Russia’s evolving rocket plans<< page 1: a new role for Feniks The Sochi meetingThe task of flying crewed missions on Sunkar was added to the rocket’s manifest during the May 22 meeting in Sochi. The meeting was convened to update President Vladimir Putin on a strategy for Roscosmos until the year 2030. A key point of the strategy is that Russia’s space program should primarily serve the interests of the national economy. Accordingly, televised parts of the meeting showed Putin urging space officials to beef up the country’s constellation of remote sensing satellites. Decisions regarding launch vehicles and the human space program were made behind closed doors and gradually leaked out in the press the following days and weeks.

The idea to move Federatsia from Angara-A5P to Sunkar had apparently been hotly debated in space circles in the preceding weeks. It first surfaced in a TASS interview with RKK Energia general director Vladimir Solntsev published on April 29. Asked whether the Soyuz spacecraft will be phased out after Federatsia enters service, he said that only made sense if the cost of launching a Federatsia crew does not exceed that of launching a Soyuz crew. That goal, he pointed out, could only be achieved with the new launch vehicle and not with Angara-A5. Roscosmos’ leading R&D institute, TsNIIMash, immediately reacted by warning that such a launch vehicle switch would delay the first Federatsia mission several more years, but had a change of heart three weeks later. On the day of the Sochi meeting, it issued a statement that the development of the new rocket could be accelerated because of its commonality with the Zenit rocket. Talking to journalists in the days after the meeting, Russian space officials said the new rocket will also fly from the Sea Launch platform, built to accommodate the Zenit-3SL rocket, and ultimately even from Vostochny, using the same pad as the heavy-lift launch vehicle. It was only now that they began referring to it as Soyuz-5, but it has nothing in common with the liquid oxygen/methane boosters earlier put forward by RKTs Progress, which the company now says it will continue to study under the name Soyuz-7. Not surprisingly, the three names now circulating for the medium-lift launch vehicle project (Feniks, Sunkar, Soyuz-5) have only caused confusion. Soyuz-5 seems to be the general name for the rocket, Sunkar a specific name for the version that will be based at Baikonur, while Feniks is the name of the rocket’s development program (OKR) under the Federal Space Program 2016–2025. RKK Energia chief Solntsev has said that the differences between the versions launched from Baikonur, Sea Launch, and Vostochny will mainly be restricted to launch pad interfaces. The goal set by the Federal Space Program 2016–2025 was to finish ground-based testing of the rocket by 2025, suggesting the first actual flight would take place only in the second half of the decade. Now the schedule has been accelerated to enable the inaugural flight of Soyuz-5 from Baikonur in mid-2022, although Solntsev has expressed optimism that even that date can be moved forward. While it would probably be prudent to begin the test flights with the launch of a dummy payload, press reports suggest that an uncrewed version of Federatsia (weighing 14.4 tons) will be aboard the very first rocket. This is especially risky considering the fact that Federatsia’s descent module is supposed to be reusable. The first crewed flight is set for 2024. The earlier schedule for Federatsia missions from Vostochny on the Angara-A5 had called for the first uncrewed flight in late 2021 and the first crewed flight in late 2023. One way of speeding up the Soyuz-5 schedule is to skip some of the formal steps that usually precede the implementation of a space project. In early August, the Russian government appointed RKK Energia as the prime contractor for the project without first announcing a tender as usual. In mid-August, Roscosmos issued detailed technical specifications for the project, calling on RKK Energia to finish a so-called “draft plan” (preliminary design) by late March 2018. Based on statements from RKK Energia officials, the company has actually started this phase in April and expects to complete it by November, benefiting from the extensive research it has done on a Zenit replacement since 2010. Turning all the paperwork into actual hardware may prove to be more challenging. The Russians like to say that about 85 percent of Zenit’s components were manufactured in Russia, but as described earlier, Soyuz-5 is far from a carbon copy of Zenit. In reality, the only element of the rocket currently being serially manufactured for other projects is the second-stage RD-0124 engine, although Soyuz-5 will use a modified version of that. RKTs Progress, the subcontractor responsible for the rocket’s manufacture, has provided no insight into the amount of work needed to open up the Soyuz-5 production line. It is also not clear if the funding level for Soyuz-5 has been increased beyond the 29.3 billion rubles set aside for project Feniks in the Federal Space Program 2016–2025. Some of the companies may be forced to pay out of their own pockets to stick to the ambitious schedule. NPO Energomash, helped by a cash infusion from the Moscow Province government, has said it will invest nearly 7 billion rubles ($121 million) of its own money in restarting the production of the RD-171MV engine. Another possible stumbling block are the costs that Kazakhstan needs to shoulder for modifying the Zenit infrastructure at Baikonur. The Zenit launch facilities, currently maintained by Russia under the $115 million rent that the country annually pays to Kazakhstan for use of the cosmodrome, will be formally turned over to Kazakhstan beginning on January 1, 2018. The Kazakh side expects to get a detailed plan from Roscosmos on the required modifications later this year, which should allow it to make a fairly accurate estimate of the costs involved. Kazakhstan was supposed to pay around $245 million for the upgrade work, but that sum was based on the assumption that the rocket would enter service no earlier than 2025 and perform only uncrewed missions. With the acceleration of the schedule and the inclusion of the crewed objective, the price tag will inevitably go up. Clearly, Kazakhstan’s costs for the modernization of the Zenit infrastructure may become a thorny issue that has the potential of delaying or even derailing the whole project. On the positive side, a crew access tower is already in place at the Zenit pad. It was erected in the 1980s for a crewed project called Zarya that was later canceled. A Russian space official has said that it is still usable, but will have to be refurbished and modified.

