The Moon and the Tragedy of the Refrigeratorby Sam Dinkin

|

| By having the parking spaces be free, the city under provided this resource and there was overconsumption of it. |

Eminent domain creates the same problem for homeowners. If the State can seize my property at any time and not fully compensate me, then I have less incentive to invest. Market price is not a sufficient compensation since the transaction is not voluntary. If I value my house at twice what I paid for it and would be inconvenienced for months if I had to move, then compensation at the “market price” would only be half what it would take for me to be a seller instead of a buyer.

I am giving a lecture today on economics to students of the Space University in North Dakota. I am giving the lecture remotely. I called FedEx-Kinko’s-Sprint to buy a video conference call. They told me that I needed the room number at the other end of the call to make my reservation. By the time I got that, the scheduled lecture time had been taken. Without my being able to buy service in advance, I will not have a good incentive to invest in setting up equipment and counterparties to participate in the videophone network. Maybe that’s why Sprint Video Conferencing was sold to Intercall. Three different people said, “Can you please schedule your call for later in the week?” even after I got the room number. Somebody please let me know when they are ready to sell me bandwidth with or without subscriber equipment instituting a property rights regime instead of a race.

If hundreds of billions of other people’s money is available in a common pool to recover from disaster, there will be less incentive to invest in preventative measures and more incentive to engage in risky activity and overuse the disaster aid.

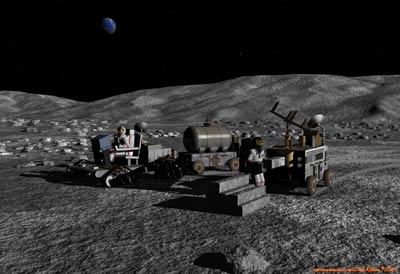

The Moon has a similar problem. It is a commons. The property rights there are not exclusive. While resource extraction and exclusion zones are being contemplated under limited property rights consistent with the Outer Space Treaty, this only gets us part of the way.

In all these examples, there were rights to use. There was also the ability for the occupant to exclude other users (e.g., eat the food first from the refrigerator or get your $2,000 debit card first). But still, there was underinvestment.

Critical ingredients

Contrast a private parking spot with a public one. If the private one has your name on it, you get several benefits:

- No race to get it

- Vacate it and still own it

- Buy it from someone else who values it less

- Sell it to someone else who values it more

- Buy it before you occupy it so you know what kind of car will fit

- Parking spot will be better surveyed, marked and coordinated and have better access for higher density utilization

- Pay taxes on it to support public services

- Leave it fallow

- Pass it to your heirs

| There will be development of the Moon as a commons. But it will be slower and less profitable than if the Moon could be sold as private property. |

If there is one person who wants to squat on a homestead on the Moon and build a shack and another who wants to build a rocket port, who should get to? In the first-come-first-serve world of races to claim and use common property, the shack would get built if the shack builder got there first. In the property rights world, a rich shack builder who likes a view could get the shack built only if he could pay (or was not willing to take) the money offered by the rocket port developer. The land could lie fallow for years while the rocket port builder gathered the money. It might never get developed. Maybe the outcome would be less development than first come first serve. But the experience with property rights bought and sold in a market economy is that total wealth increases even in the presence of uncertainty. It’s a good reason why the Soviet Union’s growth was so much slower than US’s.

There will be development of the Moon as a commons. But it will be slower and less profitable than if the Moon could be sold as private property. Property rights work well for providing incentives for development. And for filling the refrigerator.