsolete. |

Exploration is the essential first step for any mining endeavor, terrestrially or otherwise, but with the technical challenges of lunar mining largely solved, access to capital has become the prevailing constraint. While the uncertainty of operating in space is the commonly used explanation for capital constraints, in reality, terrestrial explorers have seen funding steadily decline for a decade, with investors favoring lower risk, passive exposure to the mining sector. For lunar mining firms seeking to attract capital for exploration, this essay details the incompatibility of traditional investment options, the financing strategies developed by the similarly cash-strapped terrestrial mining industry, and how prospective lunar miners should capitalize on emerging trends in project finance.

Traditional financing options

For the lunar mining industry, the need for long-term, patient, and affordable capital renders traditional investment options obsolete. While funding from venture capital (VC) firms is valuable for early-stage companies, lunar mining development requires funding sustained for a period exceeding the VC investment horizon, making this option incompatible. Alternatively, private equity (PE) investment seems attractive as larger funds possess ample capital, and on average, permit longer investment horizons than VC. However, PE firms are highly levered entities, with a business model unwilling to invest in speculative industries absent predictable near-term cash flows. A similarly attractive option is debt financing, as access to credit is historically cheap, but lunar miners lack the free cash flow necessary to pay interest on outstanding debt. Moreover, the scale of leverage required, coupled with the uncertainty of operating in space, renders debt financing incompatible. Remaining sources of funding include public equity, sovereign funds, endowments, family offices, and billionaires, but each are incompatible in risk tolerance and/or available capital for investment. Government financing could fill the void, in theory, but due to the unreliable and highly politicized nature of space funding, this analysis will omit federal financing options.

|

Recent trends in terrestrial exploration

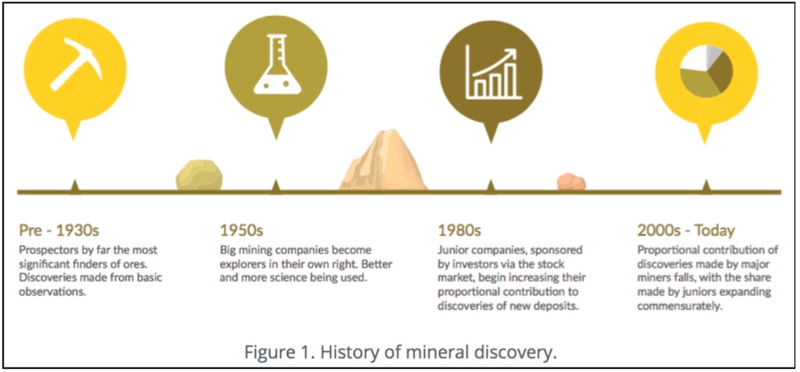

When financing a mining exploration project, the funding source must be willing to sacrifice immediate returns for long-term success. As shown in Figure 1 above, the history of terrestrial mineral discovery began with simple prospectors using basic observation.[1] Spurred by World War II, the market for minerals proliferated, leading large, vertically integrated mining companies to enter the exploration arena. With economies of scale in operations, these miners funded exploration by reinvesting cash flows earned further up the value chain, eliminating the need for impatient, external financing, and the exploration industry flourished.

In the past two decades, access to large and untapped mineral deposits became scarcer, forcing large miners to retreat to more certain activities like development and processing. A new class of small, decentralized mining explorers emerged in response. Called junior miners, these companies focus explicitly on exploration, earning revenue by selling land rights from discovered mineral deposits to larger miners for a minority stake in future operations. However, since the juniors lack free cash flow, they rely on the stock market to finance their exploration efforts.

| For lunar miners seeking investment for exploration, the short-term scarcity in terrestrial mining is an opportunity to communicate the relative value of lunar resources. |

Direct equity investment in junior miners is incredibly risky, but a successful exploration effort can produce returns many multiples of its initial stock price. Outperforming in this sector requires investor due diligence to pick individual, high-quality junior stocks. While securing funding through public markets had success, the number of listed junior miners has doubled since 2000, outpacing the growth in investor demand.[2] The proliferation of junior miners made due diligence too costly, leading investors to opt for broader exposure through passive index funds. In the last ten years, roughly 70% of direct resource funds supporting junior miners have disappeared, with the remaining funds managing, on average less than 40% of the capital they used to.[3] For lunar miners seeking investor capital for exploration, addressing the constraints faced by the junior mining sector, as well as the underlying economic drivers, presents an opportunity to highlight the comparative advantages of the emerging industry for lunar resources.