Commercial prospectsWhile the most urgent goal for Soyuz-5 is to put Federatsia into orbit in 2022, the development of the rocket cannot be justified on the basis of the piloted program alone. No detailed launch manifests for Federatsia have been revealed, but the spacecraft is unlikely to have a high launch rate. Russian space officials have regularly stressed that the rocket is supposed to play an important role in the commercial launch market, portraying it as a competitor to SpaceX’s Falcon 9. (Interestingly, the Kazakh name for the rocket, Sunkar, translates as “falcon”, but that is said to refer to the importance of falconry in Kazakh culture.) According to Roscosmos chief Igor Komarov, the aim is to reduce the launch price to $55 million, about $5 million less than the average price charged by SpaceX for a Falcon 9 launch. For the time being, there are no plans to recover and reuse the first stage, as SpaceX does with Falcon 9, which the Russians do not consider cost-effective.

Soyuz-5 will only become competitive if it can deliver a meaningful payload to geostationary orbit, the destination for the lion’s share of commercially operated satellites. For that it will need to be fitted with an upper stage. Press reports suggest the preliminary choice it the Blok-DM/SLB upper stage built by RKK Energia for the Sea Launch version of Zenit, but NPO Lavochkin has also offered its Fregat upper stage, including an upgraded version. Baikonur, situated at 46° north latitude, is not ideally located for launches to geostationary orbit. Officially released data show that Soyuz-5 can place a maximum of 5.0 tons into geostationary transfer orbit (GTO) from Baikonur. That assumes, however, that the rocket flies on a due east trajectory over China and Mongolia and that first stage thrust is increased by 10 percent. In reality, the rocket’s second stage will likely have to perform a so-called dogleg maneuver to avoid such overflights, reducing its payload capacity. NPO Lavochin claims that, with the upgraded Fregat upper stage and a five-meter-diameter payload fairing, the rocket could put 6.8 tons into GTO, giving it roughly the same performance as the Proton-M rocket.

