The growing importance of small satellites in modern warfare: what are the options for small countries?by Donatas Palavenis

|

| Small satellites seem to be conquering space at an extraordinary rate today. |

The beginning of development of small satellites was greatly stimulated, starting in 1980, by the international community of radio satellite amateurs and universities, who were looking for ways to develop cost-effective space systems performing various functions with minimal financial and technical resources. As a pioneer in the field of small satellites, the University of Surrey can be mentioned for its UoSat program, which later influenced the creation of Surrey Satellite Technology Ltd., the first small satellite manufacturer. This significant breakthrough facilitated an increase of small satellites available in orbit, which from 2012 to 2017 increased from 70 to 380. Of the 300 small satellites put into orbit in 2017, about 80% were satellites of the micro-nano class. Meanwhile, 94% of the number of satellites launched in 2020 consisted of small satellites.

Small satellites seem to be conquering space at an extraordinary rate today. After examining companies’ plans and issued permits, at least 1,800 small satellites will be launched per year in the future. Materials and technologies freely available on the market are used for the production of these spacecraft, which will allow the discovery of new and cheaper ways of performing significant observation missions. Thanks to technological innovations, continuous miniaturization of key components, and advances in mechanical systems, batteries, and sensors, small satellites can provide high-quality data and services in areas such as remote sensing; data transmission; and positioning, and timing, navigation. The standardized implementation of hardware and software components has also given a great boost to the optimization of the production, integration, and testing of satellites and their subsystems, which is especially important for the launch of satellite clusters.

Advantages of small satellites

It would be naive to expect that a single small satellite could be superior to a large satellite, but small satellites can still perform many relevant functions. First of all, small satellites are focused on performing a single function while large satellites may contain many complex sensors. Small satellites are often launched in clusters, so the area covered by them can be equal to the area covered by a large satellite. The performance of a single function leads to a smaller size of the satellite, while at the same time influencing its complexity, which allows for faster production. A large satellite can take four to five years to design and build, while small satellites can be built in a significantly shorter time frame, in some cases even months.

The shorter development time of small satellites also allows for the renewal of low Earth orbit (LEO) satellites, whose on-orbit life cycle is significantly shorter (one to five years) than that of large satellites. Scientists are currently still experimenting with new solutions to increase the duration of small satellites in space by up to seven years. Propulsion technologies have also been developed for small satellites to change their orbits and take their desired position in a cluster. Second, the constant updating of small satellites allows us to expect that the newly launched satellites will have the most recent and improved technologies installed. Third, the relative simplicity and short development time of small satellites generally result in lower costs. While traditional large satellites typically cost hundreds of millions or even billions of dollars to build, small satellites can be built for tens of millions of dollars or even less. For example, the creation and launch of the Maxar’s WorldView-4 satellite, weighing 2,500 kilograms cost $850 million, while the price of a single OneWeb small satellite) together with its launch services is estimated at about $1 million. Experts estimate that the average production and launch costs of small satellites are up to 90% lower than those of large satellites.

It is possible to create clusters of small satellites or a group of linked satellites that have different sensors that fly over the same point on the ground at the same time, allowing different types of data to be combined. In this way, several small satellites would provide identical or even more detailed information than those large satellites. Smallsats that are launched frequently can be part of a cluster or system that consists of over more than 100 satellites, which allows for an increase in the revisit frequency. The company Planet, with over 150 satellites in LEO, can collect information from any place on earth at least five times a day. Meanwhile, SpaceX, which plans to launch 12,000 and later up to 42,000 Starlink satellites, will be able to ensure constant and uninterrupted Internet access and data transmission anywhere on Earth.

Since the prices of launching satellites into orbit have significantly decreased, one expects that the interest in small satellites will not decrease in the future. LEO launches prices per kilogram range from $5,000–18,000, depending on orbit and waiting time. SpaceX’s Falcon 9 can launch the cargo cheapest, while the Falcon Heavy, when fully loaded (up to 60 tons), would cost $2,500 per kilogram. Several other companies are also trying to claim a share of the market, like Blue Origin with its New Glenn and United Launch Alliance with its Vulcan launch vehicle. Individual solutions are also offered on the market for launching small satellites from companies like Firefly Aeropsace, Rocket Lab, and Virgin Orbit.

