Estimating the cost of BFRby Sam Dinkin

|

| With a design that can only fly to Mars once every two years, it does not matter too much if it is good for 12 launches or 1,000 because it will likely be obsolete 24 years after its first launch. |

The new configuration of the booster has decreased the diameter from 12 meters to 9 and the number of engines from 42 to 31. The tanker and ship share the same hull design (and will also take over the role of the Dragon and Red Dragon). Compared to the ITS tanker and ship, the number of engines has dropped from six Raptor vacuum engines and three sea-level engines to four and two respectively. The dry mass for the ship has dropped from 150 to 85 metric tons, but is still anticipated as being able to carry 100 people to Mars in comfort. The cargo would move to a cargo ship that would also join the fleet going to Mars.

The goal for the booster and ship is for them to be fully reusable for suborbital and orbital flights from Earth and back, and also for roundtrip Earth-Moon flights.

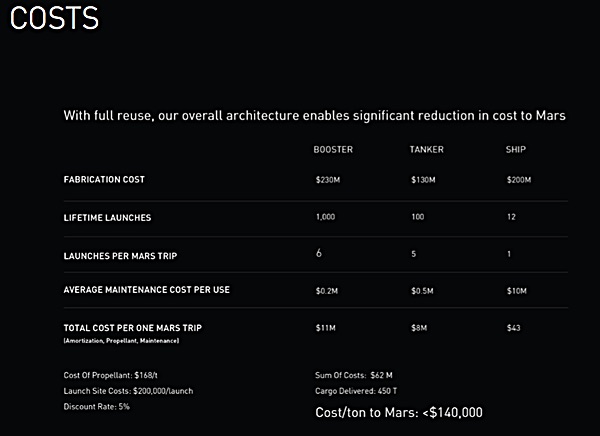

The aspirational target prices for the components of the 2017 vision of BFR are likely to be lower than for the components of the 2016 vision of the Interplanetary Transport System, but probably more per ton of dry mass. (credit: SpaceX) |

Mars

For Mars, the math will not change too much from last year. With a design that can only fly to Mars once every two years, it does not matter too much if it is good for 12 launches or 1,000 because it will likely be obsolete 24 years after its first launch. The BFR booster will likely cost about 80 percent of the ITS booster even though it only has 74 percent of the engines because of square-cube considerations and smaller-scale economies. (On the other hand, the BFR booster can be utilized more often at first while its market is growing so it may be more profitable.) So a guess for the booster is $185 million.

The BFR architecture anticipates five booster trips instead of six for the ship and the tankers, but there will be ten booster trips if we consider the companion cargo version of the ship. The ten flights would each cost about $500,000 in propellant and $200,000 maintenance, but the amortization costs would be only 80 percent as much per flight because the principal would only be 80 percent as much. There would be ten flights instead of six, so perhaps $7 million for the booster portion of the cost, and $14 million altogether for both the cargo and the settler ships.

| So point-to-point with everyone in full fare economy under these assumptions costs $1,055,000 for 853 spaceflight participants, or about $1,200 per paid seat. Not bad for a getting an extra business day on the ground. |

There would need to be eight BFR tanker flights per pair of ships. Here, an educated guess for the lifetime launches for a BFR tanker is 1,000, instead of 100 in the ITS, because the BFR Moon architecture also requires tanker flights, as would other interplanetary destinations for exploration, mining, or settlement. If there were a weekly Moon flight for every biannual Mars flight, there would only need to be a couple of tankers in the fleet to service the Moon flight and the Mars-flight propellant transfer would be a rare treat. Along the same lines as for the smaller booster, the smaller tanker for the BFR might cost 73 percent as much as the ITS version even though the BFR version has only two-thirds as many engines. The 100-percent reusability may require a bigger outlay, but we have to start guessing somewhere. Call it $100 million compared to ITS’s $130 million. With the amortization costs lower for the tanker, $100,000 maintenance and $200,000 of propellant per flight, of which one-fourth of the propellant ends up in the cargo or settler ship, call the total cost from the tankers $1 million per flight or about the same $8 million for the eight flights of the smaller, more reusable tanker as for five flights of the larger one.

Using a 75 percent factor for the smaller settlement ship (for round numbers), we get from $200 million for the ITS version, to $150 million for the BFR counterpart. The settlement ship is assumed to still cost about $10 million per use to maintain and amortization rates are assumed to not change appreciably. Call it $34 million per use for the BFR version instead of $43 million for the ITS version.

We need to add in the cost of the Mars-bound cargo ship that replaces the cargo section of the ITS ship. It will also need a major refit (a reconditioned heat shield occasionally was mentioned by Musk), but not as much as the crew version. Assume its $5 million instead of the $10 million for the settler version and assume the fit-out is the same as the tanker’s $100 million. The utilization rate will still be abysmally low since the BFR will not get too much point-to-point business while it’s on Mars—at least for the first decade or two. Its contribution to the total might be around $17 million.

Altogether the Mars cargo and settler delivery using two ships might cost a grand total of $73 million for the pair of ships vs. ITS’s $62 million. The 300 metric tons delivered to Mars will be around $240,000 per ton vs. ITS’s aspirational $140,000 per ton, but being able to pay for BFR development out of current SpaceX income makes the price a bit more believable than the price of ITS, which required components that were utilized less frequently and cost more to develop.

Earth

Making a guess of one flight per day for the point-to-point version of the ship and one flight a day of the booster, the amortization cost of the booster and ship for the purpose of a single flight is on the order of the same percent of an A380. An A380 sells for about $432 million. Suppose the BFR ship for point-to-point costs about the same as the Mars ship’s $200 million. Assume LIBOR + 8 percent, or about twice the premium for airline financing (p.28). That’s $24 million in interest and principal per year, or about $66,000 per day.

| ChUBAR may also be the result for the airplane manufacturing and airline industries if point-to-point emerges as a Collier’s magazine style future next big thing. |

Suppose we have a crew of 31 and 853 passengers like an A380. Musk did say he had as much cubic space as an A380 in the people section of the ship. This invalidates the analysis of the cost of the booster for the Mars flight because if its daily work is point-to-point flights, it will have the roughly the same amortization day rate of $61,000, reducing the contribution to Mars costs almost by half. That just leaves the propellant ($500,000 for the booster and $200,000 for the ship), maintenance ($200,0000) and the crew (if they fly once a day, five days a week, 50 weeks a year and are paid $100,000 for pilots and $50,000 for ballistic attendants—$28,000). So point-to-point with everyone in full fare economy under these assumptions costs $1,055,000 for 853 spaceflight participants, or about $1,200 per paid seat. Not bad for a getting an extra business day on the ground.

So Elon Musk might have changed up the space launch industry beyond all recognition (ChUBAR) with his BFR (see “SpaceX prepares to eat its young”, The Space Review, October 2, 2017). One BFR booster and cargo ship could potentially serve the entire current launch market if payload integration can be containerized with only a couple of launches per week. ChUBAR may also be the result for the airplane manufacturing and airline industries if point-to-point emerges as a Collier’s magazine style future next big thing. Granted, spaceports might not be quite so seamless as the video in Musk’s presentation indicated, but if SpaceX gets the flight rate up to Southwest’s five flights per plane per day, the crew down to two pilots and 14 attendants who work five flights per day, and maintenance costs down to the same order of magnitude as crew costs, prices for the flight can hug the propellant cost per ticket.