By comparison, the latest version of Falcon 9, sometimes called the Falcon 9 Heavy Thrust, can place 8.3 tons into GTO from Cape Canaveral if the first stage is expendable and 5.5 tons if the first stage is retrieved. That may seem far more impressive than Soyuz-5, but several trends in the industry, such as the growing role of regional satellite operators and the use of all-electric propulsion, are gradually lowering the mass of communications satellites. In response to the changing market requirements, Khrunichev and International Launch Services even decided to develop the lighter Proton Medium rocket (a standard Proton-M minus its third stage) with a GTO capacity of 5.0–5.7 tons from Baikonur. Soyuz-5 could take over its role once the Proton family is phased out in the mid-2020s. Soyuz-5’s GTO performance will improve dramatically if it operates from the Sea Launch platform near the equator. No data on the rocket’s GTO capacity from Sea Launch have been publicly released, but in private correspondence with this author, former rocket engineer Dmitri Vorontsov has estimated that this will be 7.8 tons, nearly matching that of an expendable Falcon 9 Heavy Thrust from Cape Canaveral. This would allow it to place a pair of the smaller “all-electric” communications satellites into geostationary orbit. Sea Launch, originally owned by a consortium consisting of RKK Energia, KB Yuzhnoe/Yuzhmash, Boeing, and Norwegian shipbuilder Kvaerner, filed for bankruptcy in 2009 because of weaker demand, mounting debts as well as a launch failure. It was then largely taken over by a subsidiary of RKK Energia, but was forced to suspend operations in mid-2014 in the midst of the Russian-Ukrainian conflict. In September 2016, RKK Energia signed an agreement with S7 Group, Russia’s largest private aviation holding company, on the sale of Sea Launch. Since Sea Launch will continue to operate from its home base in Long Beach, California, the transaction needs to be approved by US regulators, which is expected to happen later this year. The Soyuz-5 technical specifications released by Roscosmos in August specifically mention the need to make the rocket compatible with the Sea Launch platform, and several Russian space officials, including Roscosmos boss Igor Komarov, have indicated they fully expect the rocket to fly from the sea-going platform, possibly as early as 2023. The S7 Group initially said it was willing to consider another launch vehicle than Zenit and invest in its development, but has lately remained tight-lipped about its intentions. In a surprise announcement in June, the Ukrainian Yuzhmash company said it had signed a deal with S7 on April 28 to build 12 Zenit-3SL rockets for Sea Launch. Other reports suggest that these could begin flying in late 2018 and satisfy Sea Launch’s needs until 2023. This is not necessarily a sign that S7 has lost interest in the Soyuz-5. It may simply see the resumption of Zenit production as a temporary solution until the Soyuz-5 becomes available in the early 2020s. Moreover, the reported deal between Yuzhmash and the S7 Group could easily fall through if Russia decides to prohibit the export of Russian-built components for Zenit to Ukraine. The heavy-lift rocketAs mentioned earlier, an additional raison d’être for Soyuz-5 besides the launch of Federatsia and uncrewed payloads is to test the first stage of Russia’s future heavy-lift launch vehicle. It would seem that HLLV studies began in earnest in 2012 under Roscosmos’ “Magistral-Oblik” research program. At least four companies—RKK Energia, RKTs Progress, Khrunichev, and the Makeyev Rocket Center—worked out proposals under this program. In early 2015, Roscosmos’ R&D branch TsNIIMash recommended the RKK Energia proposals for further study.

