Doubts about depotsby Josh Hopkins

|

| While there are features that would be attractive, there are also problems with the concept that leave many people, including myself, unconvinced that propellant transfer is such a good idea. |

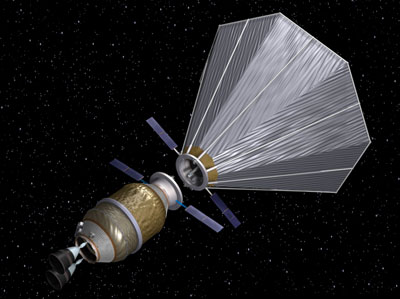

Propellant depots are conceptually simple. In almost any exploration architecture, most of the mass that must be launched to space is propellant, typically cryogenic liquid oxygen and hydrogen. Since propellant is divisible into batches of arbitrary size, it could be launched separately from the exploration spacecraft in several tankers and stored in a depot in low Earth orbit. The exploration spacecraft and transfer stages can be launched empty and can fuel up from the depot in space. Alternatively, propellant could be transferred from the tanker spacecraft directly to the receiver spacecraft without the intermediate step of a dedicated depot spacecraft. The primary advantage of propellant transfer is that it reduces the required size of the largest launch vehicle from one the size of a Saturn 5 or Ares 5 to that of a smaller rocket, sized by the largest dimensions and heaviest mass of the individual spacecraft elements.

While this concept is attractive, the details of how propellant transfer would work in a lunar exploration architecture are still vague and problematic. And, while there are features that would be attractive, there are also problems with the concept that leave many people, including myself, unconvinced that propellant transfer is such a good idea. If depot advocates want to convince depot skeptics during the upcoming debate over its use, they could start by resolving the following issues.

Concept of operations

Propellant transfer is a flexible approach. Propellant might be delivered by a variety of providers using big rockets or small ones, and the depot could be placed in whatever orbital location makes the most sense. However, by embracing that flexibility, advocates have avoided specifying the details that determine whether a design closes—that is, whether it really works. At least one viable proof of concept example is needed before the idea can be evaluated. Each reference design should specify, among other things: how big the tankers are and how and when they are launched; how the various propellant spacecraft operate together; the orbits, trajectories, and maneuvers assumed; and whether the in-space propellant transfer assets can be reused for multiple missions or are deployed fresh for each mission.

The capacity of the tankers determines the size of the launch vehicles and the number of flights that would be needed and, as a result, it influences how long it may take to perform these operations. Fueling a Constellation-equivalent lunar mission using today’s largest launch vehicles, like Delta 4 Heavy and Ariane 5 ECA, requires half a dozen tankers, in addition to the launches required for Orion, the empty lunar lander, and the translunar injection stage. If smaller rockets are used, then scores of launches could be involved. Once the number of tankers is determined, a mission timeline can be developed to estimate how long it would take to conduct all the launches and how long each spacecraft would need to operate. These factors drive mission operations costs and design features of the spacecraft, such as power supplies and protection from orbital debris.

Decisions about how the propellant delivery vehicles will be used also drive the mission timeline. If tankers transfer their propellant to a depot, the tankers can be short-lived. If the tankers load the receiver spacecraft directly, the cost of the depot is eliminated, but the propulsive stage that receives the propellant must be launched much earlier to allow time for each of the tankers to dock with it. It, therefore, becomes a more complex vehicle than is currently envisioned.

Spacecraft complexity is also determined by which vehicles are the active “chasers” during rendezvous and which are the passive targets. Do the tankers navigate to the depot and dock, or does the depot come to them? This is a key driver in the expense of each spacecraft and also influences their mass budget for maneuvering propellant. To keep the tankers simple, some have suggested a third class of spacecraft—a tug—to move tankers to the depot. Once the timeline and transfer sequences have been decided, analysts can estimate how much extra propellant must be launched beyond that needed by the receiver spacecraft in order to account for boil-off, variability, and the residuals left in the tankers or depot.

