Miscalculations of Galileo: Europe’s answer to GPS is flounderingby Timothy N. Barnes

|

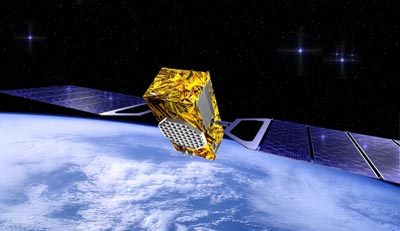

| The inability of Galileo to get off the ground has struck a blow to European space policy. |

Proponents of the satellite constellation argued that it would become a viable commercial enterprise. By charging for its unprecedented precision as well as other updated features, Galileo was promoted as able to quickly turn a profit, offsetting the cost of its deployment (€3.6 billion/$5 billion), which was to be funded through a public-private partnership. Others located its economic benefits in the jobs and economic growth that would be spurred by the pan-European effort. But non-economic reasons were also a factor. Chiefly, European officials stated that a system of their own was desirable since America could block access to its military controlled GPS at anytime.

Galileo was welcomed by most Europeans as well as some non-European governments. Europeans continually register strong support for the program in opinion polls, and Israel, China, and India initially signed onto the project. Israel was awarded a stake in the project in exchange for its technical assistance, while China agreed to invest €200 million and India was believed to have been ready to pour in another €300 million before negotiations collapsed. In addition, a number of prominent European companies such as the European Aeronautic Defense and Space Co. (EADS), France’s Alcatel-Lucent and Thales, the United Kingdom’s Inmarsat, and Germany’s Deutsche Telekom, vied to be included in the public-private initiative. It appeared that Galileo was well on its way to becoming a reality.

Challenges

In the four years since Galileo’s much-ballyhooed launch, it has encountered numerous difficulties. One of the most contentious issues that have arisen is the use of the system in support of military operations. As noted earlier, one of the primary justifications for Galileo according to proponents was to provide an independent, European satellite navigation system apart from the US-military controlled GPS. In the event that the United States denied access to GPS, European military leaders wanted to make sure they would not be cut off from satellite navigation capabilities. Europeans are far from united on this point, however. France, for example, views Galileo as a challenge to the US GPS hegemony, while Britain has sought to mitigate the possible military applications of Galileo. In response to this issue, the United States has recently taken action to make GPS more user-friendly. On September 18, the Bush Administration, based on a recommendation by the Department of Defense, announced that the next generation of GPS satellites would not have “selective availability,” or the capability to intentionally weaken the civil GPS signal. This move can be interpreted as an attempt to counter European claims of unreliability by demonstrating that the US military will refrain from needlessly interfering with the civilian applications of GPS.

Another major difficulty that has plagued Galileo has been funding. At first, project backers anticipated that two-thirds of its cost would be shouldered by private companies with the remaining portion financed publicly. However, bureaucratic squabbling has led to a number of delays, scaring away many potential investors. By the summer of 2007, the inability to divide the project among a consortium of companies led to a European Commission decision to fund Galileo wholly as a public enterprise. By that point, Galileo was already several billion euros in debt and four to five years behind its original schedule.

| Aside from bureaucratic problems, Galileo has also been challenged by the ever-evolving satellite navigation market. |

A third major difficulty arose when China and India recently softened their commitments to Galileo due to the numerous implementation problems encountered by the program, as well as their own desires to have independent satellite navigation ability. China had been working on a satellite navigation system of its own, Beidou, for several years, but it was slated to be used for military applications only. China had signed on to Galileo in order to have a satellite positioning system that could be used for commercial purposes. However, last year, China abruptly changed course, deciding to utilize Beidou for civilian activities as well. On the other hand, when further negotiations between India and the EU fell through last November, India cited security reasons, specifically that sensitive information would not properly be protected by Galileo.

Aside from bureaucratic problems, Galileo has also been challenged by the ever-evolving satellite navigation market. Four years ago, the market looked ripe for the introduction of a new, upgraded global positioning system. Proponents, particularly those who emphasized its economic virtues, touted this as Galileo’s greatest advantage. However, in recent years America has accelerated the upgrades of its GPS system and Russia and China have advanced their own programs. The push-back of Galileo’s operation date means that it will enter a market vastly more competitive than the one its founders envisioned. Combined with forced public financing and increasing debt, many of the economic advantages of Galileo have been substantially mitigated.

Conclusion

The recent collapse of Galileo’s public-private partnership has left the future of the entire endeavor in doubt. On September 19, the European Commission concluded that Galileo could be financed by shifting money allocated elsewhere in the EU budget. Specifically, their plan calls for €2.2 billion ($3 billion) to be transferred from the agriculture budget, €220 million ($309 million) from administrative costs and another €300 million ($422 million) from money originally set aside for research. However, the ultimate arbiters remain the European governments whose transportation ministers are scheduled to meet in October to discuss the issue. In the meantime, Europe holds out hope that if an agreement on funding can be reached by the end of the year, Galileo could be up and running by 2013. While certain details of the project remain unsettled—for instance, to what extent (if any) will the system be used for military purposes—it appears that Galileo will continue to limp along. Despite mounting debt, bureaucratic impediments, and an unfavorable market Europeans continue to cling to their dream of an independent satellite navigation system.