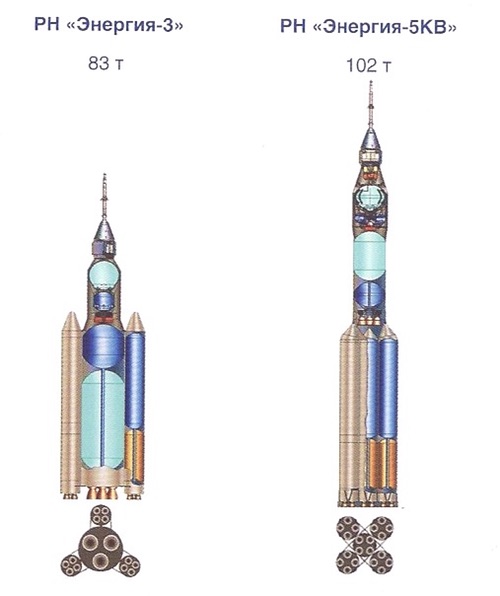

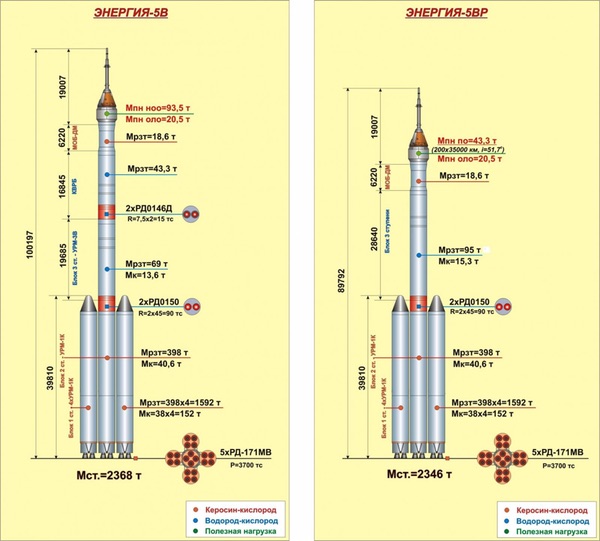

RKK Energia had looked at a multitude of schemes, but what they all had in common was the use of 4.1-meter-diameter first-stage strap-on boosters with liquid oxygen/kerosene RD-171M engines. By early 2015, two leading candidates had emerged. One, called Energia-3, was capable of placing 83 tons to LEO had a configuration very similar to that of the Soviet-era Energia rocket, featuring a 8.7-meter-wide core stage with three liquid oxygen/liquid hydrogen RD-0120 engines and three strap-on boosters. The other, called Energia-5KV, could place 102 tons to LEO and had five of the strap-on boosters clustered around a virtually identical liquid oxygen/kerosene stage with a longer burn time, turning it into a second stage. It also had a 7 m diameter third stage with four RD-0150 liquid oxygen/liquid hydrogen engines. TsNIIMash expressed its preference for the Energia-3 because it was easier to scale up to bigger sizes, but the two versions known to be under study by late 2016 were a further evolution of the Energia-5KV design, favored from the start by RKK Energia.

Both versions have a payload capacity of roughly 100 tons to low Earth orbit and 20.5 tons to lunar orbit (the mass of Federatsia’s lunar version.) While the first and second stage configuration of Energia-5KV has been retained, the diameter of the upper stages has been reduced from 7 to 4.1 meters to match it with that of the first and second stage. One version, Energiya-5VR, has a long third stage with two RD-0150 engines. The other, Energia-5V, has a shorter third stage with two RD-0150 engines and an additional fourth stage with two RD-0146 liquid oxygen/liquid hydrogen engines. The payload for lunar missions can either be Federatsia or a lunar lander, both attached to a space tug derived from the Blok-DM upper stage. A single HLLV can easily send Federatsia on a lunar orbit mission, but lunar landing missions will require multiple-launch scenarios. A recently unveiled scheme calls for two launches of the HLLV and a Soyuz-5 launch to send up the crew. Clearly, all these plans are preliminary and subject to further change.

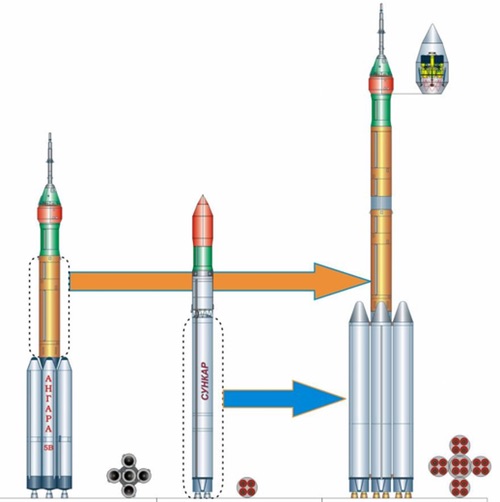

By the time the HLLV reaches the launch pad, most of its components should have been thoroughly tested on other launch vehicles. The strap-on boosters and core stage are nearly identical to the first stage of Soyuz-5 and the third stage is borrowed from that of Angara-A5V, although that of Energia-5VR is a somewhat lengthened version. The fourth stage of Energia-5V is similar to a cryogenic upper stage being developed for Angara-A5. The RD-0146 and RD-0150 engines are products of KBKhA in Voronezh. While the RD-0146 engine has been extensively ground-tested since 2001, the RD-0150 is new. Flight testing of these cryogenic engines is a crucial step on the road to the HLLV. The Russians have lost much of their expertise in cryogenic engine technology, having flown only two sets of four engines on the Soviet-era Energia rocket in 1987–1988. That engine, the much more powerful RD-0120, was also developed by KBKhA.