SpinLaunch is currently testing an alternative method of launching satellites weighing up to 200 kilograms using a mass accelerator. The accelerator spins the payload up to 10,000 g and releases it through a launch tube. When the rocket reaches the required height, its outer casing falls, and then it fires engines to deliver the cargo to the desired orbit. The 33-meter-diameter accelerator is currently being tested, after which a 100-meter-diameter accelerator will be built that will ensure the launch of small satellites into the required orbits. This method, the companies argues, can reduce the cost of space access by a factor of ten.

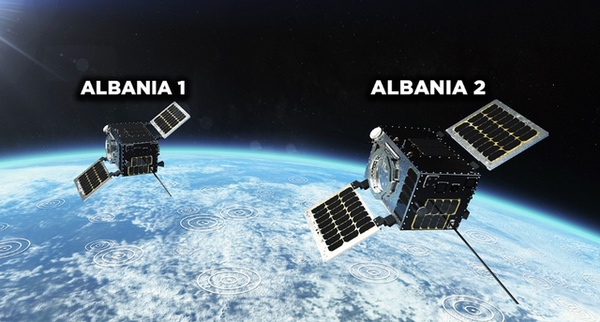

Small satellites Albania-1 and Albania-2, being provided to Albania by Satellogic. |

Trends in the civil sector

In many countries, commercial companies offering optical observation services from space have been founded, based on the currently popular small satellites. Perhaps the most famous is Planet. In total, Planet has developed and launched more than 450 satellites. Currently, two clusters of this company are functioning in orbit: 150 Dove medium-resolution satellites and 21 SkySat high-resolution satellites. Satellogic currently has 26 satellites in orbit, capable of taking images with a resolution of 70 centimeters, and by 2025 is planning over 300 satellites with the aim to ensure a weekly update of the global map. The Albanian government has signed a three-year €6.2-million contract with Satellogic for the launch and maintenance of two satellites, Albania-1 and Albania-2, which will ensure imagery that can be sued for environmental protection, border, and security services.

| Notably, no commercial small satellite cluster company has yet proven to be commercially viable without government support. |

Another US company, BlackSky Global, provides surveillance services enabled by optical and synthetic aperture radar technology, has launched 12 small satellites (1 px. - 30 cm.) into orbit and has signed a contract with the US National Reconnaissance Office for $1 billion over ten years. The Chinese company Chang Guang Satellite Technology Co. Ltd. currently operates the Jilin-1 cluster of 46 satellites, which provide imagery at a resolution of 75 centimeters, which it plans to expand to 138 satellites.

Meanwhile, other companies manufacture and operate remote sensing satellites that have different types of sensors. Spire manages 110 different satellites that collect not only radio frequency data but also allow monitoring of weather, sea traffic, and aviation activities. Another company, Capella Space, uses synthetic aperture radar technology to monitor the Earth in any weather, day and night. The company launched the first seven satellites from a planned cluster of 36 satellites.

The company HawkEye 360 has three clusters of small satellites deployed that scan radio frequencies and asses information about the spectral environment and radiation locations. The company plans to launch up to 80 satellites of this type in total.

With the significant increase in the amount of data exchanged in space, the need for the emergence of platforms that enable this also increases. There are companies that have set themselves the goal of providing Internet connection in those parts of the world where terrestrial networks are not developed. SpaceX’s Starlink is the most developed in the world, with more than 3,000 satellites launched so fa that can provide data transmission speeds of 50–200 megabits per second in different parts of the world. The Starlink cluster is planned to have 12,000 satellites in its final phase. Another international company, OneWeb, which is partly owned by the UK government, has about 400 satellites in orbit and plans to increase the number to 648 by 2023. Project Kuiper by Amazon plans to launch as many as 3,236 satellites, which would provide high-speed, low-latency broadband services at an affordable price anywhere in the world.

