Orbital ATK, EELV, and the Chinese word for crisisby Jeffrey L. Smith

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The US satellite launch market is experiencing just such a period of upheaval and Orbital ATK is trying to navigate the current situation to win a very prestigious opportunity: launching the largest satellites for the United States military. |

In October 2017, the US Air Force published the formal request for a new generation of rockets to launch satellites for the US military. The rockets chosen for this competition will also serve as the backbone for all launches from the United States, launching commercial satellites, science probes, and even astronauts. The program is known as EELV, an acronym that stands for Assured Access to Space. Okay, this that isn’t true either… but with how important the doctrine of Assured Access to Space is for the Air Force, it might as well be. The Evolved Expendable Launch Vehicle (what EELV actually stands for) program looks at the military’s satellite plans over the next decade or two and boils these down to a set of size and weight requirements for the rockets that will be needed to place them in orbit. The EELV program then funds contractors to develop rockets that will meet these requirements and finally buys the rockets from those same contractors for individual launches.

Two incumbents currently launch the largest payloads for the US military: United Launch Alliance (ULA) and SpaceX. These companies have both entered the EELV competition and expect to continue launching new and improved rockets for years to come. Orbital ATK is trying to break into the EELV market and expand its role from building smaller rockets to launching the US military’s largest payloads. Their entrant is the Next Generation Launch (NGL) rocket, and they are diligently preparing for this once-in-a-generation chance to join this exclusive club.

EELV: How we got to now

While the EELV name is a newer creation, its history stretches all the way back to the Cold War and America’s first nuclear-tipped ballistic missiles. General Bernard Schriever was the father of the US Air Force’s ballistic missile force and he was responsible for the development of America’s three original liquid-propellant space rockets: Atlas, Titan, and Thor (later called Delta). With dozens of variations, these rockets have launched satellites, science probes, and astronauts for 60 years. While the DNA of these rockets live on in all American launch vehicles, the current competition will see these iconic names fade into the history of spaceflight. Instead, rockets with names like Vulcan, Falcon, and Next Generation Launch (arguably less poetic than its counterparts) hope to take their place.

Space fans and professionals alike never tire of comparing rockets and the companies that build them, like sports fans discussing their favorite teams and players, quoting stats and figures. But these discussions often miss the elephant in the room, not the companies like ULA or even the rockets like Falcon 9, but the Department of Defense (DoD) itself. The DoD is the largest consumer of space launches in the world, and pays companies large sums to design rockets to its high performance and strict quality standards. Economists would say the DoD has market power.

By funding companies to design rockets to its own particular set of mass and size requirements, the DoD also creates a stable of rockets ready to launch all other types of non-military spacecraft. This effect is multiplied because once the size and mass capability of American rockets are defined, satellite manufactures around the world can design their satellites and components to take advantage of these same size and mass capabilities. Then, in an effort to compete for rocket launches, companies and nations around the world design their rockets to launch these same satellites. Effectively, the DoD is to space launch as Walmart is to retail shopping: they are so big and have so much money, they kinda set the rules for everyone else.

| Money is never handed out with no strings attached. Customers expect a product or service, investor seek a financial return, and philanthropists want to see an improvement in society. Governments are no different: they have their own goals, and those goals change over time. |

The DoD’s market power can be summarized by a single fact: the last time an American space capsule took astronauts to a space station was Skylab 4 in 1973. At the time, those NASA astronauts launched on a Saturn IB, a rocket that was specifically designed for the purpose of launching astronauts. It was never used to launch a commercial or military satellite, and ultimately canceled at the end of the Apollo program. Now, 45 years later, military boosters have evolved to the point where their payload matches those of NASA’s old capsule boosters. Today, NASA can commercially buy EELV-class rockets from SpaceX and Boeing to launch astronauts to the International Space Station, no custom rocket required. If the commercialization of human spaceflight has to wait until a particular national defense agency standardizes on rockets capable of launching people into space, that’s market power.

But with great power comes great… government regulations. Money is never handed out with no strings attached. Customers expect a product or service, investor seek a financial return, and philanthropists want to see an improvement in society. Governments are no different: they have their own goals, and those goals change over time. One goal for every space-launching country is to maintain its own domestic capability to independently launch satellites (neither the US nor China want to send their secret spy satellites to be launched by the other‘s rockets.)