Flying nearly identical stages on other rockets has the added advantage that they will be manufactured on a relatively large scale, significantly driving down costs. While NASA’s Space Launch System uses many components inherited from the Space Shuttle, none of these elements will be flying in parallel on other launch vehicles. The Russian “Lego” approach to building heavy-lift rockets will also make it possible to fly lighter and heavier variants of the rocket. By attaching either two or six strap-on boosters to the core stage, the payload capacity can be reduced to around 70 tons or increased to 170–180 tons. Still, ideas that look nice on paper are not necessarily easy to turn into reality, the key issue, as usual, being money. The Russian HLLV plans have had mixed fortunes over the last couple of years. The need for a heavy-lift rocket moved to the foreground in late 2011, when Russia declared the Moon as the prime objective of its human spaceflight program. The HLLV was included in a draft version of the Federal Space Program for 2016–2025 in 2014, but the decline of the Russian economy as a result of falling oil prices and Western-imposed sanctions soon forced Roscosmos to put the plans on the back burner. With an estimated cost of 1.5 trillion rubles ($26 billion) for both the rocket and its launch infrastructure, the first launch was moved beyond 2030 by the spring of 2015. As a stopgap measure, the task of flying Russian cosmonauts to the Moon in the second half of the 2020s would have to be accomplished with complex multiple launch schemes using the Angara-A5V rocket. By March 2017, the first launch of the HLLV was expected no earlier than 2035. Then, almost out of the blue, an order came to accelerate HLLV development during the May 22 meeting in Sochi. The new target date was not immediately clear, but in early June the TASS news agency quoted an anonymous source as saying it was 2028. The date may have been set at a meeting between Roscosmos and the Military Industrial Commission on June 3. It was confirmed in a presentation of the NPO Energomash company at the MAKS aerospace show near Moscow in July. Sources later also told TASS that the date could be achieved by initially flying a lighter version of the rocket with two strap-on boosters rather than five, giving it a payload capacity of 68–72 tons. This version is called Energia-3 (not to be confused with the earlier RKK Energia proposal.) In mid-August “space czar” Dmitri Rogozin gave an even more optimistic timeline, saying the rocket should make its debut as early as 2027. At first sight, the new target dates (seven to eight years earlier than what had been envisaged before) look completely unrealistic. Even if additional funds have been appropriated, which has not been confirmed, it is hard to see how the launch infrastructure for the rocket at Vostochny can be built in time to meet the new target date. In fact, the newly declared timelines for the HLLV are totally at odds with those for the construction of the launch facilities that are given in preliminary technical specifications released by Roscosmos this July. According to that document, construction should begin in 2026 and end in 2030. Considering the task at hand, even that seems optimistic. The pad will need to accommodate all versions of the HLLV as well as the Soyuz-5 rocket, handle test firings of the core stage and third stage, and require a mobile service tower. In a departure from standard Russian practice, the rocket will be rolled out to the pad vertically rather than horizontally. The support facilities, situated 4.2 kilometers from the pad, will include a 118-meter-high assembly building reminiscent of the Vehicle Assembly Building at Kennedy Space Center, a rocket stage storage building, and two spacecraft integration buildings. ConclusionThe two most recent developments in Russia’s rocket program, the third launch vehicle swap for Federatsia in eight years and the seemingly unrealistic acceleration of the HLLV project, point to a lack of long-term vision and prompts the question of who is pulling the strings in the country’s space program.