China-based companies Guodian Gaoke and Commsat Tech Dev Co. are also active in this market. The first company will launch 38 satellites into space by the end of this year, and the second will deliver eight satellites.

Over the past decade, many new satellite companies have emerged, but almost all of them are in the early stages of investment and development. Notably, no commercial small satellite cluster company has yet proven to be commercially viable without government support. Many experts are hesitant to assess when SpaceX, the company that makes the Starlink communications satellites, will establish a market share that will allow it to maintain the company’s manufacturing, launch, space and ground infrastructure, and support operations. Regardless of these circumstances, investors believe that the capacity of small satellites will increase, the technology will continue to develop, and companies would be able to take a sufficient share of the market. Companies that manufacture small satellites for remote sensing, communications, on-orbit servicing, and debris reduction are expected to dominate the space ecosystem in the coming decades.

Potential for small satellites to be used by the military and projects under development

There are noticeable trends in the US defense sector regarding services are procured from the commercial sector, often provided by small satellites. The US Department of Defense and the US intelligence community are starting to invest more and more in commercial small satellites and their clusters.

Clusters of small satellites provide the required revisit frequency, which gives military decision-makers the advantage of knowing the near-realtime situation on the battlefield. This conceptual idea is currently being tested by the US military through the Convergence experimental project, where the capabilities of commercial and government-operated satellites have been used to photograph the battlefield and rapidly exchange information with the help of communications satellites. In addition, the latest data synthesis and artificial intelligence capabilities were used for data processing, which made it possible to shorten the decision-making speed—from target identification to firing a shot—from 20 minutes to 20 seconds.

Clusters of small satellites provide another important advantage: resistance to kinetic attacks like anti-satellite weapons. Large satellites are seen as easy targets, but the destruction of one or more small satellites would not significantly affect the operation of the entire cluster or its functionality, so the adversary may decide not to launch this type of attack at all. Of course, clusters, like individual large satellites, can be vulnerable to cyberattacks or could be destroyed by nuclear explosions in space.

Due to the very short production time and cost of small satellites, in the event of a conflict, it is possible to quickly replace satellites in orbit, launch new ones for specific tasks, restore damaged ones, or increase the number of them in a certain orbit to increase the observation time.

As governments in the future will increasingly use small satellites operated by private companies to provide services to other commercial or government actors around the world, this will make it more difficult for adversary forces to make the decision to destroy several small satellites in a crisis knowing that this action can be met with a direct or indirect reaction from other states.

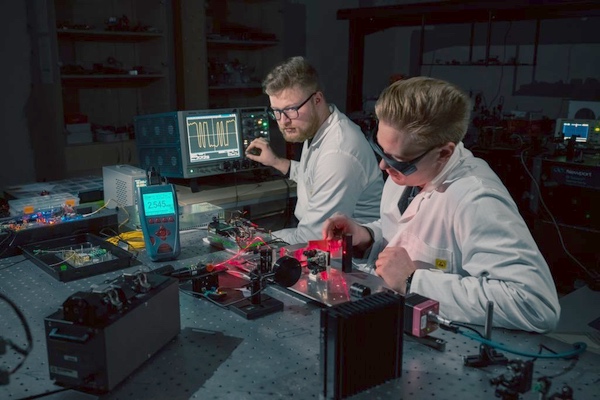

Work at the Astrolight research laboratory in Lithuania. (credit: Astrolight) |

The potential of small states in the market for small satellites: a Lithuanian case study

Of course, many small states have their own research and production potential, some of which specialize in this particular market. In this article, we will review only the case of Lithuania, because the author is from Lithuania.