A common policy is for nations to redesign their launch vehicles every generation, 20 years or so, in order to take advantage of new technologies and for senior engineers to pass on what they’ve learned to the next generation of junior engineers. The last time an EELV competition was held, in 1998, another goal was to reduce the cost of space launch by at least 25 percent, and hopefully upwards of 50 percent. This goal was largely achieved. As just one example, a Titan IVB costing $432 million in 1999, would cost $636 million in 2017 dollars. The comparable Delta IV Heavy costs $400 million in 2017, a 31 percent reduction in price. And that doesn’t even take into account performance improvements.

The Air Force still has an independent means of launching their satellites into orbit. In fact, it has two. The 1998 competition was originally intended to have two prototypes compete against each other and then to select a single winner. But a funny thing happened on the way to the launch pad. The concept of Assured Access to Space, an idea born after the Space Shuttle Challenger disaster left the DoD without a means to launch its premier satellites, morphed from having a single independent way to launch its satellites to having two redundant backups. Once the time and effort to develop both the Delta IV and Atlas V had already been invested, the DoD became reluctant to give either up. Not only are both of these rockets active today, but between the two, they already meet the size and mass requirements of the new 2017 competition (see table below).

Comparison of mass requirements for 1998 and 2017 EELV competitions (source: US Air Force)

| Orbit Description | Mass to Orbit (lbs) 1998 | Mass to Orbit (lbs) 2017 | Payload Category | |

|---|---|---|---|---|

| Medium Lift (4 or 5 meter fairing) | Heavy Lift (extended 5 meter fairing) | |||

| LEO* | 17,000 | 15,000 | X | -- |

| Polar 1 | 7,000 | 15,500 | X | -- |

| MEO Direct | NA | 11,750 | X | -- |

| MEO Transfer | 4,725 | 9,000 | X | -- |

| GTO | 8,500 | 18,000 | X | -- |

| Molniya | 7,000 | 11,500 | X | -- |

| GEO 1 | NA | 5,000 | X | -- |

| GEO 2 | 13,500 | 14,500 | -- | X |

| Polar 2* | 41,000 | 37,500 | -- | X |

*Note, these mass differences are misleading because the reference orbits were defined at different (lower) altitudes in 1998. Once this is corrected for, the masses are essentially equivalent.

But, if the 1998 EELV competition achieved its goals, then why hold another competition today? The 2017 models don’t have to be any bigger than currently available rockets, and this time around, the DoD has even stripped out any specific cost reduction targets. The answer, in addition to the “20-year rule”, is that the US launch market has undergone a massive change in the last five years with the entry of SpaceX’s Falcon 9. The 2017 competition doesn’t specify cost goals because it doesn’t have to. SpaceX has been winning a price war with ULA, with both companies trying to develop rockets that are ever cheaper to launch (or in the case of SpaceX, relaunch.)

The other reason to hold a competition today is the whole “Assured” part of Assured Access to Space. When the Atlas V was designed, it used the RD-180 first stage engine from Russia, with whom the US had just peacefully concluded the Cold War, and the two were on reasonably good terms with each other. That once-rosy relationship has deteriorated significantly, and the US Congress became concerned that a strategic defense asset was only “Assured” if the Russian kept sending over engines to power it. So, Congress inserted language into the 2015 National Defense Authorization Act to restrict the use of the RD-180. Instead of special goals to reduce costs, this time first stage engines or motors must be at least 50 percent “Made in the USA.” Interestingly, this provision is so narrowly focused that it doesn’t apply to strap-on boosters or upper stages, just first stage engines like Atlas V’s RD-180.

The Air Force will choose the winning bids by mid-2018 and the winners will have to build and launch their medium-lift prototypes by October 1, 2021, and their heavy lift prototypes by October 1, 2024. Both SpaceX and ULA are virtual shoo-ins to win a spot to build their Falcon and Vulcan rockets, respectively. This would give the US military two brand-new rocket families and guarantee Assured Access to Space for another generation. But a funny thing happened on the way to the government contracting office. Recently, the USAF has subtly changed how they talk about the EELV competition from saying they need two vehicles to saying they’d like to fund up to three prototypes. If the past is any indication, once the vast effort to design and build a rocket has already been invested, the DoD will be reluctant to give it up. That means that if Orbital ATK can win a prototype contract and successfully fly their rocket, they will be in the enviable position of having to pick a more poetic name for their Next Generation Launch rocket.

