Small satellites, small launchers, big business?by Jeff Foust

|

| “Before the end of this decade, we will likely see a very significant expansion of small satellites,” Meurer said. |

The conventional story is that the growing interest in smallsats is linked to their growing technological capabilities. And that, at least, is a necessary condition: advances in electronics and various other subsystems make it possible to perform useful missions in small form factors, including “3U” CubeSats that measure about 30x10x10 centimeters. However, those technological advances alone are not sufficient: there also has to be means to get them into space. Growth in secondary payload opportunities has helped stimulate growth in smallsats, and now a new wave of companies are trying to support the industry by offering dedicated smallsat launches, despite the poor track record of past such ventures.

Growth in the market

If the crowds at the Smallsat conference—forcing some attendees to stay in hotels as far away as Ogden, about an hour’s drive away—weren’t enough to demonstrate the growing interest in smallsats, there’s the statistics themselves. In a presentation at the conference August 4, Elizabeth Buchen of SpaceWorks Enterprises said 122 satellites with masses between 1 and 50 kilograms had launched so far this year. By comparison, 92 such satellites launches in all of 2013.

That pace, she said, won’t continue for the rest of the year. “Given the launch schedules for the rest of the year, and the manifests for those launches, we’re still looking at about 140 for the year,” she said.

That 140 would be in line with what the company forecasted in its annual Nano/Microsatellite Market Assessment, published early this year. (Its 2013 forecast projected 93 such satellites would be launched that year, just one more than the actual tally.) Its forecast projects continued steady growth through the rest of the decade, with between 410 and 543 such satellite forecast for launch in 2020.

As the market grows, though, Buchen said the company would be adjusting its forecasting methodology. “We did not place a value judgment in our past assessments” about the viability of announced smallsat ventures. “In our future market assessments, though, we want to provide a more realistic view of the market.” That will include incorporating assessments of announced smallsat systems and the likelihood of delays, based on historical data.

The SpaceWorks numbers seem realistic to another company in the industry. “We’ve done a lot of market analysis in looking at what’s out there,” said Jason Andrews, CEO of Spaceflight Inc., a company that provides arranges launches of smallsats as secondary payloads, in a talk later in the same conference session. “I can tell that you that the numbers that SpaceWorks just showed I believe are real. Our numbers support that.”

A big driver of that increase in smallsats is growing interest in using them for remote sensing. According to SpaceWorks, only 12 percent of the satellites in the 1–50 kilogram range launched from 2009 through 2013 were for remote sensing and other Earth observation efforts. However, 52 percent of such satellites forecast for launch in 2014 through 2016 will be used for those applications.

| “I’m starting to see CubeSats acting more like primaries. They want specific orbits,” Skrobot said. |

“Earth observation remains the number one small satellite application worldwide,” said Robert Meurer of ATK Space Systems in a separate conference presentation. That includes Planet Labs, which has launches dozens of 3U CubeSat imaging satellites, but also ventures like Skybox Imaging and Dauria Aerospace (see “The commercial remote sensing boom”, The Space Review, June 16, 2014). However, he noted there’s growing interest in using smallsats for communications systems, citing recent interest by Internet giants Facebook and Google for such systems.

Even within the Earth observation market, Meurer said he expects significant growth through new applications, including agricultural monitoring and management, synthetic aperture radar imagery, and commercial weather. “Before the end of this decade, we will likely see a very significant expansion of small satellites,” he said.

Perhaps the best validation of the smallsat market is a financial one. Skybox, which raised more than $90 million from venture capital (VC) firms, was acquired by Google in June for $500 million; the deal formally closed on August 1. Planet Labs has raised more than $60 million from VC firms to support the development of its satellites.

On July 29, small satellite company NanoSatisfi announced both a new name—Spire—and a $25-million Series A funding round. The company is planning to deploy a constellation of small satellites to provide maritime tracking services. IT plans to launch 50 of them in “the next future,” according to a company announcement. Those satellites, Spire CEO Peter Platzer said in an interview during the Smallsat conference, will be CubeSat-class spacecraft equipped with Automatic Identification System (AIS) and other sensors.

“Modern remote sensing traditionally focuses on the small fraction of Earth that is covered in land and is densely populated with people,” Platzer said in the press release. “What happens, particularly over the oceans, is critical in understanding global systems, and our proprietary technology delivers truly global perspectives that enable our customers to make smarter decisions.”

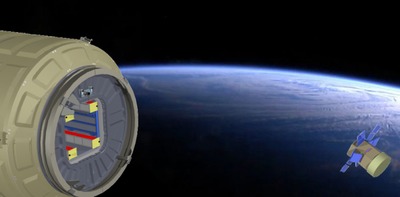

HatchBasket, from Altius Space Machines, would turn the hatch of a Cygnus cargo spacecraft into a smallsat deployment system. (credit: Altius Space Machines) |

Hitching rides

One of the biggest obstacles to greater use of smallsats, be they CubeSats or larger microsatellites, has been getting them into space. That has typically meant hitching rides as secondary payloads on the launches of larger satellites. While historically such opportunities have been difficult to come by, a couple of initiatives have helped provide more opportunities for both educational and commercial spacecraft.

