The case for shuttle-derived heavy lift<< page 1: ownership and licensing Economics and the business caseThis is the tough part. Even if changing the culture is politically feasible, with a combined carrot and stick strategy, can it produce the goods? What we don’t know is how much potential private business for HLV traffic is there, and how much could be attracted. As well, can it be made cost-effective enough to attract needed development capital? The economics of it all met with a great deal of skepticism from my partners and advisors, the most glaring of which is that current capital requirements make commercial HLV a tough sell, at least for a single leap. There may be a way phase in commercial HLV traffic, though. How much will a shuttle-derived HLV launch cost? We really need a good estimate. Depending upon whom you talk to, the most common quote to launch a shuttle today is US$500 million. But that might not be an accurate reflection of true HLV launch costs. It is quite possible that potentially half of more of that price is for the enormous labor and parts replacement costs associated with the orbiter. The engines and hydraulic systems always require a lot of refurbishment. But the thermal protection system must be a literal sinkhole for cash. Each tile on the shuttle’s skin has to be inspected repeatedly, and loose or damaged tiles have to be replaced, both very expensive, labor-intensive processes. There are literally tens of thousands of pages of documentation associated with this process. But most of the shuttle derived HLV configurations (that I have been reading about for at least 20 years) would not include these costs. So, in theory at least, they should be significantly cheaper. One of the “hidden costs” that would ride along with commercial HLV operations is an enormous investment in infrastructure refurbishment at the Cape. One of NASA’s dirty little secrets is the pathetic state of disrepair at Launch Complex 39. There are special nets in the Vehicle Assembly Building (the only place we can stack HLVs) to keep pieces of the ceiling from falling hundreds of feet onto the flight hardware—and the work crews. One of the crawlers nearly cracked in two a couple of years ago. NASA has been asking for money to fix these things in the last few budgets. Whether Congress ultimately supports the Bush initiative or not, the infrastructure repair money will have to come from somewhere and the cost could easily run into the hundreds of millions. Existing federal law already sanctions the leasing of government facilities. That’s all well and good as long as NASA is footing the bill for bringing KSC up to snuff, which any private consortium wanting to lease the place would undoubtedly insist upon before signing anything.

Given enough traffic, an increase in production hardware for shuttle-derived HLVs would certainly lower the per-unit cost but how low could it realistically be expected to go? It’s hard to know that without a flight rate and if one is looking to make a case to either the feds or private enterprise, one would have to come up with something. It’s my guess that it would have to be at least double the all-out-pedal-to-the-metal shuttle rate that we saw a couple of years ago, say 6-7 missions a year. Even if one could drop launch costs to a barebones $200 million, and can offer to place 100 tons into LEO, that’s still $1000 per pound—which looks very competitive, but that’s just the breakeven number. There would still have to be developed a new cargo canister to hold the freight, in some sort of modular manner, like a freight train or container ship. That development cost will have to be amortized over a 15-20 year period. There is marketing, insurance, and a lot of other ancillary services to pay for, plus the leasing of the launch complex. Add to that the biggest nut of all, debt service, i.e., paying back the investors (long term bonds might help here, but the government would probably have to be the backer of last resort). Now one is creeping back into the $2500-$3000/pound range, but that is still definitely a competitive “bulk rate” at today’s prices. But remember the only selling point for private HLV is economies of scale. The challenge is that one would have to be able to offer a regular schedule, like that freight train or container ship, and have to be able to completely fill the container with 100 tons of paying cargo to make the flight pay. If the container is only filled to, say, 70% capacity (like many typical airliners today), much of the gross margin is lost, and the investors along with it. For investors to come onboard all these problems need to be solved, not to mention producing a stack of customer orders 3-5 years in advance. The good news: Combining crewed and cargo payloads (CEV, for tourists) might generate some engineering controversy, but the economic justification is a no-brainer. Launch vehicles—from the biggest to the smallest—are designed to carry their maximum payload weight and launch engineers always make sure that they do, lest their flight dynamics be in jeopardy. If an HLV can put 100 tons into LEO and a given payload only weighs 80 tons, they will put 20 tons of dead weight on that vehicle. For decades now, some consumers of launch services (including radio amateurs who have literally built satellites in their basements) have taken advantage of that fact to fly payloads at costs WAY below market prices. The larger the launch vehicles and the more frequent their launch rate, the more such opportunities would present themselves. That might be one way to get a commercial foothold on an existing HLV launch infrastructure. Early success would encourage greater participation. Eventually we could see HLVs carrying 100% commercial payloads. Bottom line:

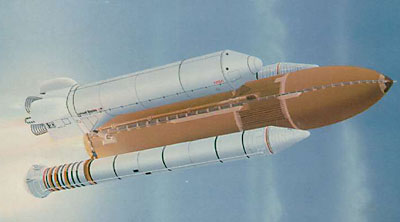

Competition and technologyIn the near term, we concluded that a booster such as Falcon 5 is likely to be more reliable and less expensive than a shuttle booster for orbital tourist launches. Why would people climb atop something with a demonstrated 2% fail rate with human crews, when there is an alternative with liquid engines and the ability to run when an engine fails? Shuttle-C has been virtually obsoleted for any payload heftable by SpaceX. The “8x/64x” oft-quoted speed and energy numbers might not be such a challenge. If a Tier 1 vehicle has some thermal protection on it and is launched atop a Tier 2 vehicle, voila, you have a Tier 3 vehicle. In other words, staging can get you there. We should never underestimate the likes of XCOR, Armadillo, SpaceX, HARC, and the rest of the smaller “independent” launch services companies. In addition, as shuttle-derived technology has been unavailable to the private sector at any price for so long, that sector has worked long and hard around the problem. In fact, one big player is looking to develop something of its own for the heavy-lift field, and is ready to invest some serious bucks into it (please don’t ask me who—unfortunately I am sworn to secrecy for the time being). While a “blank sheet” approach has been suggested on the government side, even the most liberal estimates show break-even launch costs at no less than $300 million, and likely a lot more. Many suggest that we need to rethink our definition of “heavy lift”, given present day economic realities. The reasoning here is if access costs come down low enough using smaller launchers, why, exactly, do we need heavy lift? The Saturn 5 had a payload of about 130 tons to LEO. If we can more cost-effectively get a bunch of 10-ton payloads to orbit, we can assemble anything we need, without the complexity and nailbiting risk (not to mention insurance liability) of a single 130-ton launch. And again, this “think smaller” modular capacity was developed precisely because NASA and its symbiotic contractors slammed the door shut on the rest of us decades ago. Even if the door was opened wide now, it may well be too late—many may just yawn, shrug, and go their merry way. Plus if you’re launching lots more tonnage, you may not want 100-ton modularity. You’re going to want oceangoing capacity like JP Aerospace, HARC, or Sea Launch. In the words of one advisor: “The shuttles need to be retired to museums, the SSMEs need to be parceled out to engineering schools as astonishment pieces, and somebody somewhere needs to issue a purchase order for 1,000 RS-68s.”

The new hybrid engines are showing a lot of commercial promise. Companies from SpaceDev to Lockheed Martin are working on them. Lockheed just test fired a model using liquid oxygen as oxidizer that got 31,000 newtons of thrust. The thing is only 25 centimeters in diameter. The math is compelling, if one assumes clustering ability. As stated earlier, while government payload needs are very different, and HLVs may really be necessary to return to the Moon, etc., the market for that kind of capacity in the private sector has yet to be demonstrated. Near- and long-term prescriptionsFixing this problem is not easy and not very straightforward. Things the US government could/should do:

While political advocacy to affect change is always a positive thing, the Aldridge prescriptions, as I suggested in my last article, may have bitten off more politically than the government can possibly chew. For the challenge of changing United Space Alliance’s core culture, the two main things needed are (1) NASA changing its culture first and setting an example and (2) finding lots of private HLV customers with cash in hand.

In the final analysis it’s about “baggage”: Shuttle-C has too much, both technological, and political. Like NASA itself, when the instrument becomes the institution and takes on a life of its own, sooner or later, as Jeff Goldblum’s character stated in the film Jurassic Park, “life will find a way”. Not ever allowed access to heavy lift, private entrepreneurs are rapidly creating and deploying leaner, cheaper and more reliable means of space access. The dinosaur is being circumvented by the more efficient mammal. Commercial shuttle-derived HLVs would have been a terrific idea 15-20 years ago, but now it may well be too late. Between the antiquated and too-complicated technology and methodology, the intractable, inefficient internal cultures of both NASA and USA, and the major renovations that are desperately needed at KSC, there is little to attract heavy lift customers, or the capital either. We’ll be able to get the job done, very soon now, in smaller chunks, with on-orbit assembly. All that being said, any effort to split United Space Alliance off into a truly independent company—with authority to hire and fire—would definitely be a Good Thing. Home |

|