A rocket fit for an Air Force

The funny thing about new rockets is that they are never truly “new.” When designing a new rocket, the first step for every design team is to look around at what they already have and figure out if they can make it do what they want. Because each group has different hardware lying around and different expertise, the solution each group comes up with will be different. There’s nothing wrong with this approach. Each team will play to its strengths and experience: if you ask a painter and composer for a piece of art, don’t be surprised if neither gives you a sculpture.

| If the past is any indication, once the vast effort to design and build a rocket has already been invested, the DoD will be reluctant to give it up. |

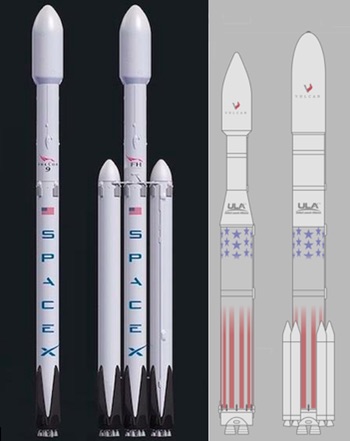

For ULA, that means their EELV solution will be based on Atlas and Delta heritage, while SpaceX will use their Falcon experience. SpaceX’s Falcon 9 is a capable medium-lift vehicle, and when used in the expendable mode can even meet the most taxing medium-lift EELV requirements. In order to meet the heavy requirements, SpaceX grows their rocket sideways by strapping three of their existing Falcon 9 cores together—the Falcon Heavy. ULA plans have changed somewhat since they first announced their Vulcan rocket. Originally, ULA was going to combine the first stage of their Delta IV (with upgraded engines) and the Centaur upper stage of the Atlas V for medium-lift payloads. For heavy payloads, instead of growing their vehicle horizontally like SpaceX, ULA planned to grow Vulcan vertically by upgrading its upper stage. Since that time, ULA has announced they will move up the introduction of a larger version of the Centaur upper stage for Vulcan’s debut. It’s worth mentioning that heavy-lift payloads are a small fraction of military’s payloads and so only one heavy-lift rocket, the Delta IV Heavy, from the 1998 competition was ever built. Finally, while it’s not necessary for this competition, ULA is maintaining the horizontal-growth option for a three-core Vulcan Heavy, evidently for a future super heavy-lift capability.

Falcon 9 and Falcon Heavy next to Vulcan with 3-meter Centaur (medium) and Vulcan with 5-meter ACES (heavy). Rocket designers have multiple ways of achieving the same goals. (credits: SpaceX and ULA) |

Unlike SpaceX and ULA, Orbital ATK doesn’t have an existing EELV-class rocket they can upgrade to meet the 2017 competition requirements, but they do have a lot of hardware lying around to choose from. NGL combines everything that Orbital ATK and its predecessor companies have learned over the decades to make a launch vehicle like no other. The GEM-63 (Graphite Epoxy Motor) boosters on its sides are a stretched and widened version of the first composite case booster that debuted on the Delta II in 1990. The two core stages apply this same composite material technology to the solid rocket boosters that powered the Space Shuttle for 30 years. Orbital ATK will stretch both the first core stage and the upper stage of the NGL to tackle the same heavy-lift design challenge that SpaceX solved with horizontal growth and ULA solved with vertical growth of the upper stage.

Such an approach makes sense with solids rocket motors. Because the solid propellant itself acts as thermal insulation during the motor burn, you can’t build a larger tank and then fill it only halfway, as SpaceX and ULA can with liquid propellants. Exposed surfaces would burn or melt under the intense heat of combustion. Then, to compensate for the extra thrust from the larger first stage, you have to stretch the upper stage and make it heavier or else additional thrust might overspeed it, subjecting either the rocket or the payload to accelerations or aerodynamic forces it wasn’t designed for.

In addition, avionics will be taken from the Minotaur family of ICBMs that have been converted for space launch, and the upper stage will use a composite fairing and boattail that are similar to ones already built for ULA’s Delta and Atlas rockets. The heavy reliance on carbon composite materials makes sense given Orbital ATK’s expertise, but it’s unusual for the space launch industry—no competitor uses composite materials to the same degree. In the same way the Boeing 787 is the world’s largest composite aircraft, NGL can claim to be the world’s largest composite rocket.

NGL combines decades of know-how from all across Orbital ATK. (credit: Orbital ATK) |

One place that NGL won’t be using composite materials is the propellant tanks for its cryogenic upper stage. Instead, it will use traditional metal propellant tanks for the incredibly cold, and often temperamental, liquid oxygen and liquid hydrogen. This is a very practical decision. Metals compatible with liquid oxygen and liquid hydrogen have been well understood for decades, and oftentimes lead to lighter weight designs.

