Financing the purchase of a new Interplanetary Spaceshipby Sam Dinkin

|

| The ticket buyers would be uniquely able to manage the risk of the spacecraft destruction while they are on it because, in that event, they would need neither to buy a home nor to pay for their retirement. |

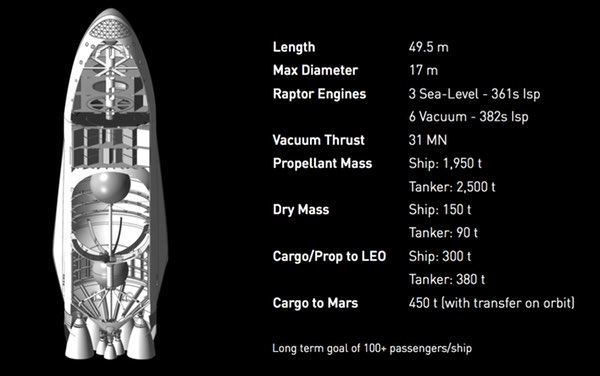

If “stealing underwear” and “Kickstarter” do not pan out to finance the Interplanetary Spaceship and the rest of the Interplanetary Transport System, then one possible source of money is venture capital. The elevator pitch would be, “We buy a plastic spacecraft from SpaceX and send it to Mars twelve times in the next 24 years and charge $200,000 per ticket for 100 tickets, of which we get to keep a bit over two thirds of that to pay back the spacecraft investors, propellant, and maintenance. Plus, we’ll take another 280 metric tons of cargo to go with the 130 metric tons of 100 people and their included luggage, furniture, and consumables.”

The venture capitalist might say, “We need a 37-percent internal rate of return to do this. You have a good track record as a serial entrepreneur, but there are risks that the ship won’t make it to orbit, won’t come back, might not have that long a useful life, and that no one will want to go, among a long list of other risks. If you use money from us to buy the craft you’ll need to about triple ticket prices to pay back investors $150 million for each flight.”

Maybe SpaceX should just quadruple the ticket prices and cargo fees so the customers can pay for the whole spaceship out of their ticket and cargo fees and either live in it afterwards, collect rent on it, or wait two years for the next set of customers to buy it from the owners. The ticket buyers would be uniquely able to manage the risk of the spacecraft destruction while they are on it because, in that event, they would need neither to buy a home nor to pay for their retirement.

Another possible source of money is the stock market. If venture capital pays for 51 percent, and 49 percent is raised from a public offering, that might cut the finance cost. The investment banker might say, “You had great luck with the Tesla IPO, but if you want to keep control of the company, you cannot sell more than half the equity to the public before it starts to look like a shady holding company like Kenobe Inc, Obe-1 Holdings LP, and Chewco LLC from the Enron scandal. And investors tend to earn a seven-percent return on shares.” If inflation is around two percent, then selling stock actually works with a five-percent amortization as long as ticket prices and cargo prices rise with inflation—if there are buyers of the stock at that price. The public might not be ready to buy stock based on such a risky proposition without higher than normal expected returns.

Jamestown was paid for in part by a lottery. Perhaps the lottery proceeds could be used to effect the same carrying cost as a five-percent loan. A state lottery commissioner might say, “No, the lottery money is already earmarked for other things, but maybe we could do a deal where we buy a seat from time to time as a prize for one of our games.”

Recently, Vidvuds Beldavs suggested that a new space currency might enable space settlement (see “Blockchains and the emerging space economy”, The Space Review, October 10, 2016). Fortunately Elon Musk already did that with his success founding and selling PayPal so he could use the proceeds to found SpaceX. Doing it again might be challenging.

| That does not mean it is impossible to finance, just that it takes innovation in finance (or lobbying) to make it possible. |

My favorite is to convince Congress that the United States government offer a low interest loan, or just pay for the production of the spacecraft. I know it’s a long shot to get Congress to pay $200 million for a spacecraft to send 1,200 people to Mars during its service life. Maybe if SpaceX raised the price of the spacecraft to $5 billion per vehicle for the first four it might have better luck at getting Congress to pay. Perhaps SpaceX could get Congress to change the law so Fannie Mae could treat the interplanetary spaceship as a house and offer a federally guaranteed loan. The FHA rates on 30-year mortgages are 3.625 percent. Or maybe an alternative rocket fuels subsidy on methane-fueled rockets.

So a five-percent amortization plan is similarly optimistic to the assumptions made about reuse, spacecraft material, on-orbit propellant transfer, in-situ propellant production, and higher performance from liquid oxygen and methane. That does not mean it is impossible to finance, just that it takes innovation in finance (or lobbying) to make it possible.