Relative value of lunar mining

The rise of passive investing has significantly reduced access to capital for terrestrial exploration, as investors can gain broad mining sector exposure without performing due diligence on junior miners. As a result, industry leaders fear the emergence of a major imbalance in supply and demand for mineral resources, like cobalt, nickel, and lithium, as exploration is not growing fast enough to meet global demand.[3] Moreover, the growth in global population and the rapid industrialization of emerging economies has led to further concerns over scarcity of raw materials. In this context, it is necessary to note the difference between short- and long-term scarcity. In the short term, scarcity refers to the reliability of producers and their existing production capacities, which are strongly influenced by investment decisions and government policies. In the long term, scarcity depends on actual geological availability, which changes based on the evolution of production techniques, and the presence of public policy constraints.[3] So while current terrestrial mining technology limits access to large, easily accessible mineral deposits, straining the supply chain for raw materials and leading to scarcity concerns, claims that the Earth is running out of minerals are unfounded.

While the sentiment remains for titanium, iron ore, platinum, and other resources, this paper assumes lunar ice as the first resource target, given the estimated annual demand of $2.4 billion,[4] and supply projections of 100 million to 1 billion metric tons of lunar water at each pole.[5] For lunar miners seeking investment for exploration, the short-term scarcity in terrestrial mining is an opportunity to communicate the relative value of lunar resources. Initially, lunar resources will be used to support in-space activities, as the lunar economy needs complementary infrastructure to develop, where the demand grows proportionally to supply.[6] In the case of lunar ice, a potential human presence in lunar orbit or on the lunar surface, facilitated by the NASA Gateway or ESA’s Moon Village, will be limited by the available supply of oxygen and water. The uncertain demand for lunar transportation leads to constraints on companies like ULA, SpaceX, and Blue Origin. Understanding the economic potential enabled by lunar resource utilization, ULA pledged to purchase propellant in LEO at $3,000 per kilogram,[4] providing prospective lunar miners with a guaranteed customer and price point. With assured demand for lunar ice derivatives and an abundance of untapped resource deposits on the lunar surface, reliable supply is the prevailing economic constraint.

At the moment, the economics of lunar mining exploration are most similar to terrestrial mineral discovery in the early 20th century, when the sheer abundance of ores allowed prospectors to use basic observation. Most deposits were large enough for numerous independent operators to share in its riches, and many of the world’s largest mining companies were nucleated around ownership of these early, large orebodies.[1] The importance of complementaries, coupled with the lack of resource scarcity, will lead to an inherent culture of collaboration in the lunar economy. Similar to early terrestrial prospectors, the discovery of a large lunar ice deposit by any one miner will attract numerous independent operators, collaborating to maximize resource utilization. With multiple companies vying to discover a concentrated deposit of lunar ice, the success of only one miner will create value for all remaining operators. Moreover, the culture of collaboration incentivizes the diversification of exploration locations and techniques. While lunar research efforts have largely focused on polar regions, operating in permanently shadowed regions may prove too difficult, so an equatorial focus offers value for lunar explorers seeking more favorable operating conditions.

In the short term, while terrestrial economics are designed to maximize value under conditions of scarcity, the lunar economy will operate independent of scarcity, offering an attractive value proposition to early investors, particularly when considered relative to the winner-take-all system employed by junior mining explorers. In the long term, once proven for high-value metals, the additional supply from lunar mining could depress prices on Earth, representing a considerable tail risk for terrestrial mining investments. Despite their relative value, lunar miners will increase their probability of funding by understanding the alternative financing solutions employed by cash-strapped terrestrial explorers.

Alternative financing options

Tokenized crowdfunding

As access to equity capital tightens, junior miners are utilizing increasingly creative solutions for raising cash, notably the use of crowdfunding. Crowdfunding is the practice of funding a project by raising many small amounts of money from a large number of people, typically via the Internet. In 2019, a UK-based lithium explorer, Cornish Lithium (CL), closed a successful crowdfunding campaign securing more than £1.4 million (US$1.8 million) from more than 1,100 investors.[7] Each investor received an equity stake commensurate with CL’s pre-funding valuation of £20 million (US$25.8 million).[7] Though the majority of capital came from people living in Cornwall, the same location CL aims to explore for lithium and facilitate new industry, the campaign success shows the emerging value of crowdfunding for exploration. For large scale financing, however, the lack of investor return limits the viability of crowdfunding.

| Tokenized financing presents a relevant near-term opportunity for lunar miners. |