But every stage with liquid propellants requires an engine to transform chemical energy into thrust, and that’s where the current story gets complicated. Originally, Orbital ATK proudly chose Blue Origin’s BE-3U engine and went so far as to win a contract from the Air Force to design an upgraded nozzle for it. That enthusiasm has gone from hot to warm and now cold as Orbital ATK first brought in Aerojet Rocketdyne’s venerable RL10 as a competitor and finally announcing the current choice is only between the RL10 and Airbus Safran’s yet-to-fly Vinci engine.

| On paper, any of these rockets are capable of launching satellites for the US military. But the launches don’t take place on paper and not all rockets are created equal. |

Orbital ATK has stated they were concerned Blue Origin’s engine wouldn’t meet the already tight development schedule. But, there are obvious technical reasons to choose the smaller RL10 or Vinci over the larger BE-3U. The smaller engines both use the more efficient expander cycle and have thrust levels between 25,000 and 40,000 pounds-force, compared to the BE-3U’s 120,000. Even if the BE-3U is throttled to lower thrusts so as not to overstress the upper stage and its payload, an engine that can put out three to five times the thrust can be expected to weigh three to five times more and be three to five times larger—all things that rocket designers have to account for. This points out an inherent issue with the BE-3U: it makes a great first stage engine for Blue Origin’s New Shepard or upper stage engine for their New Glenn (or even NASA’s SLS), but it’s overpowered for EELV-class rockets. Imagine trying to put a 1,000-horsepower engine into a car that only needs 200 horsepower. The extra hood space and chassis weight to support the massive engine would make for one of the worst performing (and looking) cars in history. And to add insult to injury, you’d still have to pay for all that extra car and engine that you didn’t need in the first place.

Competition: Changing the game

On paper, any of these rockets are capable of launching satellites for the US military. But the launches don’t take place on paper and not all rockets are created equal. Compare the history of Atlas V to Delta IV. Both won spots in the 1998 EELV completion. Both have 100 percent success rates. But the Atlas V flies twice as often as the Delta IV. The difference is “good enough” versatility at a lower price. Going for a sweet spot has always been profitable. The success of both Falcon 9 and Atlas V lie in their ability to launch the most common-size payloads at competitive prices. On the other hand, Delta IV Heavy, the Space Shuttle, and Saturn V had the ability to perform the most extreme missions of their generation, but that extreme performance came at an extreme sticker price: those vehicles had to be optimized to the point where they weren’t price competitive for other purposes. Add to this a new push for practical reusability from SpaceX, Blue Origin, and others that is intended to further bring down costs of launching satellites.

Left, subscale composite motor segment in 2013 funded by NASA for SLS. Right, full sized composite motor segment in 2017 funded by DoD for NGL. Note the absence of the ‘factory joint’ common to Space Shuttle SRB cases. (credits: Orbital ATK) |

Into this uncertain environment of falling prices and reusability, Orbital ATK is introducing the NGL, a non-reusable rocket. In order to compete, Orbital ATK is vertically integrating their manufacturing wherever possible and aggressively looking for the best prices where they can’t. In addition to bringing in multiple companies to compete for NGL’s upper stage engine, Orbital ATK is also looking for more competitive pricing on ammonium perchlorate (AP), the oxidizer that makes up roughly 70 percent of their solid propellant by weight. The idea of going with foreign suppliers for either an upper stage engine or AP may have been anathema in the past, but in the race to lower costs, saving 50 percent on the primary propellant ingredient becomes a necessity.

Another way that NGL can reduce costs is by reducing its ground facilities. After refurbishing an old factory, Orbital ATK claims NGL will simply use existing facilities and personnel to design, build, and launch the NGL. NGL will even launch from the existing Space Shuttle launch site at Kennedy Space Center, sharing the same equipment as NASA’s Space Launch System. With the announcement that Cape Canaveral is working toward allowing polar orbit launches from Florida, the NGL may not even need a launch site at Vandenberg Air Force Base in California.

One area of vertical integration is the aforementioned composite cases. Orbital ATK has spent years building up toward replacing the reusable steel cases of the shuttle’s Solid Rocket Boosters (SRBs) with in-house produced disposable composite cases. This change is expected to reduce the production time by 46 percent, a number closely linked to the overall price because the vast majority of the cost of a rocket is in the time of the skilled technicians and engineers who build them.