The operational orbit of the depot and the orbits in which the launch vehicles release the tankers must also be specified. Outbound exploration missions from Apollo to the tiny Lunar Prospector typically use LEO park orbits below 300 kilometers altitude because energy spent raising the park orbit is mostly wasted when translunar injection occurs. These low orbits are fine for short stays of a few hours or days, but are difficult places to operate a depot for weeks or months at a time. Residual atmospheric drag is strong enough to de-orbit a spacecraft in a few days or weeks, and gravity gradient and aerodynamic torques will fight to rotate the depot away from the sun-relative orientation desired for keeping cryogenic propellants cold. Would the tankers and depots be designed with enough propellant to overcome this, or must they operate at higher altitude orbits? In either case, the implications need to be accounted for in the design, such as when evaluating launch vehicle performance or the spacecraft’s propellant budget for maneuvers.

| Propellant delivery costs of $5000–10,000 per kilogram are often suggested based on current raw launch prices to LEO. But these costs completely ignore the tanker spacecraft that is wrapped around the propellant, reducing the cargo mass which can be carried and adding to the mission cost. |

Would the propellant transfer infrastructure be semi-permanent (i.e. a long-lived depot) or temporary and replaced for each lunar trip? In addition to the obvious cost implications, it turns out this decision defines the launch windows the architecture can support. In order to depart towards the Moon, the plane defined by a spacecraft’s park orbit must intersect the plane of the Moon’s orbit at the same point where the Moon will be when the spacecraft gets there. In orbital mechanics terms, the park orbit must have the correct right ascension of ascending node. A single launch approach like Apollo addresses this constraint by selecting the appropriate launch time and park orbit inclination to enable a launch window of a few hours on any day. Being able to depart on any day of the lunar month means that other constraints can be accommodated, such as other aspects of lunar orbital phasing or sun angles for proper lighting. A multi-launch approach like Constellation has the same flexibility until the first element is launched, at which point the departure date becomes fixed. However, a permanent orbiting facility does not have this flexibility. Once in a particular orbit, brief departure opportunities recur 9–10 days apart (slightly faster than twice per lunar month due to the precession of the park orbit).

A permanent depot could be launched into an orbit that allowed the first lunar mission to go at a desirable time, but later missions will be restricted by orbital mechanics. The same kinds of issues make it difficult for a single depot to support multiple customers for different applications. Incidentally, it’s also one reason why permanent space stations like the ISS may not be desirable for assembling lunar exploration mission elements. Would it be better to accept these constraints for the benefits of a long-lived facility, or to launch fresh single-use depots into different orbits for each mission?

Comparing costs of propellant transfer and heavy lift

Propellant transfer promises to reduce the cost of exploration by eliminating the development and operational costs of the ultra-heavy launch vehicle in favor of smaller launch vehicles, and by relying on competition between commercial launch providers to drive down launch costs. Both of these effects are real and significant. However, while propellant transfer saves costs on one side of the ledger, it adds a whole new category of costs for an activity which isn’t required in a heavy lift architecture, namely repeated autonomous rendezvous, docking, and transfer of propellant from the tanker to the depot to the exploration spacecraft. Basically, propellant transfer substantially increases the number of spacecraft that must be built for each mission. Just how much would this add to the cost?

Propellant delivery costs of $5000–10,000 per kilogram are often suggested based on current raw launch prices to LEO. But these costs completely ignore the tanker spacecraft that is wrapped around the propellant, reducing the cargo mass which can be carried and adding to the mission cost. The tanker and depot spacecraft need a structural container to carry their cargo, a docking and fluid transfer interface, relative navigation sensors for rendezvous, and the conventional spacecraft subsystems such as power, reaction control thrusters, avionics, and software. Functionally, these requirements closely resemble the spacecraft used for delivering cargo to the International Space Station, so it is worth comparing the costs for those systems.

Based on publicly released data for the Commercial Resupply Services (CRS) contracts, SpaceX appears to be delivering about 28 tons of pressurized and unpressurized cargo for about $1.6 billion, or around $60,000 per kilogram. Orbital Sciences is charging around $95,000 per kilogram. Europe’s ATV cargo vehicle is intended to cost around €325 million per mission, or around $60,000 per kilogram. In each case, these figures represent recurring prices after development and first unit flights are paid for separately. The CRS cargo vehicles are commercially developed systems with limited NASA involvement, procured competitively, exactly as is proposed for the propellant transfer concept.

