|

|

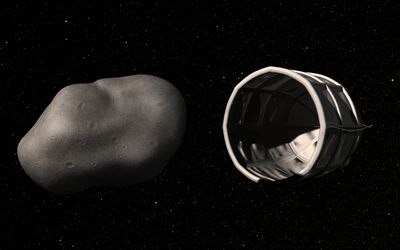

Emerging companies like Planetary Resources demonstrate there is commercial interest in accessing solar system resources. What can the US government do to support those efforts? (credit: Planetary Resources) |

After Apollo: Creating an economically robust space policy by learning from the American West

by Martin Elvis

Monday, August 13, 2012

Just over two hundred years ago an American president initiated a program of exploration that sent two men to the Pacific Ocean. Fifty years ago, another US president initiated a program of exploration that sent two men to the Sea of Tranquility. Fifty years after Lewis and Clark we had the California Gold Rush, and it was just another 16 years to the completion of the first transcontinental railroad with the Golden Spike. But fifty years after the start of the Apollo Program, the High Frontier of space is trailing far behind the pace of the frontier of the American West. Why the striking contrast?

| The federal government should play the same role in space in the 21st Century that it played in the development of the American West in the 19th Century: Make the frontier safe for capitalism. |

From the beginning, the effective goal of the US space program was to dominate this new frontier against Soviet incursions. Despite the costs, it worked. Until recently, whether by accident or design, it has suited the United States for space to be expensive. As long as no other country or regional bloc could rival US expenditures on space, US supremacy was assured by these high costs. Even after the Cold War, this has been the de facto US strategy for space. In this sense, we are still living in the Apollo era of space policy.

What should our “After Apollo” space policy be? Perhaps no new US response is needed. Our pride may be hurt, but realism suggests that space really doesn’t matter. After all, space is a small industry. In 2007, the entire global space industry, by its own Space Foundation estimates (even including the GPS chips that are now common in cell phones), amounted to just two-thirds of Walmart’s annual turnover. Perhaps the US should simply ignore space.

In fact, US competitiveness is threatened—in space and on Earth—and a new economically oriented space policy is critical for American success in both realms. The US government should respond to this new situation by playing to the nation’s strength. The federal government should play the same role in space in the 21st Century that it played in the development of the American West in the 19th Century: Make the frontier safe for capitalism.

Unleashing capitalism in space

This is not a Cold War argument, attempting to scare the US into a renewed space program based on military fears. Rather, the US has made a huge investment in space and it now has a clear technological advantage, but it could easily lose this advantage if the necessary changes are not made. As the Chinese and others catch up, US technological advantages are eroding. At some point, which could be in the near future, the value of space resources will become commercially exploitable. When that happens, will US companies reap the rewards?

The formal goal of the US space program, for nearly 30 years and under both parties, has been, as George W. Bush clearly stated, “to advance US scientific, security, and economic interests through a robust space exploration program.” Considering the three elements of this goal—science, security, and economic growth—NASA has done a great job promoting a robust scientific program in space. Military utilization of space for security, from spy satellites to the GPS system, is also robust: the Air Force and National Reconnaissance Office space programs form a $20–30 billon a year enterprise.

The third interest, economic growth in space, has not fared as well. In fact, as Jeff Greason, the president of XCOR, has emphasized, the US has no coherent strategy to achieve this goal. Space resources are vast, and could be harnessed to the great benefit of the nation. These resources will benefit not only American citizens but, through networks of global commerce, all the peoples of the world. A strategy for achieving economic benefit from space must involve both government and industry, as did the development of the American West.

Imagine that the US had ignored the territories acquired in the Louisiana Purchase. At first, this was a hostile territory and much of it was considered a desert. Ignoring the American West might have left Native Americans better off, but the wealth and power of the US would today be radically reduced. Other European nations were then actively exploring the “Wild West,” as other nations are now exploring space. In the hostile territory of space there are, fortunately, no indigenous populations to abuse, and we already know that the resources are there.

| One problem that blocks this virtuous cycle from starting outweighs all others: the forbiddingly expensive cost of access to space. |

What are these resources? They have been discussed for years, and are expertly cataloged in John S. Lewis’s 1996 book, Mining the Sky: beaming solar power to Earth, mining the Moon for helium-3 (for use in fusion reactors), and mining asteroids for many things, including iron to use in construction in space, water for astronauts, and methane for rocket fuel. These are truly vast resources, with trillions of dollars in street value, and capable of solving today’s oil-based energy crisis. Policy makers have not paid serious attention to these resources, because they seem more like tales of El Dorado than real opportunities. The possibility that the US may soon lose leadership in space means that American policy makers should reconsider the facts of the matter and make a reasoned choice, lest we cede their bounty by default.

Developing space resources means enabling profits to be made from them. The paeans to the value of space resources have almost all been written by scientists, not by business people. And we scientists are financially naïve. We add up the value of the resource, but ignore the cost of bringing that resource to market, or even the existence of a market. There are, for example, no fusion reactors to fuel with helium-3, nor will there be for at least several decades. In space, the large capital costs and long payback time make it impossible to turn a profit from almost any of these resources, as John Hickman showed in 1999. However, Hickman does point out that if, for example, functioning solar power stations were in orbit, they would be profitable. That positive financial feedback (profit) could then fuel entirely new space-based industries. Getting to that starting point is the problem. Historically, governments have often invested in long-term infrastructure development projects to lower cost and risk barriers, and thereby empower private enterprise. Can they do it today, in space?

One problem that blocks this virtuous cycle from starting outweighs all others: the forbiddingly expensive cost of access to space. Today it costs $10,000 to $20,000 per kilogram just to get to low Earth orbit (LEO). It is a rare industry that can make a profit with cargo rates this high. This price has barely changed since Apollo, in constant dollars.