In response, terrestrial explorers are incorporating tokenized financing into the crowdfunding model. Unlike Bitcoin and Ethereum, which are not backed by any physical security, tokenized financing for mining is based on the intrinsic value of a mineral deposit or its production, much like gold coins were supported by the underlying value of the metal itself.[2] Tokens are distributed via an initial coin offering, with purchasers ranging from retail investors to large institutions. The tokens are listed on third-party exchanges to facilitate trading and liquidity [2] and permit investment in privately held companies, both significant advantages relative to traditional crowdfunding. In 2018, an Australian investment firm named PCF Capital planned to issue security tokens, dubbed FutureGold, to fund gold explorers, developers, and producers. Described as a gold and royalty stream-backed security token, PCF Capital aimed to raise to $250 million.[8] However, lacking sufficient investor interest in the fund, PCF Capital halted the offering in 2019, citing a general public distrust of cryptocurrencies.[8]

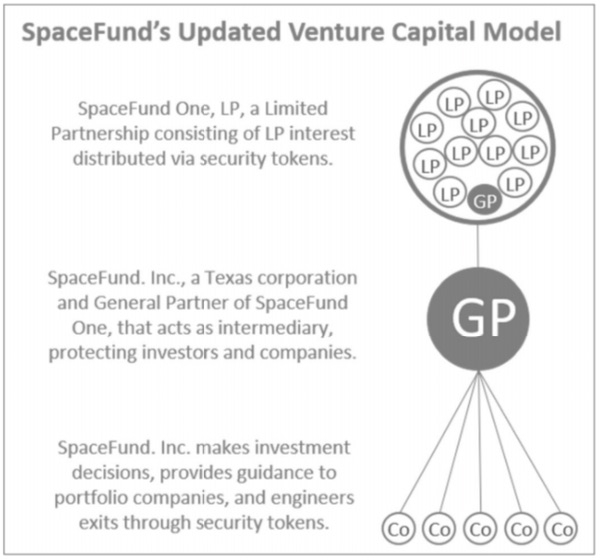

Tokenized financing presents a relevant near-term opportunity for lunar miners. Companies can remain privately held, thereby avoiding the costly regulatory requirements of public equity issuance, and investors are permitted liquidity in trading. SpaceFund, a US-based VC firm, recently began offering security tokens, supported by the underlying value of their fund portfolio. As shown in Figure 2, by purchasing security tokens, investors receive a limited partnership (LP) interest in the fund. SpaceFund acts as the general partner (GP) strategically investing the capital raised in companies, publicly or privately held, serving five distinct verticals, including transportation, communication, human maintenance, energy capture, and supply chain. As most investors lack specialized knowledge of space, the fund structure combines the risk mitigation benefits of indexing, crowdfunding, and blockchain technology. Due to their speculative nature, security tokens are available only to accredited US investors, operating within the guidelines set by the Securities and Exchange Commission (SEC), but the offering will expand to foreign investors once international legal frameworks emerge.[9] And though existing funds have limits on permitted capital, a favorable regulatory environment will enable an increase in offering entities, not restricted to VC firms, as well as a rise in capital contribution limits, and the permitted pool of investors. However, as seen with Bitcoin and Ethereum, if tokenized crowdfunding becomes too speculative, or attempts to bypass the regulatory environment, governments will act swiftly to limit its capabilities.

Figure 2: SpaceFund’s Venture Capital Model [9] |

For lunar mining companies seeking tokenized crowdfunding capital, communicating near-term revenue potential, like non-lunar applications of technology, will make it easier to attract investment. For example, space robotics can be used in markets other than lunar mining, such as servicing of orbiting satellites, construction of large space structures, and in-space manufacturing. Developing technologies that can also be applied to terrestrial operations opens up an even greater variety of markets. Examples include uses in deep-sea resource exploration; remote research, mining, and military operations; and the automation of complex industrial processes. Investors are more willing to fund technology development with multiple avenues for investment return.

Production-based financing

Production-based financing (PBF) offers another financing solution devised by terrestrial miners, whereby companies secure cash by selling rights to receive future production from their mines. For example, suppliers of strategic metals, like lithium and cobalt, will enter into offtake agreements with purchasers willing to prepay for future production rights. While limited in application to terrestrial mining exploration, since junior explorers sell land rights to larger miners for development and processing, vertically integrated lunar miners can use PBF to engineer near-term cash flows.