NASA’s CubeSat Launch Initiative has provided rides for such spacecraft to a number of schools and NASA centers. In an August 2 presentation at the CubeSat Developers Workshop, held immediately before the main Smallsat conference, Garrett Skrobot of NASA’s Kennedy Space Center said 20 CubeSat missions had flown on three launches over the previous 12 months, with 16 more slated for launch in the next 12 on six launches.

More CubeSats, including international and commercial ones, have found rides to space via NanoRacks. Those satellites are ferried to the International Space Station (ISS) on commercial cargo spacecraft, and transferred to the Japanese module, Kibo, and deployed from that module’s airlock (see “Making the most of the ISS”, The Space Review, March 24, 2014). The Cygnus cargo spacecraft launched to the ISS last month carried 32 CubeSats, 28 of them by Planet Labs. The deployment window for those satellites opens next week, NanoRack’s Kirk Woellert said in an August 3 talk at the CubeSat workshop.

While those initiatives have provided significant new launch capacity for CubeSat-class spacecraft, they are not without their issues. As secondary payloads, CubeSats are limited to the orbits the primary payloads are going to, which can be an issue for missions that need a specific orbit to perform their mission. “I’m starting to see CubeSats acting more like primaries. They want specific orbits,” Skrobot said.

For CubeSats launched from the ISS, there’s another issue: orbital lifetime. The relatively low orbit of the ISS—about 400 kilometers—and the fact that CubeSats are deliberately deployed from the station into lower orbits to avoid the risk of “recontact” with the station limits the time the satellites remain in orbit before atmospheric drag causes them to reenter. “The orbit lifetime, we’re finding from experience, is probably about six to seven months,” Woellert said. While that may be sufficient for technology demonstration satellites, other missions are looking for ways to increase that lifetime.

One approach is to supply CubeSats with their own propulsion, but that runs into safety issues, particularly on the ISS. “Propulsion is a high-visibility capability that the CubeSat community really wants now,” Woellert said. NanoRacks can currently support that “within reason,” he added: cold gas thrusters, for example, are acceptable, but more powerful—and toxic—hydrazine thrusters are ruled out.

An alternative concept unveiled at the Smallsat conference would deploy small spacecraft not from the ISS but instead from departing cargo vehicles. HatchBasket, a project by Altius Space Machines, would carry smallsats, ranging from CubeSats to so-called “ESPA-class” smallsats weighing more than 100 kilograms, in a container stowed in the back of a Cygnus cargo vehicle.

| GOLauncher 2’s schedule calls for a first launch in late 2016, ramping up from there “to a rate of something like 24 per year by the end of the decade,” Piplica said. |

Once the Cygnus completes its mission at the ISS, the HatchBasket, as the name suggests, would replace the conventional hatch. After unberthing, the Cygnus would maneuver to a higher altitude using propellant reserved for contingencies during the approach to the station, then deploy the smallsats. Cygnus could go up to altitudes of 500 kilometers and still have enough propellant for deorbiting; at that altitude, smallsats would have orbital lifetimes of up to two to three years, versus the half-year they would have if deployed from the station.

Altius is working with NanoRacks on the HatchBasket, and Orbital Sciences Corporation, which builds the Cygnus, has been “really helpful,” company president and CEO Jonathan Goff said in an August 5 conference presentation. Assuming the company can work through some final issues with NASA on the concept, he said, “we’re hoping to get manifested for a flight by the end of next year.”

Firefly Alpha, a two-stage ground-launched system, could place up to 400 kilograms into Earth orbit for $8–9 million a launch. (credit: Firefly Space Systems) |

The new wave of smallsat launchers

The surge in demand for smallsats has also stimulated interest in dedicated launchers for them. There have been several such projects started in the last few years. Some of them have the support of the US government, like the Airborne Launch Assist Space Access (ALASA) program by DARPA, which selected Boeing earlier this year to develop a smallsat launcher using an F-15 as its carrier aircraft (see “Air launch, big and small”, The Space Review, June 30, 2014). Others are being developed privately, like Virgin Galactic’s LauncherOne (although Virgin did win an early ALASA study contract after announcing its LauncherOne plans in 2012.)

Another private venture for launching smallsats is Generation Orbit. Like ALASA and LauncherOne, Generation Orbit’s GOLauncher 2 is an air-launch system, using a Gulfstream IV business jet as the launch platform. The rocket is a two-stage vehicle with a solid first stage and a liquid oxygen (LOX)/RP-1 upper stage; the latter is being developed by Ventions, a company also involved in ALASA. GOLauncher 2 will be able to place about 45 kilograms into low Earth orbit at a price per launch of $2.5 million, company COO AJ Piplica said in an August 5 conference talk.