The change of launch vehicle and launch site for Federatsia have been justified on economic grounds, but the benefits are questionable. Despite the similarities between Soyuz-5 and Zenit, the costs and technical difficulties associated with opening up a totally new production line and modifying the launch infrastructure at Baikonur are hard to predict. While Soyuz-5 may ultimately prove useful as a commercial launch vehicle and a test bed for the HLLV, human-rating it entails additional risk and costs that may push back Federatsia’s first crewed mission far beyond the current 2024 target date as well as the 2023 date originally envisaged for its launch by Angara from Vostochny. The sudden acceleration of the HLLV project is all but a cost-saving measure. The latest announced cost estimate for the HLLV project (1.5 trillion rubles or $26 billion) exceeds the total Russian civilian space budget approved for the period 2016–2025 of 1.4 trillion rubles or $24.3 billion (which, to give a sense of scale, is not much more than NASA’s roughly $19 billion annual budget.) The decision to step up HLLV development is hard to explain in Russia’s tough economic times and in light of recently formulated space strategies where prestigious piloted space projects take a backseat to practical space applications. It also conflicts with statements made by some of the country’s top space officials before the Sochi meeting. Speaking in an April 2016 interview, Roscosmos head Igor Komarov declared he saw no economic or technical justification to field a heavy-lift rocket before 2030. The politician in charge of Russia’s space program, Deputy Prime Minister Dmitri Rogozin, has regularly called into question the very need for a human spaceflight program. Just last March, during a meeting of the country’s Military Industrial Commission, he stated that the time has come to decide if people are needed in space and consider the possibility of ending human presence in space if no proper answer to that question can be found. Although Roscosmos is formally in charge of formulating space policy, there are clearly other forces at work in determining the country’s path in space. There must be at least some lobbying from the country’s main space enterprises, which are actually part of the Roscosmos State Corporation, the entity that replaced the Roscosmos space agency on January 1, 2016. Major players in the industry, like RKK Energia, obviously benefit from big-ticket projects like the HLLV. Apart from that, there is the unmistakable influence on space policy decisions exerted by President Vladimir Putin. The least that can be said is that space is higher on Putin’s agenda than it has been for any recent US president. In the last two years alone, Putin has held four dedicated meetings with the country’s top space managers and paid two visits to the Vostochny cosmodrome, his pet construction project, a record that would make most NASA officials envious. In his public comments on space in recent years, Putin has usually stressed that the space program should be geared to serving the interests of the Russian economy, but the most recent developments can only lead one to conclude that he also continues to see space as a means of boosting national prestige. It was apparently Putin who ordered that the medium-lift rocket program be tailored to the needs of the HLLV project during discussions on the ten-year space budget in late 2015 (Rogozin said several weeks later that “the president has persistently urged us to move in that direction.”) By all accounts it was again the president who ordered to move forward the first HLLV launch from 2035 to 2027–2028.

Bound by corporate interests, Putin’s ambitions, as well as changing economic and political factors, Roscosmos has been struggling to formulate a clear long-term space strategy. In the last five years alone it has produced five major space policy documents: a plan for space activities in the period 2013–2020 (approved by the government in December 2012), a national space strategy until 2030 (signed by Putin in April 2013), the Federal Space Program 2016–2025 (ratified in March 2016), and a Roscosmos strategy until 2030 (seemingly still awaiting final approval.) Few outside the Russian space community seem to understand how these documents are interrelated, how exactly they come about, and how binding they are. Commenting on the recent Sochi meeting, Russian space policy analyst and former cosmonaut candidate Sergei Zhukov lamented the lack of long-term vision and the space industry’s influence on space policy decisions: “I think we are drifting about in our strategic thinking… Without a [clear] strategy, I cannot understand at all why we need a super heavy rocket. I think this decision was made to serve the interests of the space industry and not those of the country.” Indeed, decisions like the acceleration of the HLLV schedule only make sense if there is a clear goal to justify them. Although Russia set its sights on the Moon six years ago, it still hasn’t decided which course to take in the post-ISS era. The options are to assemble an all-Russian follow-on space station (see “The status of Russia’s human spaceflight program (part 1)”, The Space Review, February 20, 2017), join international partners in setting up a Deep Space Gateway in cislunar space (see “The status of Russia’s human spaceflight program (part 3)”, The Space Review, March 6, 2017), or mount a national lunar landing program. Clearly, it cannot afford to do all three at the same time. Early this year, Dmitri Rogozin ordered the formation of an independent work group with the specific goal of plotting a long-term course for Russia’s piloted space program, but nothing has been heard of it since. Roscosmos itself was expected to formulate new recommendations on the program to the Russian government in August (several months later than the date mentioned by Rogozin early this year), allowing it to inform international partners about its intentions at a meeting of space agency heads next November. Whether the Russian HLLV will have a useful role to play in those plans before 2030 will become clear only then. Home |

|