A reasonable optimist could point out that costs for propellant transfer in an exploration architecture might be lower than current ISS cargo prices due to the much larger demand, enabling higher flight rates and the efficiency of larger transfer vehicles. The lower launch inclination of a lunar mission compared to an ISS cargo mission also helps a bit. A reasonable cynic would point out that the $60,000 per kilogram figure is only a projection that has not yet been demonstrated to be achievable, but let’s stay with the optimist for a moment. What are the implications if propellant could be bought in orbit for half the current low-end price of ISS cargo delivery, say at around $30,000 per kilogram of delivered propellant?

| The description of the “commercial” propellant delivery industry envisioned by some to support exploration isn’t very commercial at all. |

To understand what these prices mean for a lunar mission, consider a simple variation of the Constellation architecture in which the Earth Departure Stage is launched to low Earth orbit with all of the hydrogen fuel it needs for translunar injection, but none of the liquid oxygen. Smaller propellant tankers would deliver the necessary 85 metric tons or so of liquid oxygen to orbit and transfer it to the Earth Departure Stage. The Ares 5 heavy launch vehicle could be replaced by a less expensive rocket with roughly half its capability. At $30,000 per kilogram of propellant, it would cost over $2.5 billion to refuel each lunar mission, or $5 billion per year to perform the intended two missions per year. That’s more than the predicted annual cost of the Ares program or some of its heavy-lift competitors, and yet it doesn’t include the launch costs for Orion, Altair, and the Earth Departure Stage. (All figures are approximately 2010-year dollars, without adjusting for future inflation.) An approach using propellant transfer appears to be more expensive than building some variety of heavy lift vehicle unless the cost can be brought down by at least a factor of four from the lowest prices currently being offered for LEO cargo delivery.

Cost and schedule risks

The complexity of assembling exploration systems spread over many launches increases the risk that one of the launches or docking events will fail, or that launch schedule delays will prevent one of the pieces from being launched on time. NASA’s prior architecture studies overestimated the risks of a propellant transfer architecture by assuming that all launches are equally important. As advocates of propellant transfer rightly point out, it is less significant if one of several propellant tankers is lost to failure or stuck on the launch pad than if this were to happen to an expensive, unique lunar lander or Orion, because it is plausible to have an extra tanker and more than one launch option.

Proponents of propellant transfer go too far, though, when they claim that this solves the problem. While it’s true that liquid oxygen is a low-value payload (the stuff costs pennies per kilogram), the launch service and the tanker spacecraft that is wrapped around the propellant each costs many millions of dollars. Losing a tanker will be painful and expensive. Moreover, a variety of failure scenarios can have cascade effects on other launches, which are hard to mitigate simply by buying a backup tanker. For instance, a failure of a launch vehicle or a tanker, either in flight or in ground tests, could cause a stand-down which substantially delays future propellant launches, causing additional propellant boil off in the depot which must be made up with additional propellant launches. These risks can either be accepted or they can be reduced by spending money on additional backup vehicles, but one way or another they need to be accounted for when comparing propellant transfer architectures to heavy lift architectures.

How commercial is propellant transfer?

One primary selling point for using propellant transfer for exploration is that it might support substantial growth of the commercial space industry by providing a large market for a product that is a standardized commodity and, therefore, easy to compete. If that were true, this would, indeed, be a desirable outcome. However, this particular “commercial” market doesn’t look like other successful commercial space industries. A healthy commercial industry, like launch services (at least in the 1990s), satellite manufacturing, or satellite communications services, has multiple competing suppliers who take the risk to create products mostly using their own investment in order to sell to multiple customers, many of whom are, themselves, commercial entities. A government agency may support development of the technology and might be one significant customer, but in a truly commercial market the government does not provide all the funding or buy the majority of the product.

| While it’s true that liquid oxygen is a low-value payload (the stuff costs pennies per kilogram), the launch service and the tanker spacecraft that is wrapped around the propellant each costs many millions of dollars. Losing a tanker will be painful and expensive. |

In contrast, the description of the “commercial” propellant delivery industry envisioned by some to support exploration isn’t very commercial at all. Most scenarios that have been described rely heavily on substantial investment from NASA to fund both the technology risk reduction and system development, and then further rely on NASA purchases for all or nearly all of the demand. While other customers such as commercial communications satellite operators might be in the market for propellant delivery, they seem to want different commodities in much smaller quantities, often in quite different orbits. The envisioned NASA-dominated market approach isn’t a healthy commercial market. Instead, it’s a government monopsony, a market condition similar to a monopoly in which a single buyer rather than a single supplier dominates the market. If, like COTS and CRS, this kind of quasi-commercialism enables a more efficient way to do relatively traditional government procurement with less oversight, that efficiency would be a good thing. But it’s not the same thing as enabling a commercial market.

Next steps

In engineering, there are four fundamental steps to inventing the next big thing. First, come up with a new idea that looks promising. Second, figure out the details of how it would work. Third, compare it to known alternatives to figure out whether the new idea is actually any better. Propellant depots for exploration have gotten through step one. But until someone performs steps two and three to figure out whether depots really are an improvement, it’s premature to move to step four: making it happen.