NGL would potentially be able to reach all desired orbits using existing Space Shuttle/SLS facilities in Florida (credit: Orbital ATK) |

This brings up the question everyone is trying to answer: when is rocket reusability necessary and what form should it take? NGL’s heritage lies in the reusable SRBs on the Space Shuttle that are now becoming expendable to reduce costs. Falcon started its life as an expendable rocket that has become reusable to reduce costs.

There are also many forms that reusability can take SpaceX tried using parachutes before settling on vertically landing its rockets. The Space Shuttle and Sierra Nevada Corporation’s Dream Chaser spacecraft make use of airplane-like horizontal landing. Boeing wants to land their Starliner capsule on land while SpaceX wants to land their Crew Dragon capsule in the water just like the Space Shuttle SRBs on which NGL is based—a form of reuse that Orbital ATK has determined would actually add to the total cost. And so we’ve come back to where we started.

| Orbital ATK’s Antares rocket was expected to be a replacement for ULA’s Delta II, the workhorse that has launched light and medium-size payloads for nearly 30 years. But Antares was conceived under vastly different circumstances. |

Physics doesn’t mandate one singular way to reuse rockets, so the question comes down to one of economics. We’re still very early in the history of rocket development and even earlier in the history of reusable rockets. But we shouldn’t be surprised if reusability is selectively applied, and the way it’s implemented takes different forms. For example, the simple plate can be either reusable fine china or disposable paper plates, or anything in between. Depending on how they’ll be used, plates are made of different materials (paper, plastic, wood, metal, or ceramic), are intended to last different amounts of time (minutes for paper plates, centuries for fine china) and cost different amounts (pennies for paper, hundreds of dollars for fine china). You probably have each of them in your cupboards at home, you intuitively know when to use each one, and you never get angry that paper plates aren’t reusable or that fine china is so expensive. Ultimately, Orbital ATK will have to actually design and build the NGL to prove whether an expendable rocket can be competitive against a new generation of reusable rockets.

Try everything, keep what works

Even as Orbital ATK tries to join the premier ranks of the launch industry, they are still maintaining their jack-of-all-trades approach by developing systems for new market opportunities. Beyond just building rockets and rocket components, Orbital ATK continues to adapt existing technology for new uses.

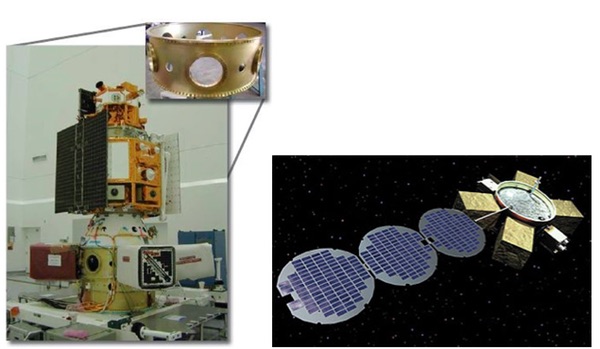

Left, an ESPA ring with experiments sits between the primary payload above and rocket below (not shown). Right, Orbital ATK’s EAGLE concept in 2012. (credit: Moog and Orbital ATK) |

An example of this adaptation is how Orbital ATK has drawn on their experience with small satellite platforms to make use of otherwise wasted space inside payload fairings. In 2012, Orbital ATK announced EAGLE, a short barrel that replaces the normally empty adapter ring that attaches a satellite to its rocket. Instead, Orbital ATK outfits the ring with the hardware necessary to turn it into an independent satellite capable of carrying instruments or deploying its own even smaller satellites.

Sadly, the name EAGLE starts a series of frustrating nested acronyms that the aerospace industry is famous for. EAGLE stands for ESPA Augmented Geostationary Laboratory Experiment. But ESPA itself stands for EELV Secondary Payload Adapter. And as explained above, EELV stands for Evolved Expendable Launch Vehicle, so three layers of acronyms. EAGLE is certainly easier to say than Evolved Expendable Launch Vehicle Secondary Payload Adapter Augmented Geostationary Laboratory Experiment!