Generation Orbit completed a flight test of the system last month, flying out of Cecil Field, an FAA-licensed spaceport in Jacksonville, Florida. While the airplane carried a mockup of the rocket that was not deployed from the aircraft, the flight demonstrated the airplane’s flight profile, including a 30-degree pullup maneuver that will be used when releasing the rocket.

GOLauncher 2’s development schedule calls for a first launch in late 2016, under a contract from NASA it won last year, ramping up from there “to a rate of something like 24 per year by the end of the decade,” Piplica said.

More ventures are entering this field, including several new vehicles announced just in the last couple of months. In early July, Firefly Space Systems, a company based in Austin, Texas, that also has offices just down the street from SpaceX’s headquarters in Hawthorne, California, announced its small launcher, Firefly Alpha. The two-stage rocket, powered by LOX/methane engines, is designed to place up to 400 kilograms into low Earth orbit for an estimated price of $8–9 million. The company hasn’t indicated when the vehicle will enter service.

“Until now, there existed virtually no dedicated launcher capacity in the small satellite industry to deliver their respective payloads to orbit,” company co-founder Michael Blum said in a statement announcing the vehicle. “This announcement today just changed all that.”

But Firefly isn’t alone in even announcing a smallsat launch vehicle in the month of July. On July 29, Rocket Lab Ltd., a company headquartered in the US but with the bulk of its activity in New Zealand, unveiled its plans for the Electron launch vehicle. The three-stage vehicle—two stages using LOX/kerosene engines and a solid motor for the third stage—can place 110 kilograms into a 500-kilometer sun-synchronous orbit at a price of $4.9 million.

| “I’m getting more interested in the smallsat launchers than the spaceplanes used for tourism,” said Jurvetson. He claimed that “at least three of the spaceplane companies, including one in France most people don’t know about, have quietly said, ‘We’re all about smallsats, not people.’” |

Rocket Lab, which has received funding from the New Zealand government as well as Silicon Valley VC fund Khosla Ventures, said in its announcement that the company has “commitments” for the first 30 launches of Electron. Company CEO Peter Beck, in a conversation at the Smallsat conference last week, said those commitments were not yet binding contracts, and represented a range of potential customers.

Another company is seeking to handle dedicated launches of CubeSat-class satellites. In a presentation at the Lightning Pitch Competition at the NewSpace 2014 conference in San Jose, California, last month, a startup called CubeCab discussed a concept to air-launch individual CubeSats at prices comparable to current secondary payload accommodations: $100,00 for a 1U satellite and $250,000 for a 3U satellite.

CubeCab disclosed few specifics about their air-launch design. In his brief pitch, company CEO Adrian Tymes listed some technologies the system will incorporate, from room temperature self-pressurizing propellants to the use of 3-D printed components, but not a complete system architecture. “We’re still weighing the various options,” he said in a brief interview after the judges awarded CubeCab the $20,000 first prize.

All of these dedicated launch ventures, despite their different technical approaches, face a similar obstacle: whether there’s enough of a market to support any of them. Other companies have, in the past, come and gone from this market without finding sufficient customer interest. A decade ago, SpaceX was hailed as a savior for the smallsat industry by planning to offer the Falcon 1, which would carry several hundred kilograms into low Earth orbit at prices of $6–7 million: not too different from some new ventures. However, SpaceX quietly retired the Falcon 1 a few years ago, citing a lack of demand, focusing instead on the larger Falcon 9.

Smallsat vehicle developers aren’t deterred by that history, understandably, and one potential investor is also intrigued by the possibilities of such vehicles. “I’m getting more interested in the smallsat launchers than the spaceplanes used for tourism,” said Steve Jurvetson, partner in VC firm Draper Fisher Jurvetson, in a keynote address at the Smallsat conference on August 4. He claimed that “at least three of the spaceplane companies, including one in France most people don’t know about, have quietly said, ‘We’re all about smallsats, not people.’”

Jurvetson, who is an investor in SpaceX, said he would not invest in a direct competitor to that company, but would not rule out investing in a smallsat launch venture. Asked after his talk to explain what would make such a company a compelling investment for him, he said he found particularly interesting companies planning launch systems for satellites weighing 100 kilograms or less for $1 million or less. “As a non-investor, I’d like to see everyone succeed,” he said of the smallsat launch industry. “I haven’t bet on one yet, so I’m still looking.”

“I’d love to see someone who says they’ve got it down two orders of magnitude below” current prices, he added. That would seem to rule out just about all current launch ventures, who offer less substantial price reductions. However, unlike past efforts, there’s now a large and growing demand demand for smallsats. That could, if forecasts like those from SpaceWorks prove out, outstrip even the increased capacity provided by secondary payloads accommodations and deployments from the ISS. If there are real businesses that can be built on smallsats, they could yet support smallsat launch systems that provide lower, but hardly revolutionary, launch prices.