Given the speculative nature of lunar mining, with technologies for in-situ exploration, development, and processing still unproven, the near-term value of PBF is limited absent government intervention. The establishment of a federal tax credit, similar to the Mineral Exploration Tax Credit (METC) in Canada, a 15 percent tax credit on mineral exploration expenses, offers to improve the near-term viability. With government tax credits, lunar miners would use the future value of tax credits to attract private financing, a strategy supporting the US renewable energy industry. For example, US investors in solar energy infrastructure receive the Investment Tax Credit (ITC), a 30% tax credit claimed against any incurred tax liability. Whoever installs, develops, and/or finances the project claims the credit, receiving a dollar-for- dollar reduction in the income taxes paid to the federal government.[10] Renewable developers use the value of future tax credits to attract private financing from tax equity investors, seeking to reduce their taxable income base. Generally, tax equity investors cover 50% of the capital expenditure for site construction, receiving 99% of tax benefits and 50% of cash flows until earning a specified internal rate of return (IRR). Once the investment is recouped, the developer takes back full ownership of the project, enjoying a substantial reduction in the realized cost of these facilities.

| For the aggregate lunar economy, the emergence of large, vertically integrated companies will lead to the standardization necessary for economies of scale to develop. |

However, government incentives like the solar ITC require frequent approval for extension, leading to uncertainty in future operations for beneficiaries. After establishment in 2005, the ITC was set to expire by 2007, but its popularity and success led to multiple extensions.[11] It is currently set to expire for commercial development after 2021, but Congress is evaluating the merits of an additional extension. Without certainty in future financing, existing developers are rapidly constructing new solar facilities while the tax credits are active, leading to concerns of overcapacity. Although a federal tax credit would significantly improve the economic viability of lunar exploration, while simultaneously creating value for terrestrial investors, the uncertainty of government financing leads to major risk for industry reliant on patient and sustained capital.

Future opportunities in lunar financing

Space holding company

A holding company is a parent corporation, limited liability company, or limited partnership that owns enough equity in another company to control that company’s policies and oversee its management decisions.[12] While a holding company owns the assets of subsidiaries and maintains oversight capacities, it does not actively participate in a business’s day-to-day operations.[12] As discussed previously, traditional private capital models are ill-equipped for lunar mining investment. However, a dedicated holding company offers immense value in solving capital constraints. By pledging downstream revenue on behalf of subsidiaries, holding companies can lower the cost of capital for their companies, enabling debt financing at lower interest rates than if the subsidiary operated independently. Once backed by the financial strength of the holding company, the subsidiary company’s risk of defaulting on its debt drops considerably. In addition to capital, holding companies provide shared infrastructure for its portfolio of subsidiaries, allowing employees to focus on their expertise rather than spending time on legal and administrative tasks.

In 2019, Voyager Space Holdings was established as the first holding company dedicated to space, and capable of providing support over time periods long than traditional private capital. Voyager is looking for companies beyond the seed stage, producing revenue in the range of a few million to a few tens of millions of dollars,[13] so the near-term acquisition of lunar miners is unlikely. However, with the capacity to alleviate capital and administrative constraints faced by emerging space operators, lunar miners seeking capital for exploration should monitor and support the proliferation of additional space holding companies. For the aggregate lunar economy, the emergence of large, vertically integrated companies will lead to the standardization necessary for economies of scale to develop. An oligopoly of dedicated space holding companies, each comprised of diverse companies along the lunar value chain, could alleviate capital constraints of emerging companies and support the emergence of natural economies of scale. Furthermore, by establishing a prize program for subsidiaries, a holding company could foster and maintain a necessary culture of innovation and competition, avoiding the pitfalls of traditional oligopolistic industries.

Power of prizes in space

Prizes are a common feature in the history of space exploration and are among the most effective and overlooked tools for incentivizing breakthrough solutions to difficult problems. In practice, the prize sponsor defines the challenge and terms of success, and the innovator assumes full cost and risks of research and development while enjoying relative freedom in finding a solution.

While primarily sponsored by public entities, like NASA, the space economy has a unique experience with private sponsors attempting to ignite large-scale innovation. For example, the Ansari X PRIZE was created in 1995, offering a $10 million award to the first privately funded firm whose spacecraft could launch twice in a two-week period to an altitude of at least 100 kilometers, and be able of carrying three people.[14] A team led by aviation pioneer Burt Rutan claimed the prize in 2004, then licensed its technology to the newly created Virgin Galactic.[14] Even though the competitors spent, in aggregate, over ten times the sum of the reward, the publicity of the competition led to the formation of the space tourism industry. Space is an inherently high-visibility industry, so even if the cash prize is a tiny fraction of total investment, a successful contest generates spillover benefits in non-monetary incentives, like publicity and prestige, that exceed the value of the prize itself. Since emerging financing options, like tokenized crowdfunding, rely upon public interest for success, non-monetary benefits are especially attractive.