Left, the refined 2017 ESPAStar platform. Right, an ESPASat detached from the ESPAStar. (credit: Orbital ATK) |

With its original five-year contract complete, EAGLE is ready to take flight this year (pun intended). Orbital ATK doesn’t just see this a one-time technology demonstration, and so they are commercializing the product as the ESPAStar. ESPAStar (only two layers of acronyms, a slight improvement!) can be attached to any EELV-class vehicle and carry up to six separate payloads, functioning as either a platform for instruments or a mothership to drop off its own cargo of satellites. And if you don’t want to supply your own satellite, Orbital ATK will build it for you in their ESPASat format (at least the naming convention is consistent.) If the image of the ESPASat above looks familiar, that’s because you can see them attached to the ESPAStar mothership, with its solar panels folded up. In a few years’ time, Orbital ATK may be in a position to supply an entire EELV-class rocket, an ESPAStar to attach secondary payloads, the secondary payloads themselves, the bus for the primary satellite, and even, thanks to the impending acquisition of Orbital ATK by Northrop Grumman, the sensors on that satellite. And if the entire multi-course meal isn’t to a customer’s taste, Orbital ATK will be happy to offer each item à la carte.

Of course whenever you try a lot of different things, you will find some of them work better than others. Then comes the difficult decision of keeping the most successful ideas and abandoning those that didn’t live up to expectations. Orbital ATK’s Antares rocket was expected to be a replacement for ULA’s Delta II, the workhorse that has launched light and medium-size payloads for nearly 30 years. But Antares was conceived under vastly different circumstances, when good US-Russia relations enabled access to the RD-180 engines that power the Atlas V. Now, the same geopolitical issues that led to the new EELV competition and the NGL also exclude the Antares from military launches. As for other customers, its small nosecone size and launch site at Wallops Island limit its ability to launch physically larger payloads and reach the polar and geosynchronous orbits that are the mainstay of commercial launches, respectively. Orbital ATK clearly recognizes this deficiency and is already positioning NGL in the medium-lift category that Antares currently occupies.

Left, a Cygnus spacecraft arrives at the International Space Station. Right, a Cygnus-derived module could be used to support NASA’s Deep Space Gateway. (credits: NASA and Orbital ATK) |

While Antares may not have the future Orbital ATK originally hoped for, the Cygnus spacecraft it launches to the ISS has been quite successful. Cygnus delivers cargo to the station at half the cost NASA could with the Space Shuttle. It has already visited the ISS eight times, five atop Antares and three onboard Atlas V after an early Antares failure prompted Orbital ATK to search for a backup rocket. ULA would even be happy to launch even more Cygnus spacecraft to the ISS, which would further cut into Antares’ workload. The versatile Cygnus is the only ISS cargo vessel to launch aboard more than one rocket. Orbital ATK would like to extend that versatility even further by developing a version that could operate all the way out to the Moon. This Lunar Cygnus would presumably be capable of either delivering cargo or serving as a crew module where astronauts could live and work.

NASA’s SLS with advanced composite solid rocket boosters (credit: Orbital ATK) |

| Just as it has taken years for Orbital ATK to get to where it is, it’ll take years more to see some of these opportunities come to fruition. |

Cygnus’ lunar prospects are part of NASA’s larger efforts to return to the Moon. These plans call for constructing the Deep Space Gateway, an ISS-style space station in orbit in cislunar space. While the mandate to return to the Moon has only recently been formalized, serious planning has been ongoing on nearly a decade. These plans make use of NASA’s super heavy lift rocket, the Space Launch System. Orbital ATK already makes the solid rocket boosters for this massive rocket, just as they did for the Space Shuttle before it. NASA already envisions an upgraded version to carry even more cargo to the Moon or other destinations. The same rocket technology that is being perfected now for the NGL can be directly applied for improved versions of this super booster. Regardless of where the funding has come from, be it from NASA, the DoD, or from inside the company itself, Orbital ATK is now combining all of these efforts to maintain its position as the builder of the largest solid rockets in the world.

At least it’s never boring

While rockets may be the fastest thing around, the contracting and development process around them can be frustratingly slow. Just as it has taken years for Orbital ATK to get to where it is, it’ll take years more to see some of these opportunities come to fruition. The next step is a waiting game until the DoD announces the winners of the EELV competition in mid-2018, and the US military is rarely punctual when it comes to making multi-billion-dollar decisions. But Orbital ATK has already shown remarkable patience, letting projects play out over years and even decades.

In the meantime, whether it’s designing rockets, apply old technologies in new ways or sending things to the Moon, the team at Orbital ATK always seems to have something to do. There’s another relevant Chinese proverb that, while it might be invented, it’s still true nonetheless: “may you live in interesting times.” For those at Orbital ATK, it will certainly be interesting times.