The business of space travelby Frank Stratford

|

| Many of the business models these startups are proposing are not new, and most of their business models have been kicked around for many years in the space community. |

In the last several years, we have seen the rise of many new space companies offering anything from short suborbital hops and new commercial satellite services to one-way trips to Mars, orbital hotels, and lunar tourism, and everything in between. Some have quite near term and practical plans, such as development of new propulsion or space vehicle designs, while others propose more complex and speculative revenue models like sales of media rights, samples, cut-price missions for potential government customers, or advertising sponsorships.

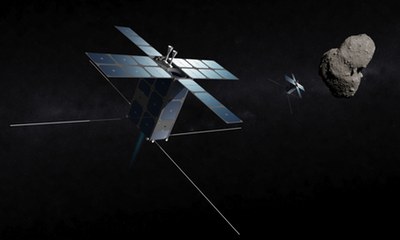

Private companies have formed around ideas from asteroid detection and mining operations to human exploration and settlement of the Moon and Mars. Many of the business models they are proposing are not new, and most of their business models have been kicked around for many years in the space community. For example, from my own experience at MarsDrive, we have examined many of the revenue raising ideas these new companies are now trying and, having found some quite massive flaws and holes, decided to keep researching revenue ideas going forward.

When I speak of flaws, it comes down to commonly known investment issues we see brought up in TV shows like “The Dragons Den,” or any venture capital process for that matter. They ask questions like, “Is there a market for your product/service in existence today?” and “How is your product or service going to solve a current problem or beat its competition?” The problem with speculating about what “might” make money someday is that every investment plan contains elements of this, some more fantastic than others.

This is exactly why the most promising and realistic new space businesses are taking advantage of emerging tourism markets, new government space programs expanding around the world, and growing commercial space markets as their first order of business. The most progressive of these companies, like SpaceX, Virgin Galactic, Bigelow Aerospace, and Blue Origin, are largely self-funded efforts.

So the picture that emerges for successful new space businesses follows similar patterns of being self-funded, serving real or closely emerging markets, and providing diverse products and services sometimes not even related to space—take the three companies under the Elon Musk banner of Tesla Motors, SolarCity, and SpaceX, or Blue Origin and Amazon owned by Jeff Bezos. Non-space businesses can provide revenue support and ongoing capital injections for new space businesses.

| What can help them bridge that gap is to seriously look at engaging in or acquiring non-space businesses and revenue streams to give them the capital they need to keep them going to pursue their larger goals. |

But when we look at some of the newer companies focused on longer range goals of space mining or lunar or Martian projects, they seem to have embraced a different set of ideas: well-known boards and advisors, explanations of how markets are going to come for their services someday, eye-pleasing websites and narratives, and the starting of various fundraising efforts from finding sponsors to donation campaigns, all a far cry from successful current NewSpace companies.

Despite the well-known backers of such plans attaching their names, they have not financially backed their own ideas to the degree people like Musk and Bezos have, and for some sound reasons. They are very smart in the areas of finance and even they know that without real markets their plans are not ready to attract the large-scale funds (usually in the billions) they require.

So are we not ready yet for such businesses? I would say argue that, in fact, we are ready. The model they have adopted simply does not fit their large-scale dreams now, but in time—once they get moving financially—their more untested ideas will fit in. What can help them bridge that gap is to seriously look at engaging in or acquiring non-space businesses and revenue streams to give them the capital they need to keep them going to pursue their larger goals.

So far, this idea does not seem to have attracted any attention by the backers and big names listed on their boards, but if they are to grow into bigger phases required to achieve their ambitious goals, they can’t just rely on donations and ideas out of time.

The new business of space travel is truly here in 2013. If the new breed of “long-range” companies can adopt more practical nearer-term revenue streams, our future among the stars will come ever closer, and sooner.