Application to holding companies

As the lunar economy matures, space holding companies will support numerous subsidiaries along multiple verticals, from launch to mining and processing. While prize sponsors generally set a single, ambitious goal without restriction on entrants, a space holding company could create incremental performance goals for each vertical, fostering a culture of competition for applicable subsidiaries. Since competitors will operate within the same holding company, the prize programs will require information transparency to reduce duplicative efforts, where contestants hoard critical information only to counterproductively adopt similar methods. By mandating information exchange, the prize programs will support a culture of coordination while maximizing the potential for complementary technologies to develop. Moreover, as the holding company provides capital for research, contestants need not worry about fundraising efforts. In essence, the relative value of non-monetary rewards, along with the natural benefits of a holding company, makes prize programs a viable method for lunar economic development.

Conclusion

The proliferation of a lunar economy rests upon patient access to capital and fostering innovative ideas for large-scale development. At the moment, capital requirements for lunar miners are too high for companies to succeed in a perfectly competitive market. For the lunar economy, the emergence of large, vertically integrated companies will lead to the economies of scale necessary for proliferation.

Terrestrially, when an industry becomes mature and beholden to traditional economics, like scarcity, a focus on profit margins takes over, and limitations emerge in the form of price manipulation and a lack of competition. As mentioned, the lunar economy will operate privately, and independent of scarcity, using profit margins to increase cash flow for innovation. An oligopoly of dedicated space holding companies, each comprised of diverse companies along the value chain, funded by the parent company and incentivized by prizes, will maintain a culture of innovation and competition. Rather than a few concentrated entities, each sacrificing their identity to their acquirer, the lunar economy will be an oligopoly of teams.

When seeking capital for exploration, lunar miners should:

- Address the capital constraints faced by the terrestrial mineral exploration industry, and how resource scarcity is inversely related to return potential

- Educate investors on the history of terrestrial mineral exploration, highlighting the immense value created by collaboration among early 19th century prospectors

- Explain how the relative abundance of resources, coupled with the necessity for complementary infrastructure, supports an inherent culture of collaboration in the lunar economy

- Discuss the viability of terrestrial project financing techniques for the lunar mining industry, communicating the potential for near-term revenue through non-lunar applications of technology

- Advocate for emerging trends in lunar financing, emphasizing how each trend facilitates access to patient and sustained capital

References

- Hedley, Widdup. “The Past, Present and Future of Exploration Funding.” AusIMM Bulletin, 2 June 2019.

- Vella, Heidi. “Alternative Financing for the Mining Industry: What Are the Options?” Mining Technology | Mining News and Views Updated Daily, 25 Mar. 2019.

- “Sandstorm Gold CEO Nolan Watson - The Stock Pocast.” The Stock Podcast | CEO and CFO Interviews, 31 Oct. 2019.

- David, Leonard. “Moon Mining Could Actually Work, with the Right Approach.” Space.com, Space, 15 Mar. 2019.

- Spudis, Paul D. “How Much Water Is on the Moon?” Air & Space Magazine, Air & Space Magazine, 5 Jan. 2018.

- Barton, Sussane. “The Massive Prize Luring Miners to the Stars.”, Bloomberg, 2019.

- Scott, Andrew. “Cornish Lithium’s £1.4mln Crowdfunding ‘an Unqualified Success’.” Proactiveinvestors UK, 11 Oct. 2019.

- Investor Insight. “FutureGold – Today’s Cryptocurrency to Fund Tomorrow’s Gold Mines.” Investor Insight, Investor Insight, 5 Oct. 2018.

- “Security Tokens Will Fund the High Frontier.” SpaceFund, Nov. 2018.

- “Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2019.” ReadkonG.com, 2019.

- “Investment Tax Credit for Solar Power.” EnergySage, 2019.

- Bloomenthal, Andrew. “Getting a Grip on Holding Companies.” Investopedia, Investopedia, 11 Sept. 2019.

- Foust, Jeff. “New Holding Company to Support Space Startups.” SpaceNews.com, 4 Oct. 2019.

- Hendrix, Michael. “The Power of Prizes.” U.S. Chamber of Commerce Foundation, 3 Feb. 2014.

Note: we are temporarily moderating all comments submitted to deal with a surge in spam.