Could the cost come down? Space is not inherently expensive. Of the $50 million launch price for a Falcon 9 rocket, from SpaceX, less than one percent is the cost of the fuel. Nor do we need new technologies. Jet airplanes have been around about as long as rockets to orbit, and a ticket from New York to Los Angeles costs about a tenth of what it did in 1960, in constant dollars. Incremental improvements driven by competition drove down the cost.

There are some hopeful signs. There is a nascent space tourism industry. Virgin Galactic will soon offer short, suborbital flights for $200,000 a ticket. Early demand is brisk. But the business plan to go from suborbital to orbital flights is not obvious. It takes 30 times as much energy to reach orbital velocity as it does to briefly exit Earth’s atmosphere going straight up and down. Bigelow Aerospace is developing commercial space stations, in hopes of renting inflatable rooms in space. And Elon Musk’s SpaceX has announced plans to launch cargo to LEO for just $2,000 per kilogram. If realized, this would be a substantial price break. But it is not enough to make space based solar power pay off, which requires launch costs closer to $200 per kilogram. After all, sunlight does come to the ground for free. And while asteroids offer metals and minerals in abundance, until there are in-space markets for iron, water and methane, these resources cannot be profit centers.

We need to find a pump primer. We need some space venture that makes enough profit, on the ground, even at high access costs, to get the ball rolling. The profits will have to be as extreme as those of the luckier Gold Rush pioneers. And it has to pay off right away. It must have a very high price per kilogram. Does space have a “Gold Rush” resource?

The answer is a resounding “Yes! But…” Gold, silver, platinum, and similar heavy metals are rare today because most lie out of reach in the Earth’s core, where they settled early on, when the planet was still molten. Only small amounts remain in the Earth’s crust, where they can be mined. As a result, some precious metals have prices of $2000 per ounce, or $70,000 per kilogram. That’s a promising number compared with $20,000 per kilogram to launch, especially as a kilogram of mining equipment should bring back much more than a kilogram of ore.

But why go to space to mine even these most precious metals? Meteorites tell us that among the asteroids there are ores that are far richer than any mines on Earth. If we could find one of the smaller asteroids, just 200 meters diameter, that was as rich in platinum and related metals as the richest meteorite, it would have a value of about $30 billion, and provide close to two year’s production of platinum at current levels. These are encouraging numbers. The technical difficulties in bringing the ore back to Earth profitably are large, but perhaps not insurmountable. So: Yes. The platinum group metals (PGMs) could be the pump primers we need to build a profitable space economy.

| Bringing down this risk and cost barrier is where the US government can play an historic role. |

What about rare earths? Strategically, the near-monopoly on rare earth production by China is a concern to other nations, as the recent sharp spike in prices has shown. But rare earths are poorly named. They are not particularly rare, just hard to mine. Normally the most expensive rare earths command only about a tenth the price of platinum, so they would not be profitable as a space venture. However, the strategic lesson is good. If demand for hydrogen fuel cells takes off for powering automobiles, then the demand for platinum could multiply several-fold. (Fuel cells use platinum as a catalyst.) US strategic interests would be well served by ensuring a commercial supply from asteroids. Today, more than 75% of the world’s platinum and more than 85% of the rhodium comes from a single geological feature in South Africa.

And yet, $30 billion is not really a big enough number, given the costs and risks involved. There have been, over the years, numerous articles studying the problem of mining the asteroids for PGMs. Jeffrey Kargel (1994), Mark Sonter (1997), and others, in a scattered literature, have laid out the technical and economic challenges. Sonter, and Shane Ross (2001), in particular, began to explore the costs to determine whether a profit is possible. More recently, Ricky Lee (2009) examined several legal as well commercial concerns regarding profitable asteroid mining.

High risk, long term, venture capital is likely to require at least a 20% per year return. In that case, for a venture capital fund to invest $5 billion today, they will want to see a return of about $30 billion in 10 years, with a good chance of success. While $5 billion is not an outsized investment for a new terrestrial mine, the risks and rewards are far better known on Earth. As a result, the likely profit from an asteroid mining venture today is negative.

Bringing down this risk and cost barrier is where the US government can play an historic role. As Hickman notes:

Capitalization is a crucial problem for these projects because the total capital investment required is very large and the investment takes a very long time before producing economic returns. Very large space development projects are best understood as massive public works projects which are necessary to open frontiers. Despite the libertarian sentiments in much of the popular science writing on very large space development projects, government would likely have to play a large role in capitalizing such projects.

Strategic government investment could “buy down the risk” over the next decade so that a venture capitalist could reasonably undertake an asteroid mining enterprise. This is a role the US government has played well in the past, notably in the development of the American West. The late historian William H. Goetzmann laid out the interaction of government and private enterprise in his masterpiece, Exploration and Empire (1966). From the Lewis and Clark expedition, through detailed geological surveys, the establishment of legal rights, providing security, offering land grants, and developing infrastructure in the form of railroads, the US government was highly involved in enabling the pioneers and prospectors who developed the American West.

This tells us that the US can best respond to the international challenge it faces in space by playing to its strong suit: It is time to unleash capitalism in space.

Modest efforts along these lines have begun, like NASA’s commercial crew program. But, because we have lacked a clear strategy, our legislators have not embraced this approach wholeheartedly. One earlier NASA commercialization initiative has already paid off. SpaceX developed the Falcon 9 launcher and Dragon capsule for just $600 million, and first launched them in 2010. They now have a NASA contract to resupply the International Space Station, and successfully docked with the ISS in May. The prospect of new profits engages creativity in space, as it does everywhere else.

page 2: myriad details and thorny questions >>

|

|