Lithuania has set an ambitious strategic goal: for the Lithuanian space sector to create about 1% of the country's GDP. Currently, support for the Lithuanian space sector is being developed, and cooperation in the sector is being matured. That includes a recently created space technology cluster, the “Visoriai Information Technology Park”, in which the companies NanoAvionics, Elsis Pro, Geomatrix, and Blackswan Space participate.

| The war in Ukraine has clearly shown that the importance of surveillance tools in space is obvious and having said tools gives a very big advantage. |

NanoAvionics produces small satellites (up to 220 kilograms) and their subsystems, manages satellites and ground stations, and organizes services for launching satellites into the required orbits. It is probably the most widely known Lithuanian space company in the world. The company, which started operations in Vilnius, currently has branches in Kaunas, the US, and the UK, and is one of the largest manufacturers of small satellites in the world. Earlier this year NanoAvionics was acquired by Kongsberg Defense & Aerospace, a Norwegian technology company. Since its inception, NanoAvionics has completed more than 120 small satellite missions and other related projects. The Vilnius-based division is the company’s main strategic, production, research, and satellite management center, providing small satellites and mission management services to NASA, the European Space Agency, Thales Alenia Space, and other organizations around the world, including those related to in the creation of clusters of satellites of various configurations.

Elsis Pro develops data exchange solutions, and according to a contract with the European Space Agency, will develop a data exchange platform on the Galaxy nanosatellite cluster. Geomatrix provides solutions for satellite data processing. Startup Blackswan Space specializes in developing autonomous technologies for satellites, while another startup, Astrolight, develops wireless laser communication technologies for satellites and drones.

In terms of the potential of scientific institutions, the most outstanding could be Vilnius Tech, whose scientists specialize in the development and research of precision mechanical drives, miniature piezo drives required for the control of satellite mechanisms and optical instruments, and in the development of adaptive antenna technologies.

Options for small states while using small satellites to increase national security

The war in Ukraine has clearly shown that the importance of surveillance tools in space is obvious and having said tools gives a very big advantage. Data on the deployment of troops, equipment, and weapons, as well as approach routes, were obtained from both state-run and privately owned satellites.

According to current trends and the level of technology development, it is clear that small satellites will become popular, the cost of their production and launching into space will decrease, the technical characteristics of satellites will improve, and they will be able to stay in orbit for a longer period of time, and at the same time, there will be an increase in the number of companies that will invest in this niche by creating clusters of satellites designed to perform certain functions. Many companies will also offer users data processing and other services.

For a small state, it is important to properly assess the amount of information required for national security and ensure that the requested and received information is available to a wider range of users. Centralization of information retrieval and order would be required to avoid duplication. As the security situation changes, so should the periodicity of obtaining and updating information.

It is necessary to perform an analysis to assess what type of sensors would be the most effective, what would be the optimal number of small satellites, their orbits, and other important parameters. It can be assumed that in the case of a small state, the solution would be: to have several state-owned satellites (e.g. the case of Albania) and, in case of need, to be ready to order the data of the required areas from foreign companies or other states. In this way, the state institutions would constantly and periodically receive data on the areas of interest to the security services in the state and outside of it, and if necessary, they could ensure almost continuous monitoring and evaluation of the said areas. Countried could reduce the cost of the first step by implementing this idea together with neighboring countries.

Also, it would be appropriate to evaluate other possible alternatives to ensure the monitoring of the areas of interest from the space. It could be joining the already running programs of neighboring countries, but in this case, as long as the necessary resources are always available.

To achieve the most optimal solution, it is necessary not only to carry out a detailed analysis of the costs and benefits of the proposed options in the medium and long term but also to use independent experts to prepare the necessary studies and assessments.

The main literature used for the preparation of the article:

- Mariel Borowitz, 2022, The Military Use of Small Satellites in Orbit.

- Nicholas Eftimiades, 2022, Small Satellites: The Implications for National Security.

- Steven Kosiak, 2021, Small Satellites in the Emerging Space Environment Implications for U.S. National Security–Related Space Plans and Programs.

- Respective company websites.

Note: we are using a new commenting system, which may require you to create a new account.